Trinity (TRN) Stock Down on Q3 Earnings and Revenue Miss

Trinity Industries, Inc. TRN performed disappointingly in the third quarter of 2018, wherein both earnings and revenues missed their respective Zacks Consensus Estimate. The company’s earnings (excluding 20 cents from non-recurring items) of 39 cents per share fell short of the Zacks Consensus Estimate by 2 cents. The bottom line also declined on a year-over-year basis.

Total revenues came in at $930.9 million, which lagged the Zacks Consensus Estimate of $969.6 million. Moreover, the top line declined 4.4% from the year-ago quarter number due to lackluster performances at its Energy Equipment and Railcar Leasing and Management Services units.

Consequently, shares of the company have shed more than 12% of their value since the earnings release earlier this week.

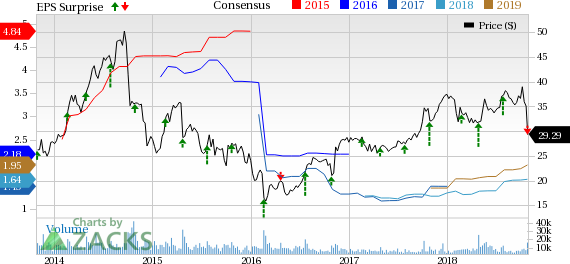

Trinity Industries, Inc. Price, Consensus and EPS Surprise

Trinity Industries, Inc. Price, Consensus and EPS Surprise | Trinity Industries, Inc. Quote

Segmental Results

The Rail Group recorded third-quarter revenues of $506.8 million, up 2.9% year over year. Segmental operating profit came in at $32.9 million, down 34.9% on a year-over-year basis. This downside can be attributed to pricing pressure and production-related issues. Notably, the group delivered 4,000 railcars and received orders for 7,725 railcars compared with 4,420 and 3,045, respectively, in the year-ago period.

Revenues at the Railcar Leasing and Management Services Group totaled $227.5 million, down 17.3% from the prior-year period. Segmental operating profit came in at $92.2 million, down 23.5% from the year-earlier quarter. Revenues decreased as a result of lower sales of railcars owned. Operating profit declined on account of lower average rental rates, soft asset management advisory fees apart from a change in the mix of railcars sold from the lease fleet.

The Inland Barge Group recorded revenues of $49.3 million, up 75.4%. Segmental operating profit came in at $3 million in the reported quarter compared to a year-ago loss of $0.7 million. Segmental results benefited from higher barge deliveries.

Revenues at the Energy Equipment Group grossed $218.2 million, down 11.4% year over year. The segment suffered an operating loss of $13.7 million in the quarter under review compared to a profit of $26.3 million a year ago. Decrease in volumes in the segment's wind towers product line led to this downside.

The Construction Products Group recorded revenues of $152 million, up 15.2% year over year. Segmental operating profit was $29.1 million, up 73.2%. The increase in revenues was mainly owing to higher volumes in the construction aggregates business and other operations.

Other Details

At the end of the third quarter, this Zacks Rank #1 (Strong Buy) company had $427.4 million of cash and cash equivalents compared with $778.6 million at 2017-end. Meanwhile, debt totaled $3,275.7 million as of Sep 30, 2018 compared with $3,242.4 million as of Dec 31, 2017. You can see the complete list of today’s Zacks #1 Rank stocks here.

During the third quarter, Trinity repurchased 1,356,484 shares for approximately $50 million. The company still has $350 million under its current authorization to be bought back through December 2019. Effective tax rate in the reported quarter was 27.4% compared with 36.9% a year ago.

2018 & 2019 Views

For 2018, the company’s Rail Group expects deliveries between 20,000 and 21,000 railcars. The company’s earlier earnings projection for 2018 currently stands withdrawn due to the proposed spinoff of its infrastructure-related businesses, Arcosa, on Nov 1, 2018

For 2019, the company’s Rail Group expects deliveries between 22,500 and 24,000 railcars. The company expects next year’s earnings per share between 90 cents and $1.10 (post spin-off of Arcosa).

Upcoming Releases

Investors interested in the broader Transportation sector are awaiting third-quarter 2018 earnings reports from key players like C.H. Robinson Worldwide, Inc. CHRW, ArcBest Corporation ARCB and Atlas Air Worldwide Holdings, Inc. AAWW. While C.H. Robinson will release results on Oct 30, ArcBest Corporation and Atlas Air Worldwide will announce the same on Nov 1.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

ArcBest Corporation (ARCB) : Free Stock Analysis Report

Atlas Air Worldwide Holdings (AAWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research