Triton International (NYSE:TRTN) Shareholders Have Enjoyed A 8.8% Share Price Gain

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the Triton International Limited (NYSE:TRTN) share price is 8.8% higher than it was a year ago, much better than the market return of around 6.3% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Triton International for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Triton International

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Triton International actually saw its earnings per share drop 10%. So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

For starters, we suspect the share price has been buoyed by the dividend, which was increased during the year. It could be that the company is reaching maturity and dividend investors are buying for the yield, pushing the price up in the process. Though we must add that the revenue growth of 14% year on year would have helped paint a pretty picture.

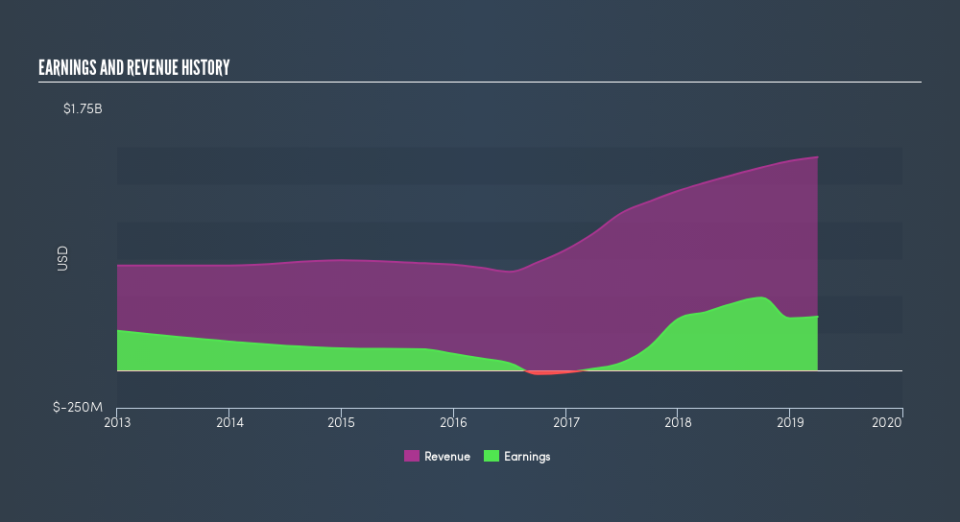

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Triton International has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Triton International, it has a TSR of 16% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Triton International shareholders should be happy with the total gain of 16% over the last twelve months, including dividends. The more recent returns haven't been as impressive as the longer term returns, coming in at just 2.8%. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). Before forming an opinion on Triton International you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.