A Trio of Stocks With Low 12-Month and Forward PEG Ratios

- By Alberto Abaterusso

When looking for bargain opportunities, investors may want to consider the following three securities, as they appear to be underestimated by the market. Their trailing 12-month and forward price-earnings to growth ratios trade below 1.5, which, as of May 20, approximately matches the S&P 500's historical average value.

The PEG ratio is calculated as the price-earnings ratio without non-recurring items divided by the five-year Ebitda growth rate. The forward PEG ratio is calculated as the price-earnings ratio without NRI divided by the future earnings per share growth rate, which is a projection for the next five years.

Wall Street sell-side analysts have also issued optimistic recommendation ratings for these stocks, indicating expectations for a strong share price performance over the coming months.

P.A.M. Transportation Services

The first company that makes the cut is P.A.M. Transportation Services Inc. (NASDAQ:PTSI), a Tontitown, Arkansas-based trucking and logistics company.

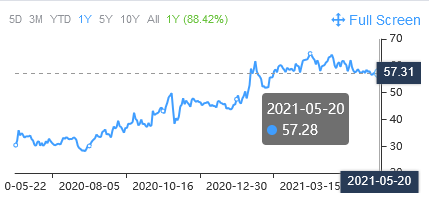

As of May 20, P.A.M. Transportation Services has a share price of $57.28, a price-earnings ratio of 10.61, a past five-year Ebitda growth rate of 11.20% and an estimated future five-year earnings growth rate of 20%. Thus, the trailing 12-month PEG ratio is 0.95 and the forward PEG ratio is 0.53.

Thanks to an 88.42% increase over the past year, the market capitalization stands at $328 million and the 52-week range is $27.3 to $66.285.

GuruFocus assigned a score of 4 out of 10 for the company's financial strength and 7 out of 10 for its profitability.

On Wall Street as of May, the stock has one recommendation rating of buy with an average target price of $67 per share.

Tronox Holdings

The second company that qualifies is Tronox Holdings PLC (NYSE:TROX), a Stamford, Connecticut-based global producer of chemicals that are employed in the manufacture of coatings, paints, plastics and paper.

As of May 20, Tronox Holdings has a share price of $22.53, a price-earnings ratio of 3.5, a past five-year Ebitda growth rate of 54.60% and an estimated future five-year earnings growth rate of 48.90%. Thus, the trailing 12-month PEG ratio is 0.06 and the forward PEG ratio is 0.07.

Thanks to a 271% increase over the past year, the market capitalization is $3.54 billion and the 52-week range is $6.15 to $23.855.

GuruFocus assigned a score of 4 out of 10 for both the company's financial strength and its profitability.

On Wall Street as of May, the stock has a median recommendation rating of overweight with an average target price of $26.75 per share.

The Carlyle Group

The third company that meets the criteria is The Carlyle Group Inc. (NASDAQ:CG), a Washington D.C.-based asset management firm.

As of May 20, Carlyle Group has a share price of $42.26, a price-earnings ratio of 8.29, a past five-year Ebitda growth rate of 32.20% and an estimated future five-year earnings per share growth rate of 15.74%. Thus, the trailing 12-month PEG ratio is 0.26 and the forward PEG ratio is 0.53.

Thanks to a 57.6% increase over the past year, the market capitalization is $14.98 billion and the 52-week range is $23.48 to $45.23.

GuruFocus assigned a score of 3 out of 10 to the company's financial strength rating and 7 out of 10 to its profitability.

On Wall Street as of May, the stock has a median recommendation rating of overweight with an average target price of $47.63 per share.

Disclosure: I have no positions in any securities mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.