TruFin (LON:TRU) Shares Have Generated A Total Return Of -56% In The Last Year

The nature of investing is that you win some, and you lose some. Anyone who held TruFin plc (LON:TRU) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 79%. TruFin may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 34% in about a quarter. That's not much fun for holders.

View our latest analysis for TruFin

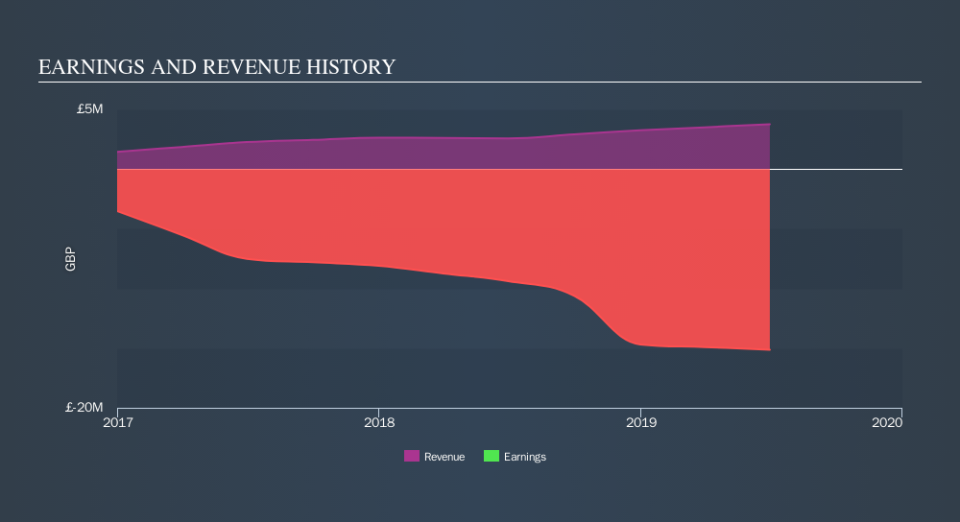

Because TruFin is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, TruFin increased its revenue by 46%. That's definitely a respectable growth rate. Unfortunately, the market wanted something better, given it sent the share price 79% lower during the year. It could be that the losses are too much for investors to handle without losing their nerve. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling TruFin stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between TruFin's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. TruFin hasn't been paying dividends, but its TSR of -56% exceeds its share price return of -79%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While TruFin shareholders are down 56% for the year, the market itself is up 7.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 34%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of TruFin's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.