Trinity Industries Pinpoints Focus On Rail

Railcar lessor and rail product manufacturer Trinity Industries (NYSE: TRN) will focus exclusively on servicing the rail industry as the company seeks to shore up its financial well-being.

The change comes as the company abruptly ended its trucking business earlier this month. Trinity also ended a logistics business.

Trinity has three goals for its new strategic framework to lower its financial breakeven point. Those goals are to optimize its railcar lease fleet, reduce the impact of cyclicality on the company and take steps to ensure the modal advantage of rail, according to Trinity President and CEO Jean Savage.

"This strategy will place more importance on cash flow and returns, resulting in more disciplined levels of growth through the cycle," Savage said during Trinity's third-quarter earnings call Thursday.

As a result of the strategy, Trinity will be focusing on its railcar products and will seek to scale new product and service offerings.

Headcount and cost reductions also occurred in the third quarter as a result of the new strategy. Year-to-date, Trinity has reduced operating and other costs by $80 million while employee headcount has been reduced by 47%.

Trinity decided to exit the U.S. trucking and logistics business and outsource this business to third parties, Savage said. The fleet had serviced Trinity's former industrial businesses. Trinity incurred a small impairment charge because of this decision, she said.

More employee reductions could occur into the beginning of next year, Savage said.

"We're evaluating our material cost and reviewing the relative spend between direct and indirect costs in order to lower our breakeven point," Savage said. "We believe through various cost efforts, the rail segment margin could meaningfully improve throughout the cycle."

As Trinity implements its new framework, the company expects that market conditions for rail will improve despite ongoing headwinds such the outcome of the COVID-19 pandemic. The company ses "a good pipeline of inquiries" for new and existing railcars, and railcar loadings in North America have rebounded in the third quarter. Trinity expects railcar deliveries to total around 11,000 for 2020.

"Right now, I think everyone's just cautiously optimistic that things are moving in the right direction. Three straight weeks with year-over-year improvement ... [for] total rail traffic numbers [is] something we hadn't seen since the beginning of 2019," Savage said. "I think this has us all thinking maybe it's going in the right direction there. And then we've had 75,000 cars come out of storage in the last quarter. So, that's also a great indicator that things might be heading up. So we may have bottomed and started the upturn."

For the industry to get to the point where there is demand to replace railcars, about 85% to 87% of the U.S. fleet needs to be moving, which means that more railcars need to come out of storage. But the industry has also been scrapping railcars, with 40,000 scrapped so far this year and potentially 50,000 to 55,000 scrapped by year's end, according to Savage. Meanwhile, an estimated 31,000 railcars are expected to be delivered this year.

As a result, "we're going to actually see a net reduction in the fleet size this year, and that contraction has not happened in the last 10 years. So, that's also a benefit for getting some cars out of the system and then opening up the need for new railcar deliveries," Savage said.

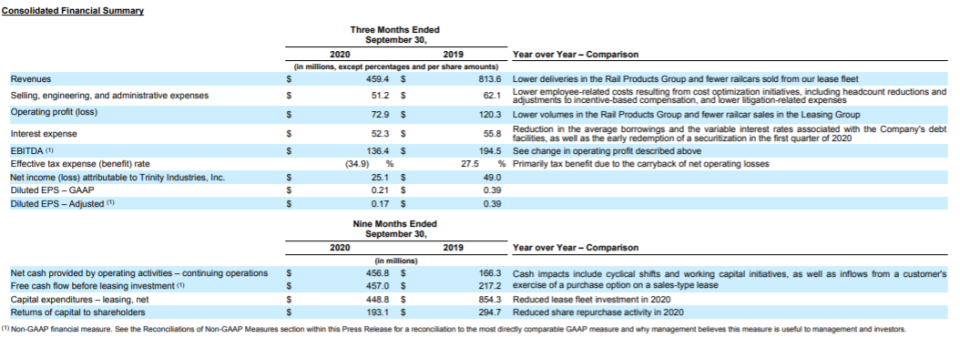

Third-quarter financial results

Trinity's net income was $25.1 million, or 17 cents per adjusted diluted share, in the third quarter of 2020, compared with $49 million, or 39 cents per adjusted diluted share, in the third quarter of 2019.

Revenue fell nearly 44% to $459.4 million on lower deliveries in Trinity's Rail Products Group, as well as fewer railcars sold on the lease fleet.

Operational expenses were down nearly 18% to $51.2 million.

(Trinity Industries)

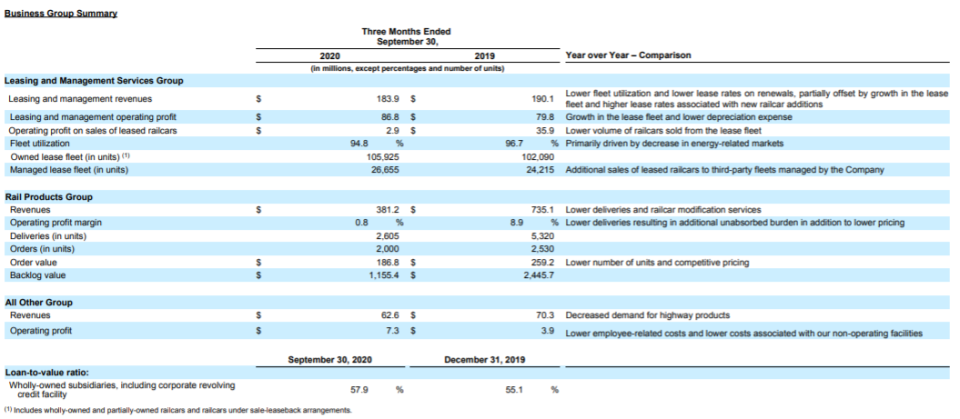

Fleet utilization was 94.8% in the third quarter versus 96.7% a year ago amid demand decreases from energy-driven markets.

(Trinity Industries)

"Trinity's third quarter performance reflects solid execution against numerous headwinds including competitive pricing, declining deliveries, and difficult decisions in rightsizing our operations," Savage said in a release. "Through it all, Trinity's rail platform, which generates significant cash flow, and our strong balance sheet have enabled us to manage through the current environment from a position of strength."

Average lease rates and the utilization of the company's lease fleet were flat between the second and third quarters, while lease rate renewal pricing continued to experience headwinds, Savage said. Rail manufacturing received orders for 2,000 railcars during the third quarter, composed primarily of larger, complex transactions, she said.

Trinity, others seek to create rail technology platform

Trinity is part of a venture with other rail stakeholders to create a new technology platform that will seek to utilize GPS as well as other telematics technology across the North American railcar fleet.

"We've been developing the analytics and infrastructure to support the addition of telematics on railcars and have partnered with other leading rail service providers to create a new technology platform called Rail Pulse that we believe will transform rail shipping in the future," Savage said Thursday on the call.

Others involved in this venture are railcar lessor GATX (NYSE: GATX), short line operators Genesee & Wyoming and Watco, and Class I railroad Norfolk Southern (NYSE: NSC).

The Commonwealth of Pennsylvania helped secure additional federal funding for the venture via the Consolidated Rail Infrastructure and Safety Improvements (CRISI) grant program.

The partners, which own nearly 20% of the North American railcar fleet, say the technology will promote safety objectives via the collection of hand brake and impact data. The technology is being further developed to include capabilities such as onboard bearing temperature and wheel impact detection sensors.

They also say the technology will improve visibility into the status, location and condition of individual railcars, which they say will meaningfully contribute to rail industry growth. Telematics capabilities will include data capture to support real-time track-level visibility, whether doors or hatches are open, whether the car is loaded or partially loaded, and other key performance metrics, the groups said in a joint release.

The technology will consist of a neutral, open-architecture, industrywide railcar telematics platform to make it easier to ship by rail and to track rail shipments across the North American rail network, all while ensuring the safety and security of proprietary car-owner data, they said.

"Rail Pulse is another example of how the freight rail industry is using advanced technology to enhance safety and service to shippers," said Jennie Granger, deputy secretary of multimodal transportation for the Pennsylvania Department of Transportation (PennDOT). "PennDOT is proud of the strong partnership we have with the freight rail industry, and we look forward to this platform being implemented throughout the North American railcar fleet."

The partners expect the platform to be available for the industry by the end of 2022.

Subscribe to FreightWaves' e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.

Related articles:

Breaking News: Texas trucking company closes its doors, sources say

Frac sand losses hit Trinity's bottom line

Federal Railroad Administration awards CRISI grants

Railroads must adopt technological strategies to stay relevant

See more from Benzinga

Options Trades For This Crazy Market: Get Benzinga Options to Follow High-Conviction Trade Ideas

Freight Railroads Meeting Harvest Season Needs, Say Shippers On STB Advisory Panel

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.