Two Big Winners of a $200 Billion Market

This article is excerpted from Tom Yeung’s Moonshot Investor newsletter. To make sure you don’t miss any of Tom’s potential 100x picks, subscribe to his mailing list here.

The U.S. Senate Finally Agrees on Something…

On Tuesday, President Biden signed two new cybersecurity bills into law. The regulations — which enhance cybersecurity practices at the federal and local levels — had been unanimously passed by the Senate several months before.

I can still barely believe Congress agreed on anything… let alone unanimously. (It makes you wonder how they pick themes for their office Christmas parties).

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Yet, governments worldwide seem to have finally woken up to cybersecurity threats. No longer are these breaches seen as minor annoyances, though I’m sure my social security number would beg to differ).

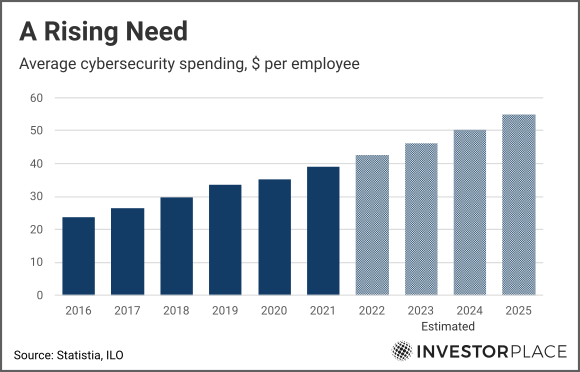

Instead, ransomware attacks on pipe firms… payroll systems… even schools and hospitals… have united Americans against a common threat. Analysts estimate the cybersecurity market is now worth $200 billion per year.

As the stakes of cybercrime continue to rise, one new firm joins the Profit & Protection watchlist, and one joins ZScaler (NASDAQ:ZS) and CrowdStrike (NASDAQ:CRWD) on the core “buy” list.

Source: alexdndz / Shutterstock.com

Two Big Winners of a $200 Billion Market

In 2010, Berkshire Hathaway (NYSE:BRK-A, NYSE:BRK-B) CEO Warren Buffett quipped how a good business is one “your idiot nephew” can run.

“And if you’ve got a really good business,” he continued, “it doesn’t make any difference.”

The same rings true for sound investing. With so many “idiot nephews” in the world, it’s only a matter of time before a company picks one as a CEO. Investors are wise to pick fool-proof sectors as protection.

Today, that winning industry is cybersecurity — a sector so crucial that even Congress can agree on its importance. And as long as you’re selling the right product and have a corporate-wide security-first mindset, it’s hard to fail in this $200 billion market.

To Buy: Okta (OKTA)

Growth: A+ | Value: A | Quality B+ | Momentum B

Overall score: A

Perhaps the best example is Okta (NASDAQ:OKTA), a cybersecurity firm specializing in authentication services. Led by CEO/founder Todd McKinnon, the company has masterfully combined workforce identity and customer identity products into an “identity cloud.”

Corporations now have a single, cloud-based source to authenticate user identities across multiple platforms. If you’ve ever used a single sign-on password or a mobile phone for multi-factor authentication, you’ve probably run into the Okta cloud.

The product has become a stunning success. Okta’s revenues jumped 43% in 2020, followed by another 56% rise last year, earning it a solid “A+” growth grade in the Profit & Protection system.

The company’s acquisition of Auth0 in 2021 was also a masterstroke of consolidation. Auth0 had built a solid user base among developers seeking flexible, drop-in authentications (i.e., the sign-in boxes on websites that log in via a Google or Facebook account). Okta’s acquisition now means enterprise clients and their developers are served by the same firm.

Garner now ranks Okta under its “visionary” category and awards them the highest score for “ability to execute.”

Trouble in Paradise

However not everything is roses with this fast-growing cybersecurity firm. Okta’s marketing and overhead expenses have risen faster than sales, despite achieving a 124% retention rate. And the company’s earnings quality sits below 98% of firms graded by Thomson Reuters. In 2021, Okta lost 65 cents for every dollar of revenue.

All this points to corporate bloat and poor sales incentives — two complaints that feature prominently on public employee forums. Higher-quality companies like buy-rated Crowdstrike tend to see overhead costs go down as sales teams gain scale. Okta has managed the opposite.

These missteps have plagued Okta’s stock. Shares have fallen 64% as investors reconsider positions in underperforming companies in the past year.

As for the Good News…

But the spectacular growth of the cybersecurity sector negates these issues. Even with a bloated corporate cost structure, the fair value for Okta still comes to $160 in my 2-stage discounted cash flow (DCF) model. Analysts at Morningstar are even more bullish, giving a $193 price target for the fast-growing firm.

That’s more than 100% upside.

Okta is also riding a wave of federal action on cybersecurity. On Tuesday, the Government Accountability Office (GAO) warned that “catastrophic cyber incidents” could warrant a federal insurance response. Such funding would open the door to greater government oversight and possibly force companies to adopt specific cybersecurity standards.

That would benefit Okta, one of the few pure plays on user authentication. In our hyper-digital world, controlling who can access networks and data is one of the first and best defenses against cybercrime. Okta sits in pole position to benefit.

Bottom line: Okta is added to the core Profit & Protection list.

Palo Alto Networks (PANW)

Growth: A+ | Value: A | Quality B | Momentum B

Overall score: A-

ZScaler, Crowdstrike and Okta all belong to a newer generation of cloud-based cybersecurity firms. These upstarts have ultra-fast growth rates and rising earnings to match.

But what about traditional players with more stability?

That’s where an investment in Palo Alto Networks (NASDAQ:PANW) comes in. This legacy cybersecurity firm has become the “IBM of the firewall market.” In other words, nobody gets fired for buying IBM Palo Alto Networks to manage their firewall. One reviewer at Gartner called the company’s cost of support “extortion,” yet grudgingly paid for the “robust” product.

That’s because the stakes of mishandling a firewall are extreme.

“Replacing Palo Alto products and services would be considerably disruptive and not worth the risk,” Morningstar analyst Malik Ahmed Khan notes. “Widespread digital transformation and work-from-home initiatives during the pandemic catalyzed a feeding frenzy for attackers and put a spotlight directly on the importance of proper security.”

These realities have allowed Palo Alto Networks to notch 25% revenue increases in each of the past three years. The company scores an “A+” in its Profit & Protection growth score.

There are, however, some downsides to PANW.

First, the company lags in its quality scores for unfettered use of share-based compensation. On paper, these stock grants have cost other shareholders $5.5 billion over the past decade and pushed return on equity into negative territory since 2013.

Second, Palo Alto’s growth is more limited than its upstart rivals. Wall Street analysts have a $633 price target on the firm, a 26% upside. My estimates put its fair value closer to $500, a 0% upside.

And finally, investors are paying up for quality. PANW trades at 67x forward price-to-earnings and 9.0x price-to-revenues, making it four times more expensive than Cisco Systems (NASDAQ:CSCO) and Juniper Networks (NYSE:JNPR).

These factors mean that Palo Alto Networks only gains a spot on Profit & Protection’s watchlist, rather than its core “buy” list.

Nevertheless, PANW is a stock that even the most seasoned investors might consider.

The $200 Billion Opportunity Hiding in Plain Sight

Why do people use simple passwords to protect essential data?

A 2018 study by SC Magazine estimated that the average person managed 38.4 passwords. The figure has only grown since.

The average employee now reuses their password 13 times, according to software firm Logmein.

These shortcuts have real costs. In 2021, the FBI Internet Crime Report found that individuals had lost more than $6.9 billion to cybercrime, a 40% jump from the prior year. And things will only get worse as the number of connected devices balloons.

But the solution is more straightforward than you might expect (and doesn’t involve remembering 38.4-plus different passwords). Multifactor authentication blocks 99% of all password safety issues, according to Microsoft (NASDAQ:MSFT). And single-point sign-ons can make passwords a thing of the past.

Companies like Okta are the ones leading this charge. And though the firm has plenty of growing pains, history shows that investors are better off buying a company in the right industry than guessing which one will survive in a dying one.

P.S. Do you want to hear more about cryptocurrencies? Penny stocks? Options? Leave me a note at feedback@investorplace.com or connect with me on LinkedIn and let me know what you’d like to see.

On the date of publication, Tom Yeung did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Tom Yeung, CFA, is a registered investment advisor on a mission to bring simplicity to the world of investing.

More From InvestorPlace

Early Bitcoin Millionaire Reveals His Next Big Crypto Trade “On Air”

It doesn’t matter if you have $500 in savings or $5 million. Do this now.

The post Two Big Winners of a $200 Billion Market appeared first on InvestorPlace.