Twilio’s Mixed Results Keep Wall Street Guessing

Twilio (TWLO) is part of the cloud communications niche, and it is among a small handful of investable companies in this particular sector. It’s a highly respected company, and the stock is well known to the trading community.

Yet, not everyone has been confident in Twilio’s ability to deliver strong fiscal results. As we will see, analysts on Wall Street were recently bracing for a sizable per-share earnings loss.

Adding to the tension is the choppy price action of TWLO stock. Even with those considerations in mind, however, it’s definitely possible to plot a path to success for Twilio and the company’s stakeholders in 2021. (See Twilio stock charts on TipRanks)

A Quick Look at TWLO Stock

It’s not an exaggeration to say that TWLO stock bounced hard in 2020, especially when the stock market recovered from the shock of the COVID-19 pandemic.

The stock fell to $68.06 in March of that year, but then the buyers took over and sent the share price to stunning heights. In February of 2021, TWLO stock reached a 52-week high of $457.30.

However, the bulls seem to have lost their way in recent months. From February onwards, Twilio stock has been frustratingly choppy and directionless.

There might be short-term trading opportunities, as TWLO stock tends to rebound every time it falls to $300. Long-term investors, on the other hand, will need to have faith in the company’s ability to deliver consistently strong results.

In any case, TWLO stock was trading close to $376 on August 10. Hopefully, some encouraging data can motivate the buyers to push the share price back to February’s peak.

Exceeding Expectations

Frankly, Wall Street experts didn’t have very high hopes for Twilio when it came time for the company to report its second-quarter 2021 fiscal results.

Specifically, the analysts had modeled revenues of $598.4 million, along with a per-share earnings loss of 13 cents.

As it turned out, the actual results beat those expectations. For the second quarter, Twilio posted $669 million in revenues, representing a year-over-year increase of 67%.

Moreover, the company reported losing 11 cents per share, so that’s another beat compared to what the experts had predicted. To be fair, though, it’s a disappointment compared to the year-earlier quarter’s profit of nine cents per share.

Overall, whether Twilio did well during the second quarter – and which data points are the most notable – seems to depend on one’s perspective.

For instance, RBC Capital analyst Rishi Jaluria mentioned organic growth improvement from 49% in Q1 to 52% in Q2 to be the “major Q2 highlight.”

Guiding for Growth

In contrast to Jaluria, Jefferies analyst Samad Samana emphasized Twilio’s forward guidance for the third quarter, observing that it was “better than consensus, partially aided by M&A and (telecom) fees.”

Looking at the number, however, it does appear that Twilio’s forward guidance isn’t overly ambitious.

For the third quarter of 2021, analysts project an earnings loss of seven cents per share, but Twilio is bracing for a much deeper loss of 14-17 cents per share.

However, while Wall Street expects third-quarter revenues of $636.4 million, Twilio projects a more robust $670-$680 million.

It’s challenging to analyze this outlook because it almost seems to suggest that Twilio is expecting strong revenue generation, but also an inability to enhance the company’s bottom line.

Wall Street Weighs In

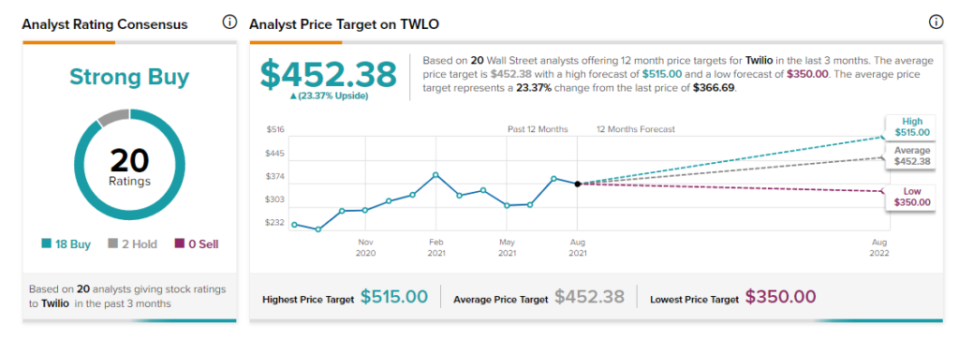

According to TipRanks’ analyst rating consensus, TWLO is a Strong Buy, based on 18 Buy and two Hold ratings. The average Twilio price target is $452.38, implying 23.4% upside potential.

The Takeaway

The choppy price action of TWLO stock might frustrate traders, but this problem won’t last forever.

At some point, the stock will find its direction. Hopefully, as Twilio and the analysts grapple with a company in flux, TWLO stock’s next move will be to the upside.

Disclosure: At the time of publication, David Moadel did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.