The 'Trump trade' is back — but it might not be because of Trump

The “Trump Trade” has returned to markets.

On Wednesday, after President Donald Trump unveiled his administration’s most recent outline for tax reform, the trades that defined markets in the days after the election were back in focus in a big way.

The small-cap Russell 2000 — which has revenues more concentrated in the U.S. than the benchmark S&P 500 — rallied almost 2% to hit a new record while the S&P finished just off a record high. Bond yields also rose, with the 10-year yield topping 2.3% for the first time since July, while bank stocks also rallied. All hallmarks of the late 2016 trends that predominated in markets.

And so after the “Trump Trade” had been declared dead back in the spring while the FAAMNG stocks became the big leaders everyone focused on, it seems this trade has come back to life.

“Having shown recent signs of life, fiscal ‘Trump Trades’ (‘reflation’ trades) moved higher yesterday on the Trump Administration’s long-awaited release of its tax plan,” wrote Goldman Sachs’ Michael Cahill on Thursday. “[Wednesday’s] repricing extended a fiscal/reflation theme that has been emerging alongside a number of positive developments for the US outlook over the past several weeks.”

Unwinding undue pessimism

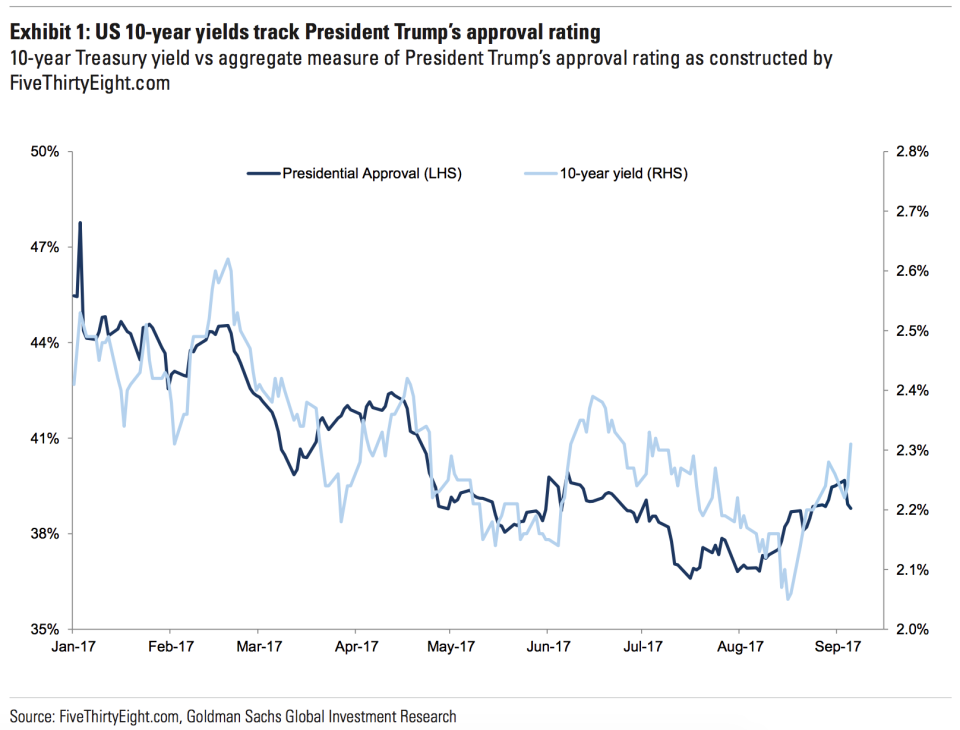

Cahill notes that the recent return of the Trump trade is likely due, at least in part, to an unwinding of what he calls “undue pessimism” about Trump’s economic agenda falling into place. President Trump’s approval rating has also closely tracked the 10-year yield, opening up a line of argument that says that as long as voter support remains somewhat intact, Trump’s pro-growth agenda has a chance at being enacted.

So while politically, the health care debate has been a headache for Republicans, investors have seen this as clearing the schedule for progress to begin on tax reform. Additionally, recent macro data, including stronger-than-expected inflation in August, makes this summer’s weakness look like a passing phase, in Cahill’s view.

“In short, we see reasons to think that most of the recent rally of fiscal ‘Trump trades’ is simply an unwind of recent (undue) pessimism,” Cahill writes.

“With continued progress on the policy front, alongside strong growth, low unemployment and continued upside risk to inflation indicators, we think there are reasons to believe that the recent reversal of pessimistic growth and dovish policy expectations can continue.”

The balance of evidence on what’s driving markets right now, however, remains a mixed bag.

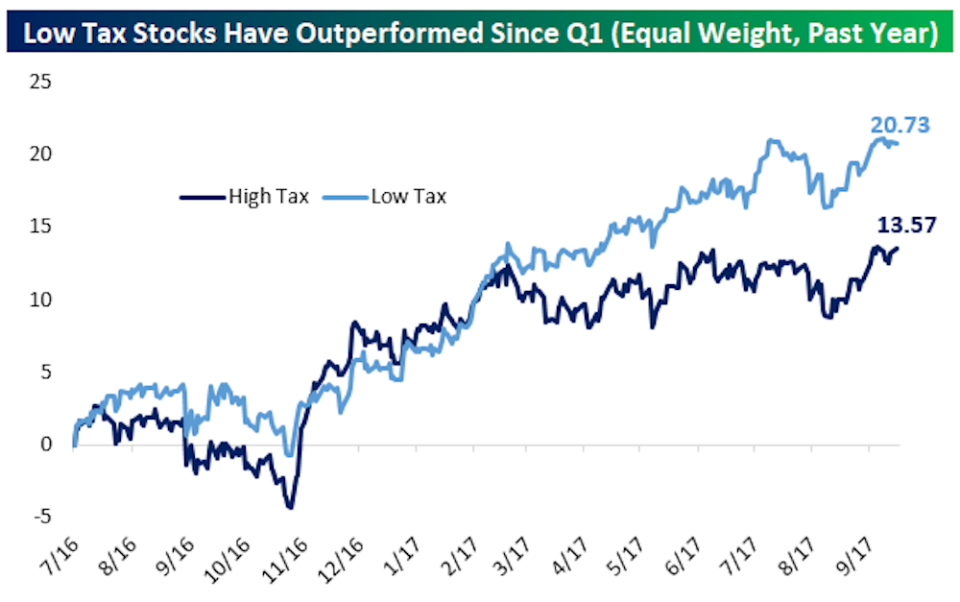

In a note to clients on Thursday, analysts at Bespoke Investment Group argued that while Wednesday’s rally has been attributed to renewed optimism around tax reform, more specific stock market trades related to the tax burden of corporates offer little compelling evidence that this is the case.

Specifically, “low tax” stocks have been and continue to significantly outperform “high tax” stocks.

And while the firm notes that several factors play into this outperformance — tech stocks, which have been the market’s leaders this year, are often in the low tax basket and high-tax firms are often more levered to the U.S. economy and thus sensitive to downward moves in the dollar — it is hard to see broad optimism from markets on tax reform right now.

Wednesday’s rally also ended a nearly 10-month period in which the Russell 2000, a market leader after the election, had done nothing. And as finance blogger and technician J.C. Parents noted on Wednesday, with the market showing characteristics of being in the middle of, not the end of, a bull market run, this breakout to new highs confirms strength in the overall rally.

So we can point to politics and Trump and the day’s news as potential reasons why the “Trump trade” is back on. Or we can appreciate that inside of a bull market sector leadership rotates, indexes push higher and then stall, and accept that the real factor driving the market higher is the market’s own strength.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: