TSM’s Dividend History is Another Reason to Like the Stock

This article first appeared on Simply Wall St News

Key takeaways from this analysis

TSM delivered an excellent set of fourth-quarter results

The company’s margins and dividend history should make it a great investment at the right price

While the current valuation isn’t completely unreasonable it may not offer a margin of safety to investors.

Taiwan Semiconductor Manufacturing ( NYSE: TSM ) reported an excellent set of fourth-quarter results, which resulted in the stock rallying as much as 9% on Thursday. Sales were lower than expected, but still 26.7% higher than a year ago. Earning per share rose 58% to $1.82 which was 7 cents ahead of consensus estimates.

TSM’s gross margin improved to 62% from 52% a year ago, while the operating margin was 52%.

Despite the strong result, there were a few negatives. The company said sales were affected by weak end-market demand, and this is expected to continue into the current quarter. The Capex forecast was also lowered by 6% which may indicate the company is less optimistic about demand.

The company also said that its new plant in Arizona will cost five times more than it would in Taiwan, reflecting a challenge the company faces in diversifying geographically.

See our latest analysis for Taiwan Semiconductor Manufacturing

TSM’s Dividend

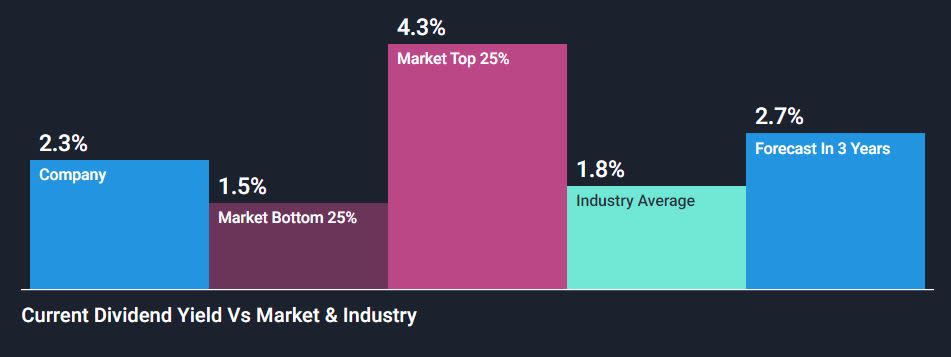

TSM’s current dividend yield of 2.3% is higher than most companies in the tech sector and the semi-industry. Perhaps more importantly, it’s been raised consistently over the last 15 years. This means shareholders should see their dividend continue to rise, and also suggests the company has confidence in continued earnings growth.

With TSM’s strong margins, the dividend is well covered and the risk of the dividend being cut is reasonably low.

Some of the other Encouraging Fundamentals

Besides the dividend, there are several other factors in TSM’s favor. The company is the world’s leading chip fabricator and is way ahead of most of its competitors in terms of innovation and capacity. This lead has allowed the company to earn and defend very wide margins and cash flows.

The company also has a stellar record of allocating capital, and ongoing opportunities to reinvest cash flows. These are the key ingredients that allow companies to compound their earnings over time.

The Catch is the Valuation

Deciding on the right price to pay for TSM is the tricky part. The valuation doesn’t appear completely unreasonable, but it certainly isn’t a bargain either. According to the six valuation measures Simply Wall St tracks, TSM is overvalued on three and undervalued on the other three.

The price-to-earnings ratio of 14.7x appears low, but it's worth noting that TSM’s cash flows are lower than net income. The price-to-free cash flow is quite a bit higher.

More important for the valuation is the likely earnings growth rate. Analysts are expecting EPS to decline by around 13% in 2023 and then increase by 23% and 13% in 2024 and 2025. That averages at around 7% for the next three years, which doesn’t look like a market-beating growth rate. The reality is that analysts can’t forecast earnings two to three years from now with any precision - and growth could be much higher or lower.

What this means for Investors

TSM’s strong competitive advantage, margins, and dividend history are great attributes for a stock. But returns may turn out to be disappointing unless the growth rate picks up. It may do just that, but a lower share price would offer more of a margin of safety.

If EPS do decline over the next year as analysts expect, investors may have an opportunity to invest at a better price.

If you would like to know more about this company and its peers check out the full analysis for Taiwan Semiconductor Manufacturing.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here