TSX Stocks Insiders Are Buying

One indicator for beating the market, which has held up extremely well over time is: if executives, directors or others with inside knowledge of a public company are buying or selling shares, investors should consider doing the same thing. This is because these insiders have unique insights into their own companies compared to individual investors. Should you followsuit? Below, I’ve selected three TSX companies which insiders have recently accumulated more shares in.

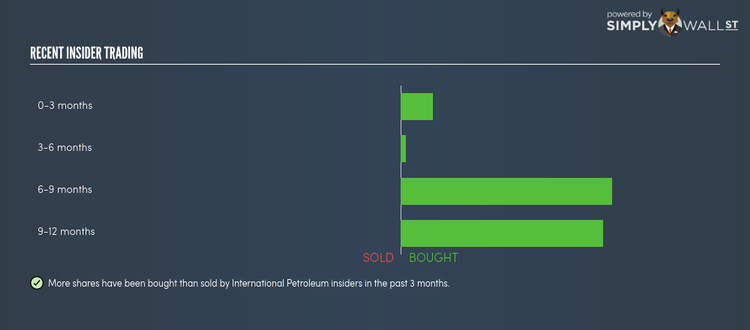

International Petroleum Corporation (TSX:IPCO)

International Petroleum Corporation operates as an oil and gas exploration and production company in Europe and South East Asia. International Petroleum was formed in 2017 and has a market cap of CAD CA$476.54M, putting it in the small-cap group.

International Petroleum Corporation’s (TSX:IPCO) insiders have invested 13,305 shares in the small-cap stocks within the past three months. In total, individual insiders own less than one million shares in the business, or around 1.07% of total shares outstanding.

The insider that recently bought more shares is Daniel Fitzgerald (management) .

Analysts anticipate an impressive double-digit top-line growth next year, which appears to flow through to a large earnings growth rate of 196.98%. If insiders believe these benefits are defensible, this could be a motivation for the net buying activity. More on International Petroleum here.

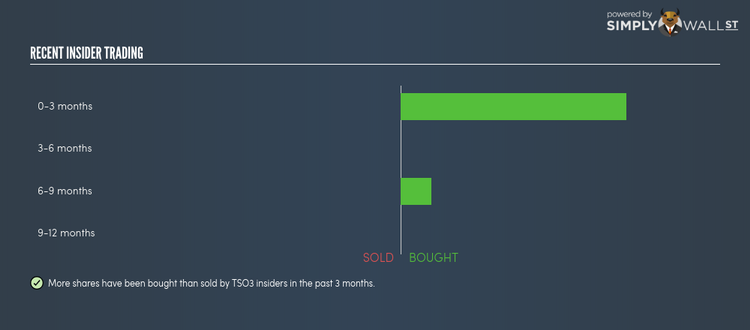

TSO3 Inc. (TSX:TOS)

TSO3 Inc. engages in the research, development, production, maintenance, sale, and licensing of sterilization processes, related consumable supplies, and accessories for heat and moisture sensitive medical devices. Founded in 1998, and now run by Richard Rumble, the company currently employs 80 people and with the market cap of CAD CA$97.54M, it falls under the small-cap group.

TSO3 Inc’s (TSX:TOS) insiders have invested 161,900 shares in the small-cap stocks within the past three months. In total, individual insiders own less than one million shares in the business, or around 0.67% of total shares outstanding.

The following insiders have recently increased their company holdings: Glen Kayll (management and board member) . , Harold Tessman (management) . and Richard Rumble (management) .

Analysts anticipate decline in the top-line next year, which could imply some headwinds going forward. Though, next year’s expected earnings growth of 36.97% could indicate the company’s cost controls will show meaningful results, offsetting the fall in revenue growth. Insiders may have confidence in these cost initiatives, or believe the market has overly penalized the company’s shares, leading to an opportune time to buy. Interested in TSO3? Find out more here.

Lucara Diamond Corp. (TSX:LUC)

Lucara Diamond Corp., a diamond mining company, engages in the acquisition, exploration, development, and operation of diamond properties in Africa. Started in 1981, and currently headed by CEO William Lamb, the company size now stands at 250 people and with the company’s market cap sitting at CAD CA$811.22M, it falls under the small-cap stocks category.

Lucara Diamond Corp (TSX:LUC) is one of Canada’s small-cap stocks that saw some insider buying over the past three months, with insiders investing in 50,000 shares during this period. In total, individual insiders own over 16 million shares in the business, which makes up around 3.96% of total shares outstanding.

The insider that recently bought more shares is John Armstrong (management) .

With revenues predicted to grow 19.28%, over the next three years from today’s level, which is an underlying driver of the impressive earnings growth of 21.53%, insiders may be buying based on LUC’s optimistic outlook which they believe are not yet priced into the stock. More on Lucara Diamond here.

For more stocks with high, positive trading volume by insiders, explore this interactive list of stocks with recent insider buying.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.