What Type Of Returns Would Boku's(LON:BOKU) Shareholders Have Earned If They Purchased Their SharesYear Ago?

While not a mind-blowing move, it is good to see that the Boku, Inc. (LON:BOKU) share price has gained 12% in the last three months. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 21% in the last year, well below the market return.

Check out our latest analysis for Boku

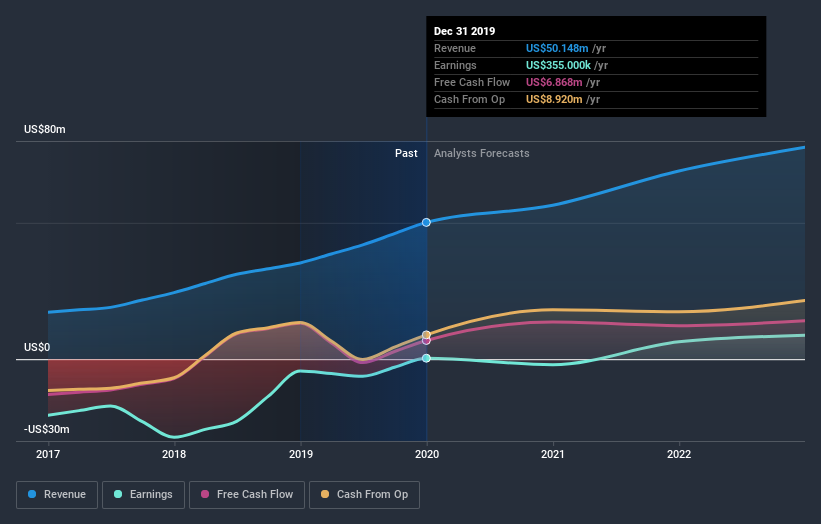

We don't think that Boku's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Boku grew its revenue by 42% over the last year. That's definitely a respectable growth rate. Meanwhile, the share price is down 21% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Boku will earn in the future (free profit forecasts).

A Different Perspective

We doubt Boku shareholders are happy with the loss of 21% over twelve months. That falls short of the market, which lost 11%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 12%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Boku , and understanding them should be part of your investment process.

Boku is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.