TSX Top Dividend Paying Stocks

Becker Milk is one of the companies that can help improve your portfolio income through large dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. If you’re a buy and hold investor, these healthy dividend stocks can generously contribute to your monthly portfolio income.

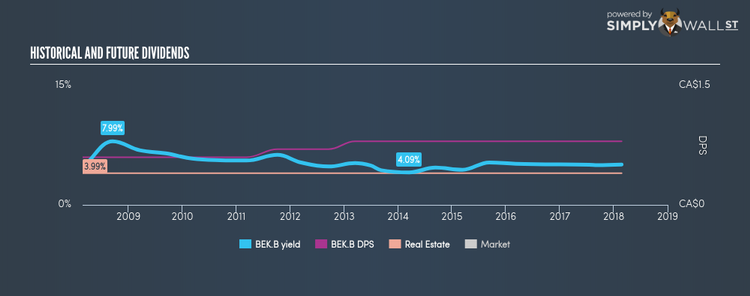

The Becker Milk Company Limited (TSX:BEK.B)

The Becker Milk Company Limited owns and manages retail commercial properties primarily in Ontario, Canada. Becker Milk was founded in 1957 and with the company’s market capitalisation at CAD CA$28.50M, we can put it in the small-cap stocks category.

BEK.B has an appealing dividend yield of 5.08% and pays out 82.53% of its profit as dividends . The company’s DPS has increased from CA$0.60 to CA$0.80 over the last 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. Becker Milk’s earnings per share growth of 3.15% outpaced the ca real estate industry’s -14.54% average growth rate over the last year. Interested in Becker Milk? Find out more here.

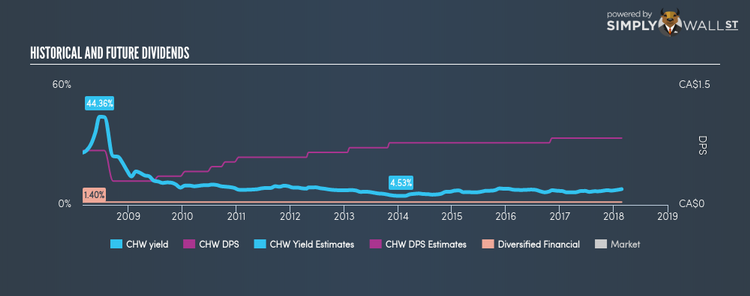

Chesswood Group Limited (TSX:CHW)

Chesswood Group Limited, a financial services company, operates primarily in the specialty finance industry. Chesswood Group was started in 1982 and has a market cap of CAD CA$195.70M, putting it in the small-cap group.

CHW has a juicy dividend yield of 7.93% and the company has a payout ratio of 87.59% . CHW’s DPS have risen to CA$0.84 from CA$0.68 over a 10 year period. Much to the delight of shareholders, the company has not missed a payment during this time. The company outperformed the ca diversified financial industry’s earnings growth of -19.07%, reporting an EPS growth of 16.86% over the past 12 months. Continue research on Chesswood Group here.

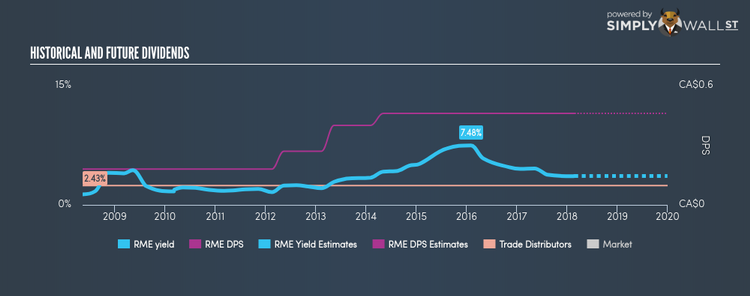

Rocky Mountain Dealerships Inc. (TSX:RME)

Rocky Mountain Dealerships Inc., together with its subsidiaries, sells, leases, and provides support services for new and used agriculture and industrial equipment in Canada. Started in 1949, and currently lead by Garrett Ganden, the company provides employment to 860 people and has a market cap of CAD CA$251.25M, putting it in the small-cap group.

RME has a sizeable dividend yield of 3.64% and the company currently pays out 45.92% of its profits as dividends . In the case of RME, they have increased their dividend per share from CA$0.18 to CA$0.46 so in the past 10 years. The company has been a reliable payer too, not missing a payment during this time. Interested in Rocky Mountain Dealerships? Find out more here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.