What Type Of Returns Would Varex Imaging's(NASDAQ:VREX) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

It is doubtless a positive to see that the Varex Imaging Corporation (NASDAQ:VREX) share price has gained some 32% in the last three months. But that doesn't change the fact that the returns over the last three years have been disappointing. Indeed, the share price is down a tragic 54% in the last three years. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

View our latest analysis for Varex Imaging

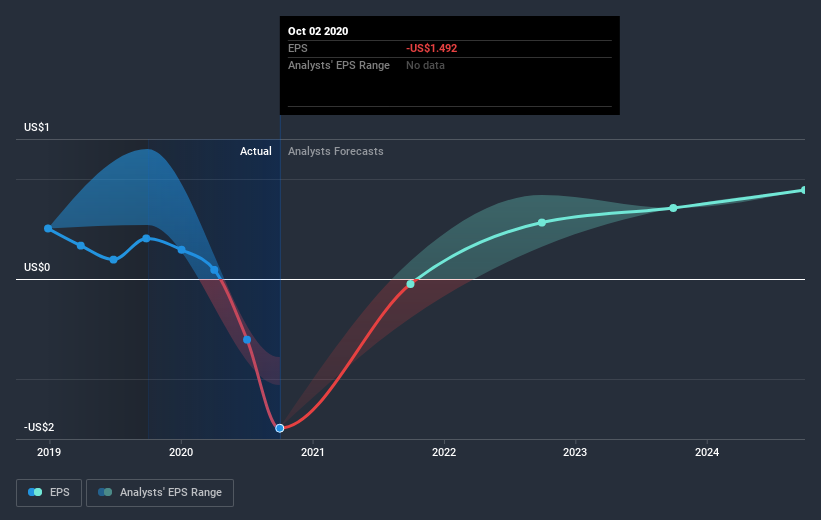

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Varex Imaging saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Varex Imaging shareholders are down 41% for the year, but the broader market is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 16% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Varex Imaging has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course Varex Imaging may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.