Tweedy Browne Global Value Fund's 3rd-Quarter Sells

The Tweedy Browne Global Fund (Trades, Portfolio), which invests in U.S. and foreign equity securities, disclosed its third-quarter portfolio updates earlier this week. Its most notable changes come in the form of sellouts of three cyclicals, Daily Mail and General Trust PLC (LSE:DMGT), Hyundai Motor Co. (XKRX:005380) and Kia Motors Co. (XKRX:000270).

As of the end of the quarter, this Benjamin Graham follower holds 83 stocks valued at $6.94 billion, down from 91 stocks valued at $7.63 billion at the closing of the previous quarter. The fund's strategy is to diversify itself throughout the world, focusing primarily on stocks that are listed in developed markets and are trading below their intrinsic value.

Daily Mail and General Trust

After reducing its holding in the Daily Mail by 69.82% in the previous quarter, the Tweedy Browne (Trades, Portfolio) Global Value Fund sold its remaining 1,625,874 shares during the third quarter. The stock was trading at an average price of 7.94 pounds ($10.23) during the quarter.

This U.K.-based publishing company has a market cap of 1.93 billion pounds ($2.94 billion). It has a price-earnings ratio of 4.84, a price-sales ratio of 2.11 and an operating margin of 6.1%. GuruFocus has assigned it a financial strength rating of 6 out of 10 and a profitability rating of 7 out of 10.

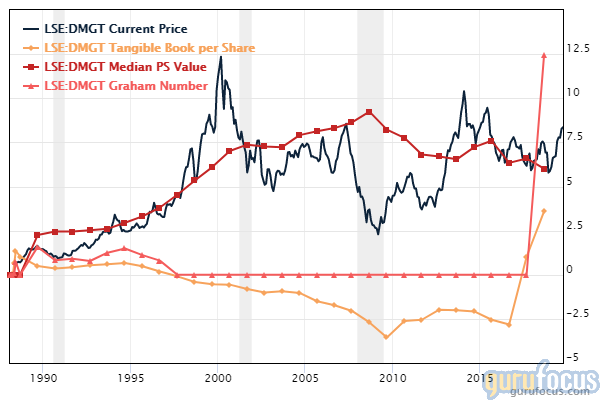

Below is a chart of the Daily Mail's stock price alongside its tangible book value per share, median price-sales value and Graham number. The median price-sales value is close to the stock price, while the tangible book value per share shows it as overvalued and the Graham number shows it as undervalued. For a cyclical company, this pattern can often mean that a stock is steeply overvalued.

Hyundai Motor

The global value fund sold all 1,208,796 of its Hyundai shares. During the quarter, the stock was trading at an average of 130,750 won per share ($110.89).

Hyundai is a South Korea-based automobile company with a market cap of 29.64 trillion won ($25 billion). It has a price-earnings ratio of 14.38, a price-sales ratio of 1.2 and an operating margin of 3.87%. It has a GuruFocus financial strength score of 4 out of 10 and a profitability score of 6 out of 10.

The chart below shows the Hyundai stock price, tangible book value per share, median price-sales value and Graham number. Both the tangible book value per share and the Graham number are above the share price and the median price-sales value, indicating that the stock is currently undervalued, though intrinsic value calculations tend to lag where cyclicals are concerned. The company's asset growth is higher than its revenue growth, which means it may be becoming less efficient.

Kia Motors

The fund sold its remaining 953,743 Kia shares. During the quarter, the stock was trading at an average price of 43,415.1 won per share.

Kia is a South Korea-based automobile company with a market cap of 16.6 trillion won. It has a price-earnings ratio of 10.73, a price-sales ratio of 0.31 and an operating margin of 2.99%. It has a GuruFocus financial strength score of 7 out of 10 and a profitability score of 7 out of 10.

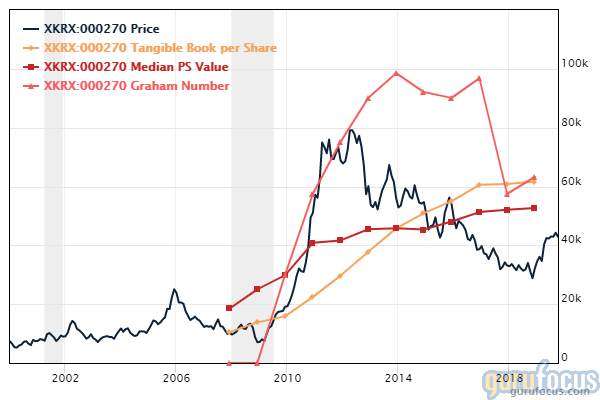

As shown in the chart below, all three of the measured intrinsic value indicators are higher than the current share price and have been since 2016, indicating that the stock may be undervalued. However, like Hyundai, Kia's assets are increasing more than its revenue, and its revenue has been holding steady while net income has been slowly decreasing since 2012. Since Kia is in the highly cyclical automobile industry, these patterns may indicate its stock is overvalued.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

T. Rowe Price Japan Fund's 3rd-Quarter Sellouts and New Buys

Food Fads: Big Names Buying the Bandwagon

Jerome Dodson's 3rd-Quarter New Buys

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.