Tsakos Energy Navigation's (NYSE:TNP) Stock Price Has Reduced 67% In The Past Five Years

While not a mind-blowing move, it is good to see that the Tsakos Energy Navigation Limited (NYSE:TNP) share price has gained 20% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. Indeed, the share price is down 67% in the period. Some might say the recent bounce is to be expected after such a bad drop. Of course, this could be the start of a turnaround.

View our latest analysis for Tsakos Energy Navigation

Given that Tsakos Energy Navigation didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Tsakos Energy Navigation saw its revenue increase by 4.9% per year. That's far from impressive given all the money it is losing. It's likely this weak growth has contributed to an annualised return of 11% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Tsakos Energy Navigation. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

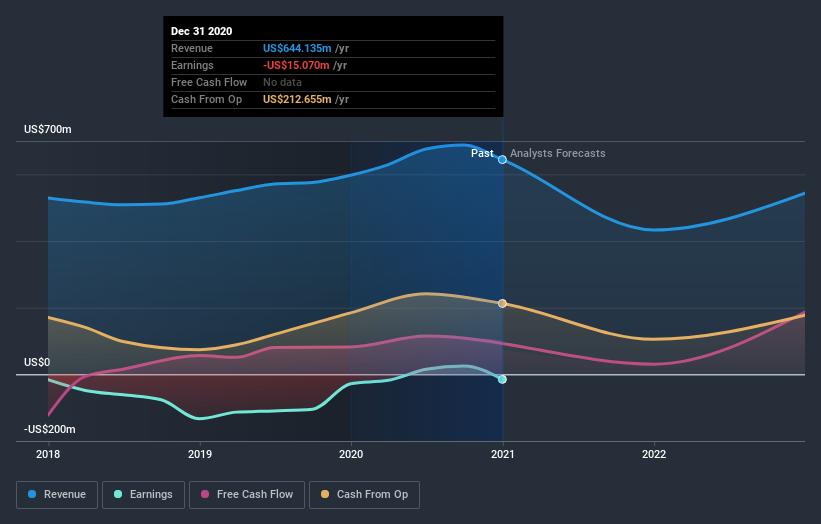

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Tsakos Energy Navigation stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Tsakos Energy Navigation's TSR for the last 5 years was -60%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Tsakos Energy Navigation had a tough year, with a total loss of 38% (including dividends), against a market gain of about 62%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Tsakos Energy Navigation (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

We will like Tsakos Energy Navigation better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.