A Trio of High Earnings Return Stocks

- By Alberto Abaterusso

Selecting stocks whose earnings returns are more than double the monthly spot rate of the 20-year high-quality market corporate bonds enhances the probability to unearth high-return investments, in my opinion. These investment-grade bonds represent corporate loans issued by triple-A, double-A and single-A rated companies.

Since these bonds are offering a monthly spot rate of 3.51% as of the writing of this article, the following three stocks may attract investors, as their earnings returns are more than 7.02% at price-earnings ratios of less than 14.25.

Shinhan Financial Group Co Ltd

Shares of Shinhan Financial Group Co Ltd (NYSE:SHG) were trading at $37.53 per unit at close on Thursday for a market capitalization of $19.39 billion.

The South Korean bank providing financial services and products in South Korea and internationally offers an earnings return of 13.93% and has a price-earnings ratio of 7.18.

The share price has risen 53.2% over the past year, determining a 52-week range of $22.75 to $38.53.

GuruFocus assigned a rating of 2 out of 10 for the company's financial strength and a rating of 5 out of 10 for its profitability.

Wall Street sell-side analysts recommend a median rating of buy with an average target price of approximately $43.27 per share for this stock.

Korea Electric Power Corp

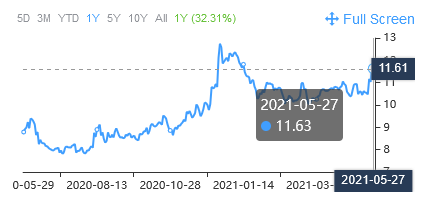

Shares of Korea Electric Power Corp (NYSE:KEP) were trading at a price of $11.63 apiece at close on Thursday for a market capitalization of $14.93 billion.

The South Korean electric generator and distributor of electricity domestically and internationally offers an earnings return of 12.29% and a price-earnings ratio of 8.14.

The stock has gained 32.31% over the past year for a 52-week range of $7.77 to $12.98.

GuruFocus assigned a rating of 5 out of 10 for both the company's financial strength and its profitability.

Wall Street sell-side analysts recommend a median rating of overweight with an average target price of $13.24 per share for this stock.

Centrais Eletricas Brasileiras SA

Shares of Centrais Eletricas Brasileiras SA (NYSE:EBR) were trading at $8.21 per unit at close on Thursday for a market capitalization of $12.88 billion.

The Brazilian generator and distributor of electricity in Brazil offers an earnings return of 9.89% and has a price-earnings ratio of 10.11.

The stock has climbed 53.2% over the past year, determining a 52-week range of $4.69 to $8.26.

GuruFocus assigned a rating of 4 out of 10 to both the company's financial strength and its profitability.

Wall Street sell-side analysts recommend a median rating of buy with an average target price of $9.43 per share for this stock.

Disclosure: I have no positions in any securities mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.