What Type Of Returns Would Hurco Companies'(NASDAQ:HURC) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Hurco Companies, Inc. (NASDAQ:HURC) shareholders, since the share price is down 10% in the last three years, falling well short of the market return of around 46%. In contrast, the stock price has popped 8.7% in the last thirty days. But this could be related to good market conditions, with stocks up around 3.7% during the period.

See our latest analysis for Hurco Companies

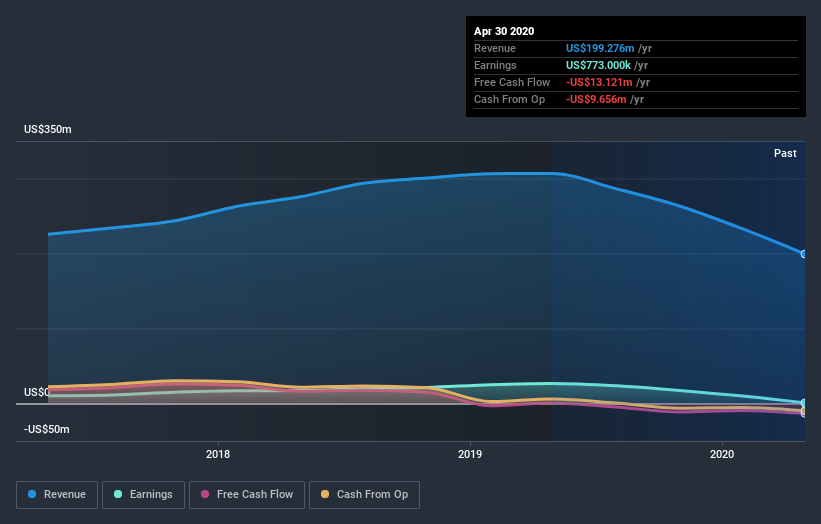

We don't think that Hurco Companies' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, Hurco Companies grew revenue at 0.5% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. Indeed, the stock dropped 3.3% over the last three years. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Hurco Companies' financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Hurco Companies the TSR over the last 3 years was -6.6%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 20% in the last year, Hurco Companies shareholders lost 1.6% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 1.4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Hurco Companies that you should be aware of before investing here.

We will like Hurco Companies better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.