What Type Of Returns Would AMC Networks'(NASDAQ:AMCX) Shareholders Have Earned If They Purchased Their SharesFive Years Ago?

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the AMC Networks Inc. (NASDAQ:AMCX) share price managed to fall 64% over five long years. That is extremely sub-optimal, to say the least. And some of the more recent buyers are probably worried, too, with the stock falling 50% in the last year. Furthermore, it's down 19% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for AMC Networks

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

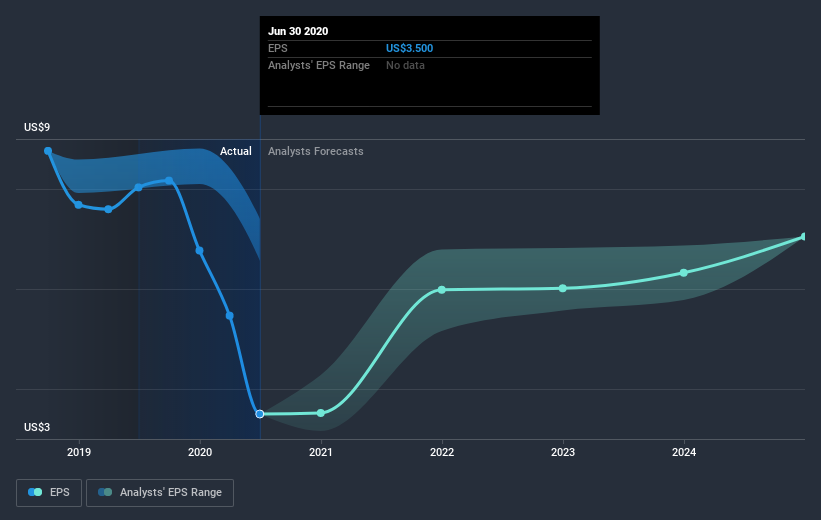

During the five years over which the share price declined, AMC Networks' earnings per share (EPS) dropped by 5.5% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 19% per year, over the period. This implies that the market is more cautious about the business these days. The low P/E ratio of 7.04 further reflects this reticence.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

AMC Networks shareholders are down 50% for the year, but the market itself is up 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand AMC Networks better, we need to consider many other factors. For example, we've discovered 4 warning signs for AMC Networks that you should be aware of before investing here.

Of course AMC Networks may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.