Tweedy Browne Loosens Hold of MRC Global

Investment firm Tweedy Browne (Trades, Portfolio) revealed last week it trimmed its stake in MRC Global Inc. (NYSE:MRC) by 19.5%.

The New York-based firm, which has been around for a century, is an investment partnership that is operated by its four managing directors, William H. Browne, John D. Spears, Thomas H. Shrager and Robert Q. Wyckoff Jr. Deriving its investment approach from the work of Benjamin Graham, the firm oversees around $4.5 billion in assets through four unique mutual funds. Each of the portfolios is managed according to the same value principles with an emphasis on seeking undervalued stocks.

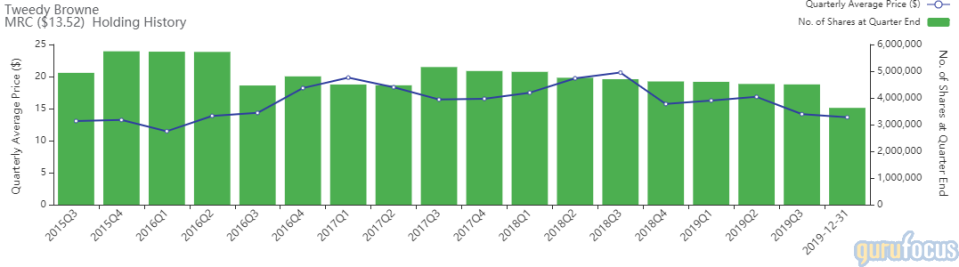

According to Real-Time Picks, a Premium feature of GuruFocus, the firm sold 878,443 shares of MRC Global on Dec. 31. It now holds a total of 3.6 million shares, which represent 1.76% of the equity portfolio. The stock traded for an average price of $13.64 per share.

GuruFocus data shows the firm has gained an estimated 7.32% on the investment since the second quarter of 2016.

Serving the energy and industrial markets, the Houston-based company distributes pipes, valves, fittings, automation and measurement products. MRC Global has a $1.15 billion market cap; its shares were trading around $14.03 on Monday with a price-earnings ratio of 24.56, a price-book ratio of 1.72 and a price-sales ratio of 0.31.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced.

On Oct. 31, MRC reported its third-quarter results. Earnings of 18 cents per share were down from 20 cents in the prior-year quarter. Similarly, revenue declined 12% from a year ago to $942 million. The company topped Zacks Investment Research's earnings estimate of 12 cents, but fell short of revenue expectations of $969 million.

MRC Global's financial strength and profitability were both rated 5 out of 10 by GuruFocus. Weighed down by low debt ratios and poor interest coverage, the Altman Z-Score of 2.34 indicates the company is under some financial pressure as its revenue per share has deteriorated over the past five years.

Despite having declining margins, the company's returns outperform over half of its competitors. It also has a moderate Piotroski F-Score of 5, which implies operating conditions are stable.

Although the firm has been reducing its position, Tweedy, Browne is still MRC's largest guru shareholder with 4.41% of outstanding shares. Other top guru investors are Jim Simons (Trades, Portfolio)' Renaissance Technologies, Barrow, Hanley, Mewhinney & Strauss, Arnold Schneider (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), T Boone Pickens (Trades, Portfolio)' BP Capital, Paul Tudor Jones (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio).

Portfolio composition and performance

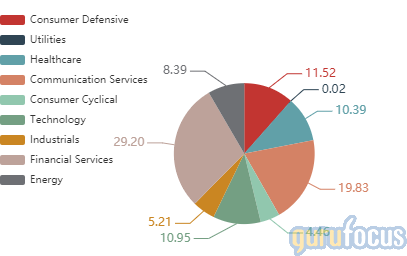

The firm's $2.83 billion equity portfolio, which was composed of 47 stocks as of the end of the third quarter, is heavily invested in the financial services sector at 29.2%, followed by smaller holdings in the communication services and consumer defensive spaces.

Other oil and gas-related stocks the firm holds as of the three months ended Sept. 30 are CKX Lands Inc. (CKX), ConocoPhillips (NYSE:COP), Phillips 66 (NYSE:PSX), Royal Dutch Shell PLC (NYSE:RDS.A), Total SA (NYSE:TOT), Halliburton Co. (NYSE:HAL) and Devon Energy Corp. (NYSE:DVN).

According to its website, the Value Fund returned 16.05% in 2019, underperforming the S&P 500's 28.43% return.

Disclosure: No positions.

GuruFocus 15-year anniversary promotion

The holiday season is here, and so is GuruFocus's 15-year anniversary! In order to celebrate, we are offering an exclusive holiday discount of up to 30% off on our GuruFocus Premium Membership.

Join now to get GuruFocus Premium membership for only $399/Year! In addition, save an extra $100 when you upgrade to our PremiumPlus Membership, and enjoy $100 off the price of each additional region you add to the subscription.

Don't miss out on this once-in-a-decade deal! You can sign up for the discount price by clicking this link. Happy holidays!

Read more here:

Omega's Leon Cooperman Ups Bet on Gannett

Top 5 Best-Performing Stocks of the Past Decade

3 Undervalued Industrial Stocks to Consider for the New Year

This article first appeared on GuruFocus.