Tweedy Browne Burns Oil Holdings in the 3rd Quarter

- By Graham Griffin

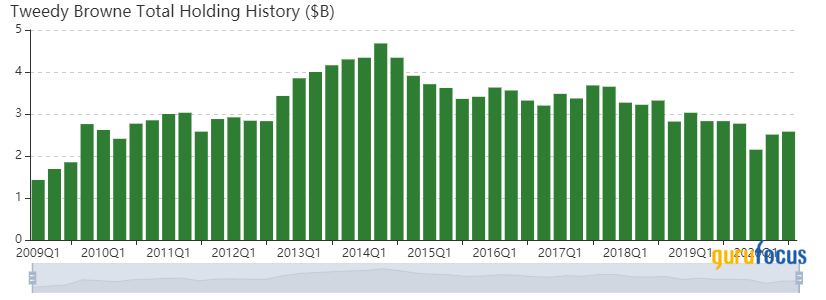

Investment firm Tweedy Browne (Trades, Portfolio) has released its portfolio for the third quarter. The firm cut down its holdings in both ConocoPhillips (NYSE:COP) and Phillips 66 (NYSE:PSX) while adding several new positions.

The Tweedy Browne (Trades, Portfolio) investment approach derives from the work of Benjamin Graham. Their research seeks to appraise the worth of a company by determining its acquisition value, or by estimating the collateral value of its assets and cash flow. Investments are made at a significant discount to intrinsic value. Investments are then sold as the market price approaches intrinsic value, with the proceeds reinvested in other situations offering a greater discount to intrinsic value.

Portfolio overview

At the end of the quarter, the equity portfolio contained 47 stocks, with four new holdings. It was valued at $2.58 billion and has seen a turnover rate of 4%. Top holdings at the end of the quarter were Berkshire Hathaway Inc. (NYSE:BRK.A), Johnson & Johnson (NYSE:JNJ), Cisco System Inc. (NASDAQ:CSCO), Alphabet Inc. (NASDAQ:GOOGL) and Baidu Inc. (NASDAQ:BIDU).

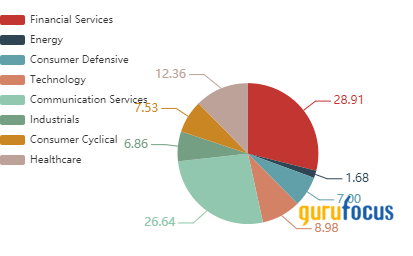

By weight, the top three sectors represented are financial services (28.91%), communication services (26.64%) and health care (12.36%).

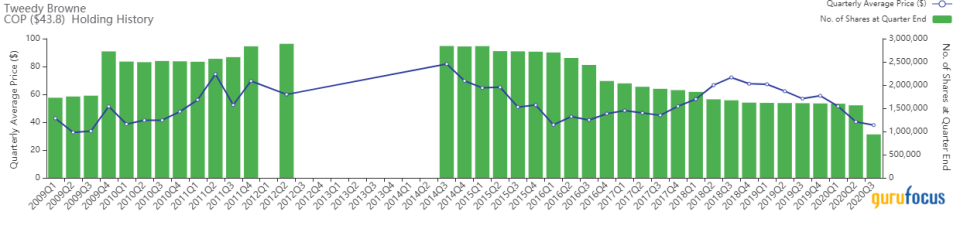

ConocoPhillips

Continuing its selling pattern since 2015, the firm reduced its stake in ConocoPhillips by an additional 40.10%. The firm sold 627,030 shares, which traded at an average price of $37.92 during the quarter. Overall, the sale had an impact of -1.05% on the portfolio and GuruFocus estimates the total loss of the holding at 4.75%.

ConocoPhillips is a U.S.-based independent oil and gas exploration and production company. At the end of the first quarter of 2020, it produced 843,000 barrels per day of oil and natural gas liquids and 2.7 billion cubic feet per day of natural gas. Proven reserves at year-end 2019 were 5.3 billion barrels of oil equivalent.

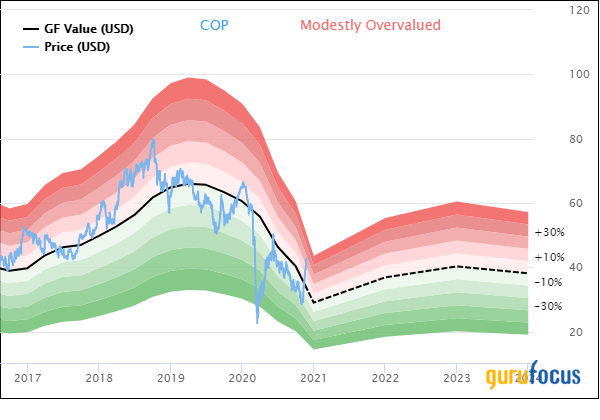

On Nov. 24, the stock was trading at $43.90 per share with a market cap of $46.78 billion. According to the GF Value Line, the stock is modestly overvalued.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 3 out of 10. There are currently two severe warning signs issued for a low Piotroski F-Score and declining revenue per share. Revenue numbers hit a low in 2016 and have been unable to recover to the same level as seen in the first half of the decade.

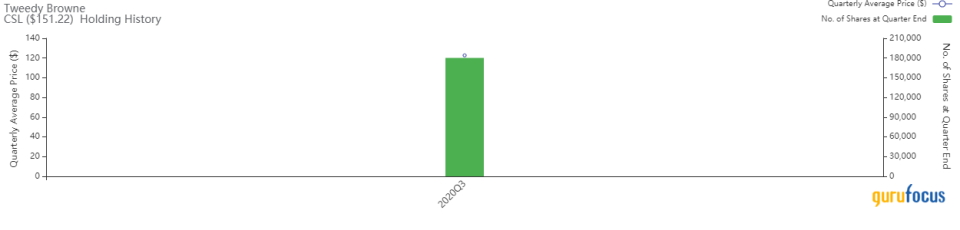

Carlisle Companies

A new purchase in Carlisle Companies Inc. (NYSE:CSL) represented the largest new buy for the firm during the quarter. The holding was established with the purchase of 180,194 shares, which traded at an average price of $122.70 during the quarter. GuruFocus estimates that the holding has already gained 23.24% and the purchase had an impact of 0.85% on the portfolio.

Carlisle Companies is a holding company. Through its subsidiaries, it manufactures and sells rubber and plastic engineered products. The company is organized into four segments based on product type. A vast majority of the company's revenue comes from the construction material segment and more than half of the total revenue is earned in the United States.

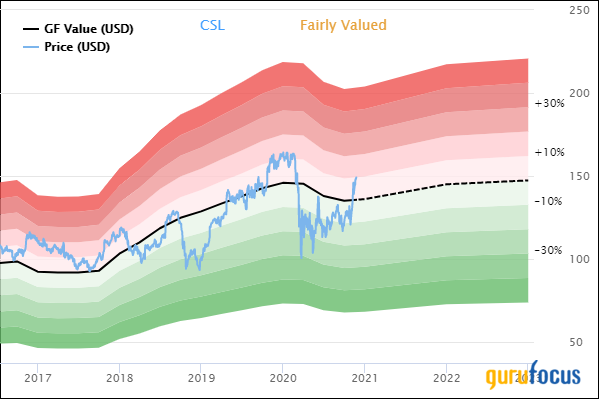

As of Nov. 24, the stock was trading at $151.65 per share with a market cap of $8.07 billion. The GF Value Line shows the stock is trading at fair value.

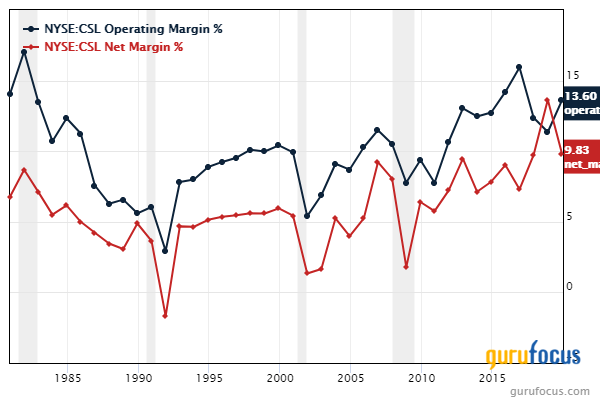

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 3 out of 10. There is currently one severe warning sign issue for declining operating margin percentage. Despite the warning sign, the operating margin of 11.86% ranks the company higher than competitors alongside a strong net margin percentage of 7.91%.

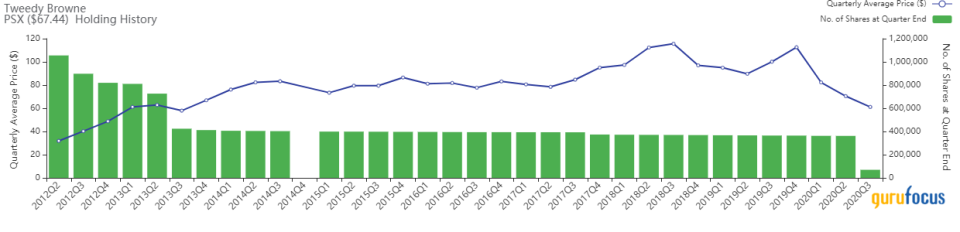

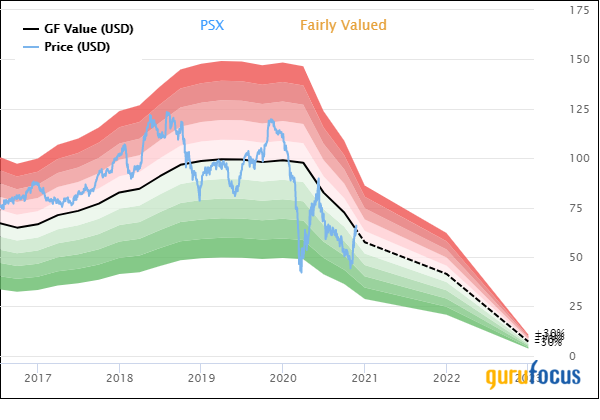

Phillips 66

During the quarter, Phillips 66 was cut down to size with an 80.81% reduction. The firm sold 292,300 shares, which traded at an average price of $61.11 during the quarter. Overall, the sale had an impact of -0.84% on the portfolio and GuruFocus estimates the total gain of the holding at 82.58%.

Phillips 66 is an independent refiner with 13 refineries that have a total throughput capacity of 2.1 million barrels per day. Its DCP Midstream joint venture holds 61 natural gas processing facilities, 12 natural gas liquids fractionation plants and a natural gas pipeline system with 64,000 miles of pipeline. Its CPChem chemical joint venture operates facilities in the United States and the Middle East and primarily produces olefins and polyolefins. Phillips 66 also holds a 75% interest in Phillips 66 Partners after exchanging its general partner incentive distribution rights for limited partner units.

Nov. 24 saw the stock trading at $67.42 per share with a market cap of $29.49 billion. The GF Value Lline gives the stock a fair value rating.

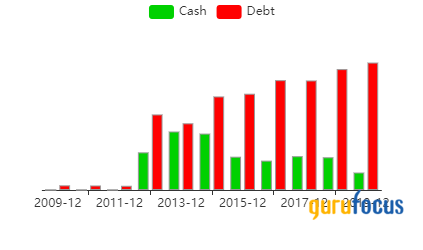

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rank of 6 out of 10. There are currently three severe warning signs issued for new long-term debt, a low Piotroski F-Score and declining gross margin percentage. The last decade has seen debt skyrocket as cash has declined over the last seven years.

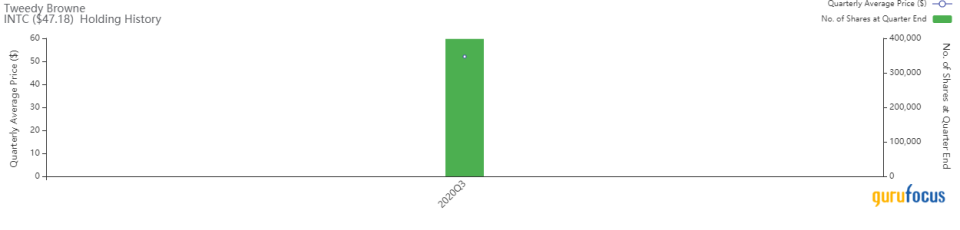

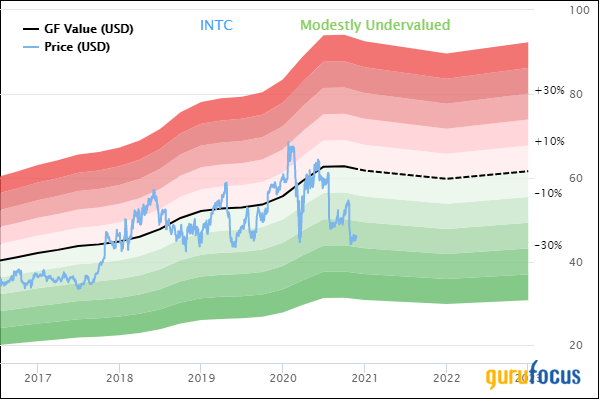

Intel

Intel Corp. (NASDAQ:INTC) was also added to the portfolio with the purchase of 398,250 shares. The stock traded at an average price of $52.07 during the quarter. The purchase had an overall impact of 0.80% on the portfolio and GuruFocus estimates the total loss at 9.39%.

Intel is one of the world's largest chipmakers. It designs and manufactures microprocessors for the global personal computer and data center markets. While Intel's server processor business has benefited from the shift to the cloud, the company has also been expanding into new adjacencies as the personal computer market has declined. These include areas such as the internet of things, memory, artificial intelligence and automotive.

On Nov. 24, the stock was trading at $47.14 per share with a market cap of $193.18 billion. The GF Value Line shows the stock trading at a modestly undervalued level.

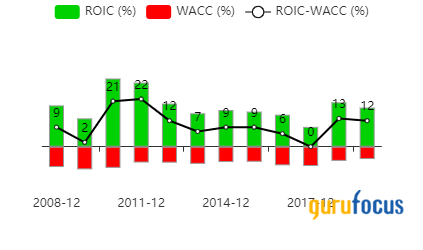

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rank of 9 out of 10. There are currently two severe warning signs issued for assets growing faster than revenue and a declining gross margin percentage. The return on invested capital easily supports the weighted average cost of capital, leaving room for growth moving into the future.

Truist Financial

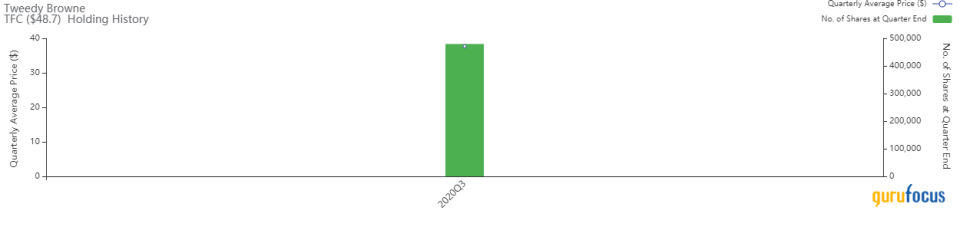

A new buy into Truist Financial Corp. (NYSE:TFC) rounds out the top five trades for the firm. The holding was established with the purchase of 479,476 shares. The stock traded at an average price of $37.68 during the quarter. The purchase had an impact of 0.71% on the portfolio and GuruFocus estimates the firm has already gained 29.25% on the holding.

Based in Charlotte, North Carolina, Truist is the combination of BB&T and SunTrust. Truist is a regional bank with a presence primarily in the southeastern United States. In addition to commercial banking, retail banking and investment banking operations, the company operates several nonbank segments, the primary one being its insurance brokerage business.

On Nov. 24, the stock was trading at $48.79 per share with a market cap of $65.65 billion. The GF Value Line gives the stock a modestly undervalued rating.

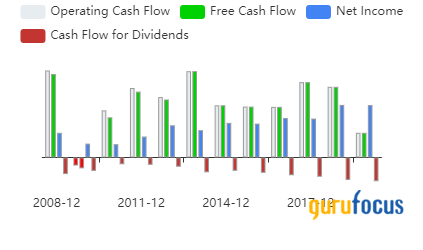

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 4 out of 10 and a valuation rank of 4 out of 10. There are currently two severe warning signs issued for assets growing faster than revenue and poor financial strength. Cash flows slipped in 2019 while net income remained high.

Disclosure: Author owns no stocks mentioned.

Read more here:

Mario Cibelli Cuts Simply Good Foods, Adds Stitch Fix in 3rd Quarter

Stanley Druckenmiller Slashes JPMorgan Chase and PayPal in the 3rd Quarter

Jim Simons' Firm's Top 5 Sells of the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.