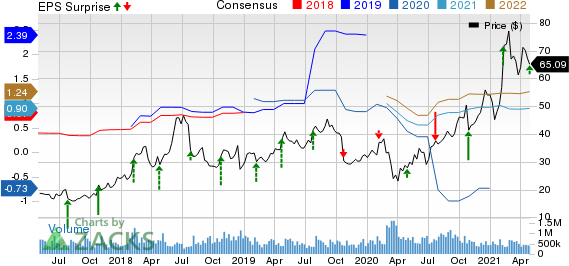

Twitter (TWTR) Q1 Earnings Beat Estimates, Ad Revenues Rise

Twitter TWTR reported first-quarter 2021 adjusted earnings of 16 cents per share that increased 45.5% year over year and beat the Zacks Consensus Estimate by 14.3%.

Revenues increased 28% year over year to $1.04 billion and beat the Zacks Consensus Estimate by 0.1%. The top-line growth was driven by strength in brand advertising in March as well as accelerating year-over-year growth in Mobile App Promotion (MAP) revenues.

User Details

Average monetizable daily active users (mDAU) grew 20% year over year to 199 million, driven by global conversation around current events and ongoing product improvements.

Average mDAU grew 7 million sequentially, reflecting increased retention across new and recently reactivated accounts due to the ongoing impact of product improvements, including continued increases in relevance across notifications, search, Explore, and the Home timeline.

Average U.S. mDAU was 38 million, up 13% from the year-ago quarter and increased 1 million sequentially. Average international mDAU was 162 million, rising 22% year over year and 7 million sequentially.

Topics, launched in fourth-quarter 2019, also drove growth as the company started personalizing Topic recommendations to help new customers find their interests more quickly. This improvement led to 33% of new customers following Topics during sign-up in first-quarter 2021.

Moreover, Twitter launched more than 700 new international Topics and deepened coverage in popular English categories like Food, Science, and Entertainment to provide a more tailored experience. Twitter stated that as of Mar 31, 2021, there were more than 7,000 Topics, up from above 6,000 Topics in the previous quarter.

In the first quarter, Twitter focused on giving creators more tools to start interesting conversations with the expansion of Twitter Spaces, the acquisition of Revue, and improvements to how people share and view media on Twitter.

For Spaces, Twitter expanded to Android in the first quarter and began shipping weekly iOS updates with a focus on giving hosts more controls and moderation tools, content discovery, and reliability.

Moreover, the company acquired Revue, a service that makes it easy for users to start, publish, and monetize editorial newsletters on Twitter. The company began testing ways to improve how people share and view media on Twitter platform, including the ability to upload and view 4K images and bigger and better images in the timeline.

Twitter continued to focus on health-related information in the first quarter. The company introduced a pilot of Birdwatch in the United States, a new community-driven approach to help address misleading information on Twitter.

Further, Twitter has been focusing on reducing abuse on its platform. In the first quarter, Twitter permanently suspended more than 150,000 accounts that were propagating a conspiracy theory linked directly to engaging in coordinated harmful activity, following riots at the U.S. Capitol.

The company started proactively applying labels to Tweets that may contain misleading information about COVID-19 vaccines. Since the time the company introduced its COVID-19 guidance, Twitter has enforced policies against 11.5 million accounts worldwide.

Revenue Details

U.S. revenues (5.37% of revenues) increased 19% year over year to $556 million. International revenues (46.3% of revenues) increased 41% to $480 million.

Japan remained the company’s second-largest market in the reported quarter. Revenues from the country (14% of total revenues) increased 26% to $176 million.

Advertising revenues increased 32% to $899 million. By advertiser objective, both brand and performance saw double-digit growth, with accelerating year-over-year growth in performance-based ad objectives.

U.S. advertising revenues totaled $464 million, up 22% year over year. International ad revenues increased 45% to $435 million.

The company’s advertising revenues witnessed strong contribution from SMB customers with double-digit year-over-year revenue growth reflecting increased investments in sales and product.

Total ad engagements increased 11%, driven by strong growth in ad impressions due to growing audience and increased demand for ads.

Cost per engagement (CPE) increased 19%, primarily driven by the mix shift to lower funnel ad formats, as well as like-for-like price increases across most ad formats.

Data licensing and other revenues increased 9% from the year-ago quarter to $137 million driven by double-digit growth in MoPub. Markedly, MoPub provides monetization solutions for mobile app publishers and developers around the globe.

Operating Details

Twitter’s total costs and expenses were $984 million, up 21% on a year-over-year basis driven by higher sales-related expenses, headcount growth and infrastructure costs.

Research and development expenses jumped 25% to $251 million, primarily due to higher personnel-related costs. Sales and marketing expenses increased 6% to $235 million, primarily due to higher sales-related expenses. General and administrative expenses rose 7% to $118 million, primarily due to higher personnel-related costs offset by decrease in supporting overhead expenses.

Adjusted EBITDA increased 39.3% year over year to $294.1 million.

The company reported operating income of $52 million, or 5% of total revenues compared with operating income of $7 million or -1% in the year-ago quarter.

Balance Sheet

As of Mar 31, 2021, Twitter had $8.81 billion in cash, cash equivalents and marketable securities (including net proceeds of $1.42 billion from offering of convertible notes in March, which is intended to prefund the $954 million convertible senior notes due in 2021 and provide for other general corporate purposes) compared with $7.47 billion as of Dec 31, 2020.

In the first quarter, adjusted free cash flow was $211 million compared with $126 million in the year-ago quarter.

Net cash provided by operating activities in the quarter was $390 million, an increase from $247 million in the same period last year.

Outlook

For the second quarter of 2021, the company expects total revenues to be between $980 million and $1.08 billion. GAAP operating loss is expected to be between $120 million and $170 million.

The company expects mDAU growth rates in the low double digits on a year-over-year basis in the second, third and fourth quarters, with the low point in terms of growth likely in the second quarter.

For the full year, the company expects capital expenditures to be between $900 million and $950 million.

Zacks Rank & Stock to Consider

Currently, Twitter has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Everbridge, Inc. EVBG, CDW Corporation CDW and Cognex Corporation CGNX each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CDW, Cognex and Everbridge are scheduled to report first-quarter results on May 5, 6 and 10, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cognex Corporation (CGNX) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

Twitter, Inc. (TWTR) : Free Stock Analysis Report

Everbridge, Inc. (EVBG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research