A Trio of Strong Performers to Consider

- By Alberto Abaterusso

Shareholders of Builders FirstSource Inc (NASDAQ:BLDR), Deckers Outdoor Corp (DECK) and InMode Ltd (INMD) saw the value of their assets increase significantly in recent years, outperforming the S&P 500 Index. The share price of the benchmark index for the U.S. market ($4,164.66 as of May 4) has gained 47% over the past year, 56% over the past three years and 102% over the past five years through May 4.

Wall Street sell-side analysts have also issued positive recommendation ratings for these stocks, which indicates that they expect share prices to continue rising in the coming years.

Builders FirstSource Inc

Based in Dallas, Texas, Builders FirstSource Inc (NASDAQ:BLDR) is a manufacturer and supplier of building materials and services to U.S. homebuilders and consumers.

Shares of Builders FirstSource have grown 201% over the past year, 163% over the past three years and 350% over the past five years through May 4, outperforming the S&P 500.

Builders FirstSource has not paid any dividends in the observed years.

GuruFocus assigned a rating of 5 out of 10 for the company's financial strength and a rating of 6 out of 10 for its profitability.

The stock closed at $48.81 per share on May 4 for a market capitalization of $10.11 billion.

The stock has a price-earnings ratio of 18.54, a price-book ratio of 4.97 and a price-sales ratio of 0.68. These ratios suggest this stock is not really expensive despite the strong share price increase.

On Wall Street, the stock has a median recommendation rating of buy and an average price target of $55.92 per share.

Deckers Outdoor Corp

Based in Goleta, California, Deckers Outdoor Corp (NYSE:DECK) is a designer and seller of casual and high performing footwear and apparel.

Shares of Deckers Outdoor Corp have grown 145% over the past year, 275% over the past three years and 521% over the past five years through May 4, outperforming the S&P 500.

During the period in question, Deckers Outdoor Corp did not pay dividends.

GuruFocus assigned a rating of 7 out of 10 to the company's financial strength and a rating of 8 out of 10 to its profitability.

The stock was trading at $349.83 per share at close on May 4 for a market capitalization of $9.85 billion.

The stock has a price-earnings ratio of 27.23, a price-book ratio of 6.5 and a price-sales ratio of 4.19. These ratios indicate that the stock is not cheap.

On Wall Street, the stock has a median recommendation rating of buy and an average price target of $395.38 per share.

InMode Ltd

Based in Yokneam, Israel, InMode Ltd (NASDAQ:INMD) is a developer and manufacturer of minimally invasive aesthetic medical devices.

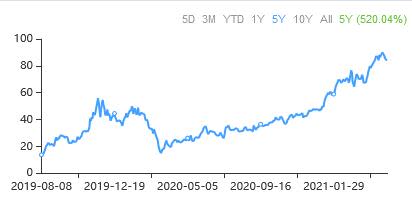

Shares of InMode Ltd have grown 237% over the past year, 558% over the past three years and 520% over the past five years through May 4, outperforming the S&P 500 Index.

InMode Ltd has not paid any dividends over the years observed.

GuruFocus assigned a score of 8 out of 10 to the company's financial strength and a score of 5 out of 10 to its profitability.

The stock was trading at around $84.14 per share at close on May 4 for a market capitalization of $3.21 billion.

The stock has a price-earnings ratio of 47.29, a price-book ratio of 12.5 and a price-sales ratio of 17.22. These ratios indicate that the stock is not cheap.

On Wall Street, the stock has a median recommendation rating of buy and an average price target of $85.33 per share.

Disclosure: I have no positions in any securities mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.