3 Travel Companies With Fortress-Like Balance Sheets

The travel industry is highly susceptible to economic conditions. When the economy is struggling, fewer people are willing or able to go on big-ticket excursions, and the opposite holds true for economies in the midst of bull markets.

It is undeniable that the Covid-19 pandemic has devastated the travel industry more so than the previous few recessions, which were purely financial in nature. People are even less willing to travel in a recession when doing so will help the spread of a potentially deadly virus that has no known cure or vaccine.

This has driven down the valuations of companies across the travel industry as more customers choose to stay at home. The economy will eventually recover, but with profits drying up, many highly leveraged companies could struggle to secure funding, which will eat into their profits long after customers return (if they can avoid bankruptcy).

One way to take advantage of the eventual recovery of the travel industry is through travel booking companies, which are some of the most profitable businesses in the industry. These companies require fewer physical assets than businesses such as hotels, theme parks, etc. Among these names, financially strong and well-moated companies are likely in a better position than competitors, as they have less debt to worry about and may even be able to snap up additional market share as the businesses they provide listings for seek to reach out to more potential customers.

According to the GuruFocus All-in-One Screener, a Premium feature, the following travel booking companies have a GuruFocus financial strength rating of at least 6 out of 10, a profitability rating of at least 8 out of 10, an Altman Z-Score of 3 or more and return on capital of 60% or more. In addition, they enjoy well-moated market positions among their respective target consumers.

TripAdvisor

TripAdvisor Inc. (NASDAQ:TRIP) is an online travel advisory company with a revenue model based around user-generated content (i.e., customer reviews and a comparison website) and online bookings for reservations, transportation, lodging, travel experiences and restaurants.

TripAdvisor spun off from parent company Expedia Group Inc. (NASDAQ:EXPE) at the end of 2011. It operates through several brands, including TripAdvisor, Bokun, CityMaps, Flipkey, Vacation Home Rentals and Seat Guru. What differentiates it from Expedia and other travel booking companies that operate primarily in the U.S. is its relatively narrow focus on building a stronger network advantage, which helps in bringing down operating costs. The leading library of user-generated content, especially travel experience reviews, also adds to the company's moat.

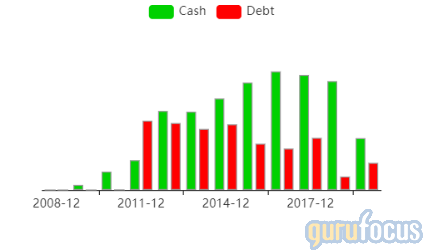

GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 8 out of 10. The Altman Z-Score of 3.32 and cash-debt ratio of 1.91 show that the company has plenty of liquidity and is not in danger of bankruptcy.

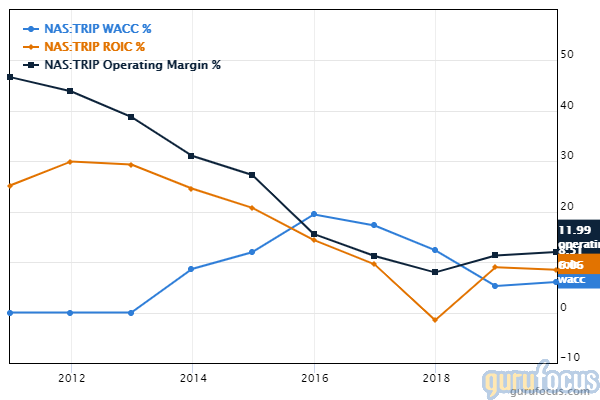

The return on capital of 63.24% is higher than 87.63% of competitors. The operating margin of 12.04% is higher than the industry median of 7.06%, and the return on invested capital has exceeded the weighted average cost of capital for most of the company's history.

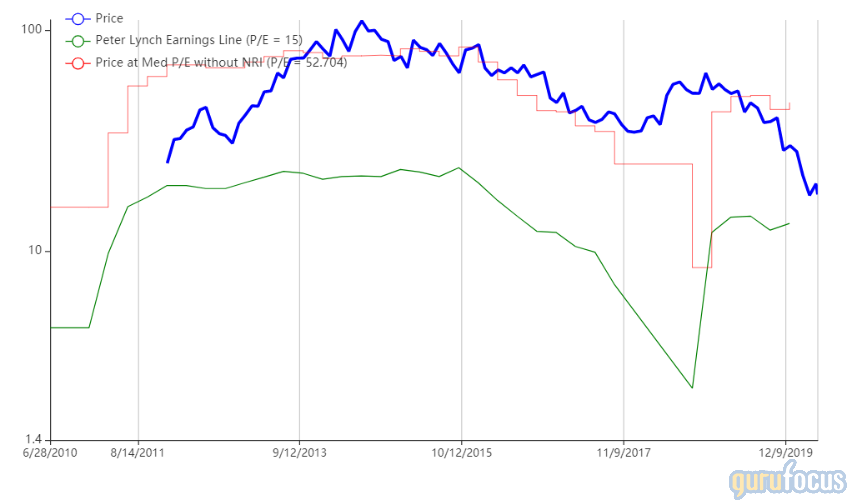

On May 11, shares of TripAdvisor traded around $17.70 per share for a market cap of $2.27 billion and a price-earnings ratio of 18.84. According to the Peter Lynch chart, this valuation falls above the company's intrinsic value but below its historical median valuation.

China International Travel Service

China International Travel Service Corp. Ltd. (SHSE:601888) is a Chinese travel agency company that provides a wide range of all-inclusive tour packages, focusing mostly on the market of foreign travelers who do not have much background knowledge on the country. It has been a leading company in the Chinese travel industry since 1954.

It its early stages, CITS was a government-run foreign affairs reception unit. Since its founding, it has transformed into a state-owned key enterprises group integrating all-inclusive travel services. Operating through a wide range of brand names, it is the largest Chinese travel company in terms of real assets and has a high reputation in the international tourism market. In addition to its strong moat as the highest-rated international travel company in China, CITS enjoys government favor, further solidifying its advantage.

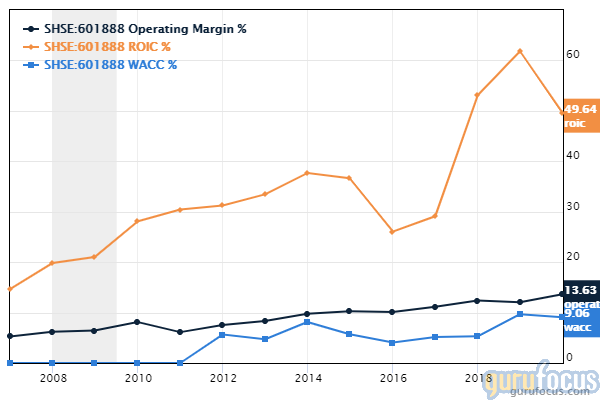

GuruFocus gives the company a financial strength rating of 9 out of 10 and a profitability rating of 10 out of 10. The Altman Z-Score of 16.4 and cash-debt ratio of 48.58 show that the company has enough cash to weather nearly anything the market throws at it.

While the operating margin of 8.65% is only slightly higher than the industry median of 7.06%, the return on capital of 65.9% beats 87.96% of competitors. As shown in the chart below, ROIC is typically more than five times WACC, while the operating margin has steadily increased over the company's history.

On May 11, shares traded around 88.90 Chinese yuan ($12.52) for a market cap of 173.58 billion yuan and a price-earnings ratio of 81.61. According to the Peter Lynch chart, this is higher than the company's intrinsic value and median historical valuation.

Booking Holdings

Booking Holdings Inc. (NASDAQ:BKNG) is a world leader in online travel services, providing booking services for everything from flights and cars to hotels and vacation packages. The company has a presence in the U.S., European and Asian travel booking markets.

The company has built a moat primarily by focusing on the more fragmented European and Asian hotel markets rather than the U.S. market, as large U.S. hospitality conglomerates are able to reach out to more potential customers directly rather than through third-party sites. Booking Holdings also focuses more on hotel bookings, which are more profitable than airfare bookings.

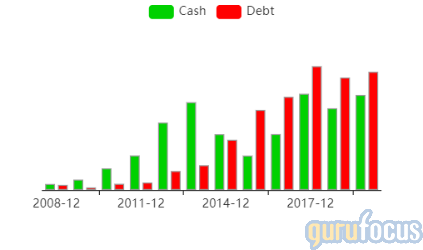

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 9 out of 10. The Altman Z-Score of 5.71 suggests that the company is unlikely to go bankrupt in the near future, and the cash-debt ratio of 0.8 is higher than 59.30% of competitors.

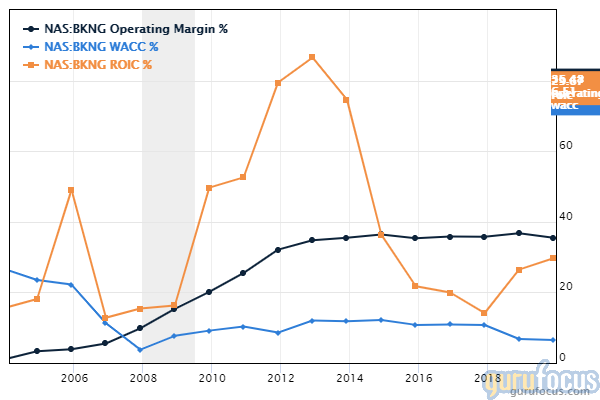

Booking Holdings has an operating margin of 35.48% and a return on capital of 517.37%, both of which are higher than 96.25% of competitors. The company's profitability is also demonstrated by a ROIC that is more than four times the WACC, as shown in the chart below.

On May 11, shares of Booking Holdings traded around $1,411 per share for a market cap of $57.75 billion and a price-earnings ratio of 12.54. According to the Peter Lynch chart, the company is trading below its intrinsic value and its historical median valuation.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.