Trump Announces Plan to Reign In Drug Prices and Pharma Stocks Rally.

On Friday, President Trump unveiled his much-anticipated plan to control drug prices in the U.S. During his presidential campaign, Trump had promised to take on the big drug companies and it was feared that the plan would include provisions that would hurt profits in the pharmaceutical industry.

As the president began speaking, the stock prices of the biggest drug companies did in fact briefly decline, only to reverse course and ended the day broadly higher.

The reason? The plan doesn’t seem to be “taking them on” at all.

The biggest fear was that the new plan would include provisions for Medicare to negotiate directly with drug companies on price. Roughly 30% of the dollar value of prescriptions filled in the U.S. is paid for by Medicare, making the U.S. government the single biggest customer for pharmaceuticals by a wide margin. Drug companies have been staunchly opposed to the idea of direct negotiation as it would almost certainly damage profits.

Once it was clear direct negotiation wasn’t on the agenda, investors snapped up shares of the biggest U.S. drug makers, including Abbvie (ABBV), Amgen (AMGN) and Merck (MRK), each of which finished the day 2% or more above their mid-speech lows.

The President Takes on Softer Targets.

Trump decried the participation of what he referred to as “middlemen”, meaning primarily Pharmacy Benefit Managers – intermediaries between manufacturers and doctors and pharmacies.

He also took aim at small pharmaceutical companies who buy up off-patent generic drugs and raise the prices sharply. Because this strategy is mainly the practice of small companies (think Martin Shkreli and Turing Pharmaceutical), it won’t affect the big names and Trump’s plan to speed FDA approval of generic drugs could actually help big pharma.

Finally, Trump took aim at a familiar target – foreign countries. Explaining that other countries pay “a tiny fraction of what the medicine costs in the U.S.” Trump continued, “…it’s time to end the global freeloading.”

Drug prices in the U.S. can often be three times as much as in the U.K. and the E.U. and the president thinks those countries should pay their fair share of the costs of research and development of U.S. manufactured pharmaceuticals. It’s not immediately clear how exactly the administration could go about raising drug prices off of U.S. soil, but the mere suggestion of concentrating on higher prices elsewhere as a catalyst to lower prices here at home was wind in the sales of the drug makers.

Cancer Drugs are Attractive

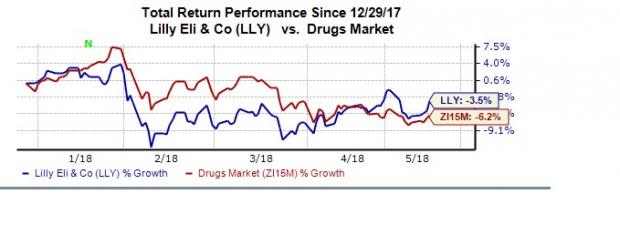

In the large cap drug space, investors should consider Eli Lilly (LLY). Having just reported a strong quarter with $1.34/share in earnings, beating the Zacks Consensus Estimate of $$1.11/share, LLY has seen 7 upwards estimates for 2018 in the past 30 days and earns a Zacks rank #1 (Strong Buy).

Eli Lilly also recently announced its planned acquisition of Armo Biosciences, bolstering its position in the hot field of immunotherapies for cancer treatment.

In the Biomedical and Genetics sector, Excelixis Inc (EXEL) shares have been moving lower lately despite a blowout earnings beat in Q1, topping estimates by 131%. In the report EXEL highlighted several promising cancer treatments in its research pipeline and reaffirmed revenue guidance of $430M to $460M for 2018.

Six recent upward revisions in earnings for 2018 and a Zacks Consensus Estimate of $0.86/share, up from $0.54 just 30 days ago get EXEL a Zacks Rank #1 (Strong Buy). The recent downturn in stock price (despite a 5% rally on Friday) make the stock an excellent value proposition, trading at a forward P/E of 23.2X, considerably cheaper than its peer group which averages 48.1X.

Looking for Stocks with Skyrocketing Upside? Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research