A Trio of Highly Profitable Businesses With Solid Financial Conditions

- By Alberto Abaterusso

If in search of value opportunities, investors could be interested in the following three stocks, as they represent equities in companies with high profitability and robust financial conditions. These qualities are represented by GuruFocus profitability and financial strength ratings of at least 7 out of 10.

Furthermore, sell-side analysts on Wall Street have issued positive ratings for them.

LHC Group Inc

The first stock that qualifies is LHC Group Inc (NASDAQ:LHCG), a Lafayette, Louisiana-based healthcare company operating more than 650 home health and community-based services as well as more than 130 hospice community-based service locations and long-term acute care hospitals.

GuruFocus rated its financial strength 8 out of 10, driven by a debt-to-Ebitda ratio of 0.41, which ranks better than 84.03% of 382 competitors operating in the healthcare providers and services industry, and an Altman Z-Score of 5.7. Additionally, LHC Group Inc has an interest coverage ratio of 121.59 versus the industry median of 11.7.

GuruFocus rated its profitability 7 out of 10, driven by a return on capital (ROC) ratio of 73%, ranking better than 87.50% of 584 companies operating in the same industry.

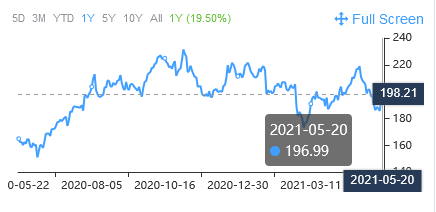

The share price ($196.99 as of May 20) has climbed 19.50% over the past year for a market capitalization of $6.24 billion, a price-earnings ratio of 49.74 (versus the industry median of 32.22) and a price-book ratio of 4 (versus the industry median of 3.19).

The price-sales ratio is 2.98 (versus the industry median of 2.66) and the 52-week range is $149.43 to $236.81.

On Wall Street, as of May, the stock has a median recommendation rating of buy and an average target price of $251.80 per share.

Balchem Corp

The second stock that qualifies is Balchem Corp (NASDAQ:BCPC), a New Hampton, New York-based developer of specialty chemicals mainly for human and animal nutrition.

GuruFocus rated its financial strength 7 out of 10, driven by an Altman Z-Score of 9.83.

GuruFocus rated its profitability 7 out of 10, driven by a return on capital (ROC) ratio of 33.65%, which ranks better than 86.33% of 1,383 companies operating in the chemicals industry.

The share price ($129.48 as of May 20) has risen by 38.79% over the past year for a market capitalization of $4.20 billion, a price-earnings ratio of 47.78 (versus the industry median of 21.3) and a price-book ratio of 4.95 (versus the industry median of 1.92).

The price-sales ratio is 5.89 (versus the industry median of 1.56) and the 52-week range is $86.81 to $134.58.

On Wall Street, as of May, the stock has a median recommendation rating of overweight and an average target price of $141.75 per share.

FinVolution Group

The third stock that qualifies is FinVolution Group (NYSE:FINV), a Shanghai, China-based operator of an online consumer finance marketplace in mainland China, where individuals needing a loan are directly connected to financial institutions.

GuruFocus rated its financial strength 7 out of 10, driven by a cash-debt ratio of 106.32, a debt-to-equity ratio of 0.01 and a debt-to-Ebitda ratio of 0.02. Additionally, the stock has a Piotroski F-Score of 7 out of 9 and an Altman Z-Score of 3.38, both pointing to a stable financial situation.

GuruFocus rated the company's profitability 7 out of 10, driven by a return on equity (ROE) ratio of 25.39%, a return on total assets (ROA) ratio of 12.52% and a return on capital (ROC) ratio of 175.35%.

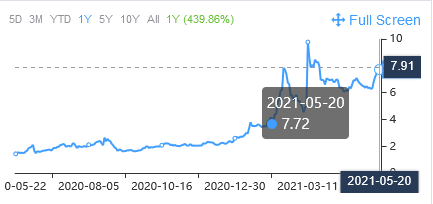

The share price ($7.72 as of May 20) has increased by nearly 440% over the past year for a market capitalization of $2.19 billion, a price-earnings ratio of 8.18 (versus the industry median of 14.08) and a price-book ratio of 1.73 (versus the industry median of 0.96).

The price-sales ratio is 2.53 (versus the industry median of 3.19) and the 52-week range is $1.43 to $10.61.

On Wall Street, as of May, the stock has a median recommendation rating of buy and an average target price of approximately $9.30 per share.

Disclosure: I have no positions in any securities mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.