Tuesday’s Vital Data: Micron Technology, Inc. (MU), Advanced Micro Devices, Inc. (AMD) and Square Inc (SQ)

U.S. stock futures are trending higher this morning, despite an impending flurry of data set to sweep over the Street. Foremost, Jerome Powell, President Donald Trump’s pick to run the Federal Reserve, is slated to testify before a Senate confirmation panel this morning.

Traders will be looking for cues on how Powell will run the central bank. Also from the Fed, a trio of regional presidents are slated to give speeches later today.

On the economic front, October advance trade goods data, September home prices and the November consumer confidence index are all slated to hit near the open.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Against this crowded backdrop, Dow Jones Industrial Average futures have risen 0.14%, S&P 500 futures have added 0.09% and Nasdaq-100 futures are up 0.09%.

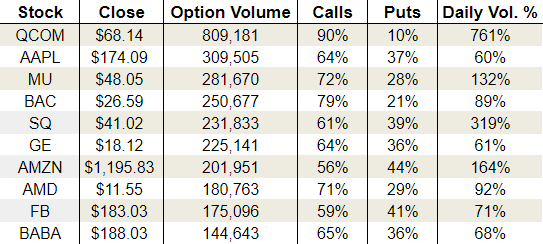

On the options front, volume remained relatively light as traders filtered back in from the holiday weekend. Overall, about 16.6 million calls and 12.1 million puts changed hands on Monday. As for the CBOE, the single-session equity put/call volume ratio ticked lower to 0.61, while the 10-day moving average held at 0.63.

Diving into Monday’s options activity, Micron Technology, Inc. (NASDAQ:MU) was smacked lower amid heavy volume after Morgan Stanley warned of falling NAND chip prices. Elsewhere, Advanced Micro Devices, Inc. (NASDAQ:AMD) has seen a surge in both call options activity and short interest in recent weeks, while Square Inc (NASDAQ:SQ) was downgraded to “sell” at BTIG due to bitcoin speculation.

Micron Technology, Inc. (MU)

Morgan Stanley downgraded several semiconductor makers yesterday after stating that “now is the time to reduce exposure to NAND (flash memory) and Asian semiconductor names.” The brokerage firm says that they see the pricing power that bolstered NAND producers is reversing soon. While Morgan said that Micron would be fine due to its exposure to DRAM, the damage was already done.

MU stock shed more than 3% yesterday, pulling back to its 10-day moving average. This technical support provided courage to MU options traders, as the stock was flooded with calls on Monday. Volume nearly doubled MU’s daily average and topped 281,000 contracts. Calls made up an impressive 72% of this activity.

Expectations were already set pretty high for December, however, as the front-month put/call open interest ratio has fallen to a reading of 0.37, with calls nearly tripling puts for the series. That said, peak December call OI still rests at the in-the-money $45 strike, hinting that, despite the enthusiasm, MU options traders are still somewhat tempered in their expectations.

Advanced Micro Devices, Inc. (AMD)

Unlike many of its peers, AMD continues to attract a wealth of negativity on Wall Street. The most recent reporting period for short interest underscored this fact, as the number of AMD shares sold short surged 12% to about 173 million. Short interest now accounts for a whopping 21% of AMD’s total float, or shares available for public trading.

At about the same time, AMD has seen a rise in call options activity. This increased attention to calls was underscored on Monday, when these typically bullish bets accounted for 71% of the more than 180,000 contracts traded on AMD. As a result, AMD’s December put/call OI ratio has fallen to a near-term low of 0.65 due to the added attention to call options.

So how are calls, or bets that a stock will go up, related to short selling? Well, short sellers will often buy calls as a way to hedge their short positions, thus limiting their losses. AMD has a history of volatile price movements, so hedging a short position with a call here would make sense. The takeaway is that sentiment remains highly negative on AMD, despite the recent rise in call open interest.

Square Inc (SQ)

Remember back on Nov. 20 when I warned that Square was overvalued due to the irrational exuberance surrounding bitcoin? Apparently, I’m not the only one who thinks so. Yesterday, BTIG issued a wake-up call, downgrading SQ stock to “sell” from “neutral” due to an overheated reaction to bitcoin news.

“We believe SQ’s valuation already reflects emphatic and unimpeded growth while failing to factor in competitive, credit-related and macro risks that did not go away when some investors suddenly viewed its shares as a play on a trendy cryptocurrency,” BITG said in the research note.

SQ stock plunged 16% following the downgrade. If you followed my secondary recommendation on SQ (the Dec $46/$47 bull call spread), I hope you already closed out your position. If you got into the primary recommendation (the Dec $41/$43 bear put spread), you should be sitting near a maximum return right now.

As for Monday’s options activity, calls were heavily favored and many traders rushed to take profits from the recent rally. Volume reached over 231,000 contracts, more than tripling SQ stock’s daily average, while calls made up 61% of the day’s take.

Square is heading lower again in premarket activity, putting the shares close to roughly 5,700 December $40 strike put contracts. I don’t see SQ taking out this level ahead of expiration unless more analysts pile on with BITG, however.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Tuesday’s Vital Data: Micron Technology, Inc. (MU), Advanced Micro Devices, Inc. (AMD) and Square Inc (SQ) appeared first on InvestorPlace.