Translate Bio Boosted by Sanofi Vaccine Agreement

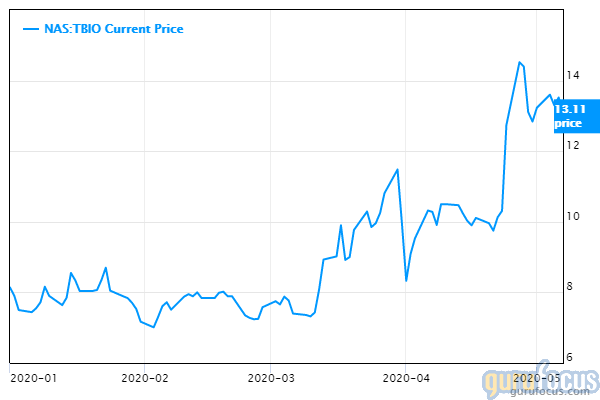

Sanofi's (NASDAQ:SNY) decision to hedge its bet on developing a vaccine for Covid-19 has helped nearly double the year-to-date share price of a Boston-area therapeutics company.

Translate Bio Inc.'s (NASDAQ:TBIO) partnership with Sanofi builds on the three-year pact the companies signed in June 2018 to use Translate's technology called mRNA to develop vaccines for up to five infectious diseases. Given the worldwide pandemic, the Covid-19 vaccine is now front and center.

GENE News reported that Translate Bio CEO Ronald C. Renaud Jr. said the companies hope to begin animal testing in weeks. "We have a goal to be in the clinic towards the end of this year, maybe the beginning of next year, but really driving toward the end of this year," he said. "That's all going to be subject to discussions with regulatory authorities. But we're moving absolutely as quickly as we can."

Sanofi is also working on a vaccine with GlaxoSmithKline (NYSE:GSK). And along with other leading vaccine producers, the company is partnering with the U.S. government's Biomedical Advanced Research and Development Authority to select the Covid-19 strain sequence used in the design of the vaccine candidate.

Additionally, the French pharmaceutical giant is collaborating with Regeneron Pharmaceuticals Inc. (NASDAQ:REGN) to develop a new Covid-19 indication for the companies' marketed arthritis drug Kevzara.

Translate Bio, formerly known as RaNa Therapeutics, was founded in 2011. The company's mRNA platform is a genetic technology intended to cajole the body's cells into producing proteins that treat a disease or spark immunity to one.

Translate's Covid-19 agreement is garnering all the attention, but the company's primary focus has been using its platform to develop treatments for pulmonary diseases like cystic fibrosis. The company's lead candidate for the disease is in clinical trials.

Under the 2018 agreement with Sanofi, Translate received $45 million upfront and could earn up to $760 million in potential milestones, according to an article in FiercePharma. Translate could also earn more from development, regulatory and sales milestones, or if Sanofi exercised options in additional disease areas. The company is also eligible for sales royalties if the programs make it to market.

In the first quarter, Translate posted a net loss of $14.3 million compared with $33.2 for the same period a year earlier. Revenue of $4.7 million, up $3.2 million from a year earlier, was derived from the Sanofi collaboration.

Translate stock closed May 8 at $14.50. According to CNN Money, the six analysts offering 12-month forecasts set a median target of $19.50, with a high estimate of $25 and a low of $17. The stock is rated a buy.

Disclosure: The author holds no positions in any of the stocks mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.