Triangle Capital Corporation (NYSE:TCAP): Are Analysts Optimistic?

Triangle Capital Corporation’s (NYSE:TCAP): Triangle Capital Corporation is a business development company specializing in private equity and mezzanine investments. On 31 December 2017, the US$566.21M market-cap posted a loss of -US$28.65M for its most recent financial year. Many investors are wondering the rate at which TCAP will turn a profit, with the big question being “when will the company breakeven?” I’ve put together a brief outline of industry analyst expectations for TCAP, its year of breakeven and its implied growth rate.

See our latest analysis for Triangle Capital

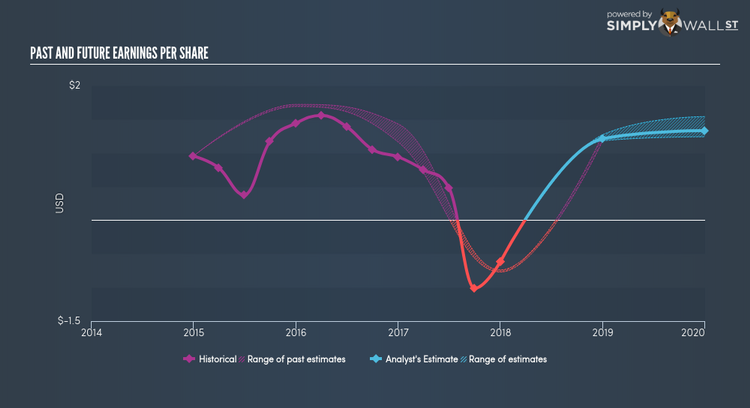

TCAP is bordering on breakeven, according to analysts. They anticipate the company to incur a final loss in 2017, before generating positive profits of US$58.52M in 2018. So, TCAP is predicted to breakeven approximately a couple of months from now! In order to meet this breakeven date, I calculated the rate at which TCAP must grow year-on-year. It turns out an average annual growth rate of 92.51% is expected, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

Given this is a high-level overview, I won’t go into detail the detail of TCAP’s upcoming projects, however, keep in mind that by and large a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

One thing I would like to bring into light with TCAP is its relatively high level of debt. Generally, the rule of thumb is debt shouldn’t exceed 40% of your equity, which in TCAP’s case is 88.23%. A higher level of debt requires more stringent capital management which increases the risk around investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on TCAP, so if you are interested in understanding the company at a deeper level, take a look at TCAP’s company page on Simply Wall St. I’ve also compiled a list of pertinent factors you should further examine:

Historical Track Record: What has TCAP’s performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Triangle Capital’s board and the CEO’s back ground.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.