Is Tyson Foods Undervalued After Earnings?

- By Nicholas Kitonyi

Shares of Tyson Foods Inc. (NYSE:TSN) rose marginally following the announcement of its most recent quarterly results on Monday. The company posted revenue and earnings that beat analysts' expectations.

The Springdale, Arkansas-based company said demand for pork and beef soared during the fourth quarter while Covid-19-related costs also came in lower than expected for the year. Shares of the company remain 29% lower this year, which indicates a potential opportunity for growth.

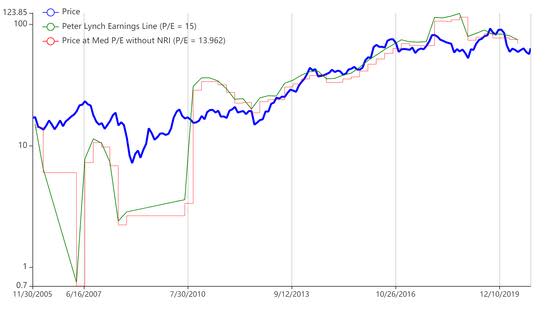

The company's stock also trades below the Peter Lynch earnings line, which suggests a potential case of undervaluation.

Highlights from recent quarterly results

During the fiscal fourth quarter, Tyson Foods' earnings per share grew 49.6% to $1.81. This was better than the consensus estimate of $1.19.

The company also saw revenue grow 5.29% to $11.46 billion, outperforming expectations of $11.01 billion. Sales were boosted by a significant increase in demand for pork and beef. Tyson Foods' bottom line also benefitted from lower-than-expected Covid-19-related costs.

CEO Dean Banks said that Tyson Foods should witness a significant drop in expenses in fiscal 2021, which would result in substantial growth in the bottom line.

The company's full-year revenue came in at $43.2 billion, up from $42.4 billion reported a year ago. Earnings per share also edged slightly higher to $5.64 from $5.46.

Tyson Foods posted $3.9 billion in cash from operations for the 12-month period despite reporting $540 million in Covid-19-related costs. The company now has $2.22 billion in leveraged free cash flow.

The company noted will play a crucial role in the coming months with some employees still working from home. "Employee absences remain elevated due to the pandemic, though, and will be a headwind for Tyson through the first half of 2021," Banks said.

Valuation

From a valuation perspective, shares of Tyson Foods are currently valued at a price-earnings ratio of 10.79. In comparison, Conagra Brands Inc. (NYSE:CAG) trades with a price-earnings ratio of 17.68. On the other hand, Hormel Foods Corp. (NYSE:HRL) and Archer-Daniels-Midland Co. (NYSE:ADM) trade at price-earnings ratios of 30.33 and 17.86.

When we factor in expected earnings growth for the next five years, Tyson Foods' stock is valued at a PEG ratio of 1.12, which again is several times better than Hormel Foods' multiple of 5.53. On the other hand, Archer-Daniels trades at a PEG ratio of 2.14, while Conagra Brands' equivalent is 2.90.

Overall, shares of Tyson Foods appear to be significantly undervalued compared to industry peers. And even when we factor in earnings growth expectations, the company appears to offer more compelling valuation multiples. It also trades slightly below the Peter Lynch earnings line, which indicates a potential case of undervaluation.

Disclosure: No position in the stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.