Trinity (TRN) Q3 Earnings & Revenues Beat Estimates, Rise Y/Y

Trinity Industries’ TRN third-quarter 2021 earnings (excluding 4 cents from non-recurring items) of 29 cents per share surpassed the Zacks Consensus Estimate of 17 cents. The bottom line surged 70.6% year over year on higher revenues. However, results were partly hurt by supply chain disruptions, as well as labor shortages and turnover.

Total revenues of $503.5 million also outperformed the Zacks Consensus Estimate of $432 million. The top line rose 9.6% year over year. Higher demand and pricing in the highway products business, and increase in external deliveries in the Rail Products Group, boosted the top line.

The Railcar Leasing and Management Services Group generated revenues of $185.5 million, up approximately 1% year over year, driven primarily by growth in lease fleet and increased servicer fees. Lease and management operating profit declined to $76.4 million from $86.8 million a year ago. This downside was caused by increased depreciation, higher fleet operating costs and lower lease rates.

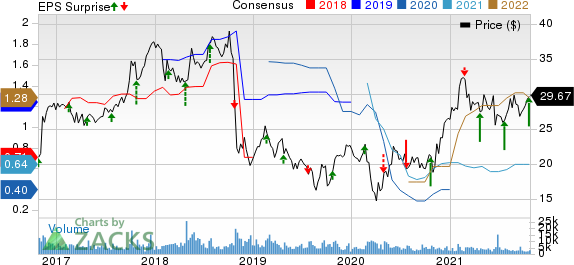

Trinity Industries, Inc. Price, Consensus and EPS Surprise

Trinity Industries, Inc. price-consensus-eps-surprise-chart | Trinity Industries, Inc. Quote

Revenues in the Rail Products Group (before eliminations) totaled $339.9 million, down 10.8% from the prior-year quarter’s number. The downside was due to lower deliveries and a shift in the mix of railcar products and services sold. Segmental operating loss was $3.1 million compared with segmental operating profit of $3.2 million a year ago.

Revenues in the All Other Group (primarily includes results of highway products business) were $83.7 million, up 33.7% year over year on increased demand and higher pricing for highway products. Manufacturing efficiencies in highway products also drove performance. Segmental operating profit came in at $14.7 million compared with $7.3 million in the year-ago quarter.

In the first nine months of 2021, Trinity rewarded its shareholders with $473 million through dividend payouts and share repurchases. Free cash flow generated during the period was $516 million.

The Zacks Rank #4 (Sell) company exited the September quarter with cash and cash equivalents of $221.8 million compared with $132 million at 2020 end.

Debt totaled $5,176.5 million as of Sep 30, 2021, compared with $5,017 million at the end of 2020.

Sectorial Snapshots

Let’s take a look at some of the other earnings releases from companies within the Zacks Transportation sector.

CSX Corporation CSX, carrying a Zacks Rank #3 (Hold), reported third-quarter 2021 earnings of 43 cents per share, surpassing the Zacks Consensus Estimate of 38 cents. Total revenues of $3,292 million outperformed the Zacks Consensus Estimate of $3030.9 million.You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Southwest Airlines LUV, carrying a Zacks Rank #4, incurred a loss (excluding 96 cents from non-recurring items) of 23 cents per share in the third quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of 27 cents. Operating revenues of $4,679 million outperformed the Zacks Consensus Estimate of $4,581.5 million.

United Airlines Holdings UAL, carrying a Zacks Rank #3, incurred a loss (excluding $2.46 from non-recurring items) of $1.02 per share in the third quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of $1.65. Operating revenues of $7,750 million surpassed the Zacks Consensus Estimate of $7639.7 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CSX Corporation (CSX) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research