U.S. Equities Getting Majority of ETF Inflows So Far in July

This article was originally published on ETFTrends.com.

According to State Street Global Advisors, exchange-trade funds have brought in more than $20 billion of inflows in the first 11 trading days of July. The lion's share of flows have gone into US equities to the tune of $16 billion as investors await a Federal Reserve that is primed and ready for an interest rate cut.

Furthermore, the latest Morningstar report for U.S. mutual fund and exchange-traded fund (ETF) fund flows during the month of June show trends that could be favoring U.S. equity funds in the long-term. With a number of market analysts and economists ready to sound the alarms on a global economic slowdown, this could mean continued strength for U.S. equities over international equities.

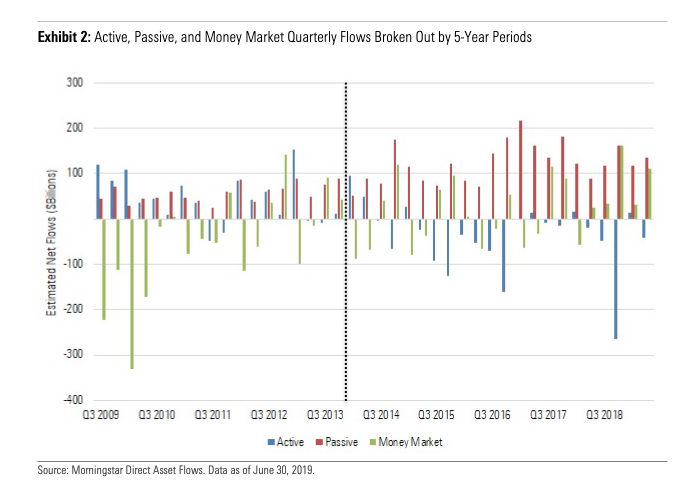

In particular, passive equity funds within the U.S. saw a large number of inflows compared to their active fund counterparts.

"In June, passive U.S. equity funds saw inflows of $29.5 billion versus $20.2 billion of active U.S. equity outflows," the report noted. "Nevertheless, active U.S. equity fund assets remain slightly ahead of their passive counterparts. Asset parity is likely still another month or two away."

This influx into passive U.S. equity funds differed from the move out of international equity funds--passive and active funds alike.

"International-equity funds are seeing the same secular move of money from active to passive, but there has been no additional growth beyond this over the past 12 months," the report added. "In June, international-equity funds had about $5.5 billion in outflows across active and passive and $1.3 billion in outflows over the past 12 months. During the latter period, $93.1 billion of active outflows were almost matched by $91.8 billion in passive inflows."

Feeding Off U.S. Equity Strength

Looking ahead, the capital markets are hoping that a rate cut by the Federal Reserve could give U.S. equities another shot in the arm before the close of 2019. Will this continue to translate into more strength for U.S. equities over international equities?

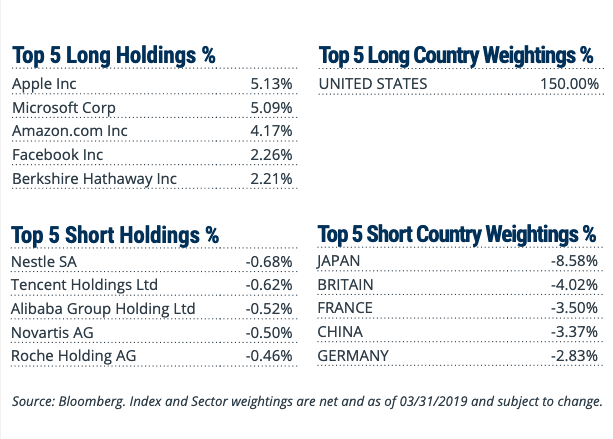

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

For the opposite side of the trade, the Direxion FTSE International Over US ETF (RWIU) gives investors the opportunity to capitalize on their hunch that international equities will outdo U.S. equities

RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index. The FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150 percent and the weight of the Short Component is equal to 50 percent of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

For more market trends, visit ETF Trends.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM