US Inflation Slowed to 8.5% in July, CPI Report Shows; Bitcoin Jumps

U.S. inflation slowed last month, possibly strengthening a widely held narrative that the worst of consumer-price increases is behind the economy.

Bitcoin (BTC) jumped 2% and Ethereum (ETH) 7% in the minutes after the report, signaling relief on the part of crypto traders that the Federal Reserve might be able to relax its aggressive approach to tightening monetary conditions.

The consumer price index (CPI) surged 8.5% in July on a year-over-year basis, though it was unchanged from the previous month, partly thanks to lower energy prices, a report by the Bureau of Labor Statistics showed. The annual figure compared to an average estimate of 8.7% in a survey of economists by FactSet.

Stripping out food and energy prices because of their strong volatility, core CPI remained unchanged at 5.9% over the past 12 months, slightly missing expectations of 6.1%.

Most cryptocurrencies across the board declined on Tuesday in anticipation of the report, with bitcoin dropping about 4% to 23,100k after rising above $24k on Monday. Ethereum (ETH) fell more than 5%.

“I think the market will continue to find confidence in the Fed staying on track with its proposed increases to the interest rates at the September meeting and we will continue to see our relief rally pick up steam in the crypto market,” said Howard Greenberg, cryptocurrency educator at Prosper Trading Academy.

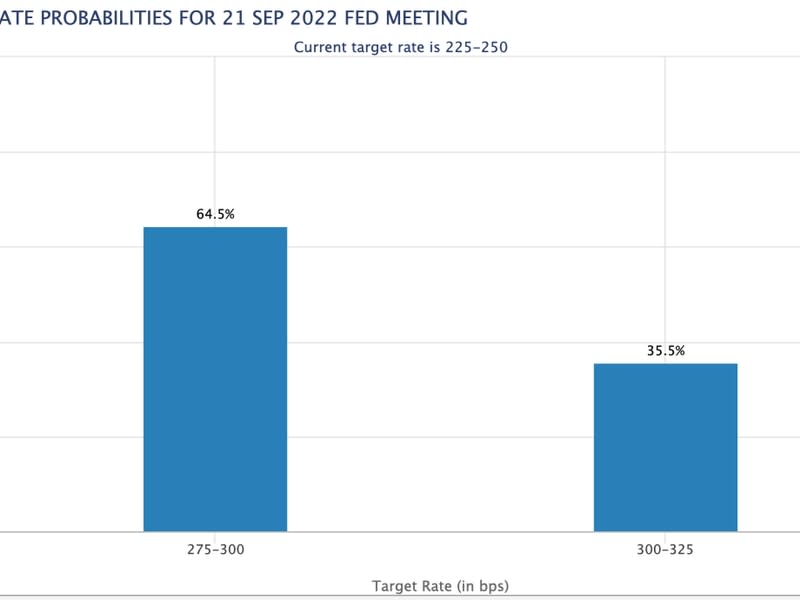

Traders are now betting on a 65% chance that the Fed will hike interest rates by 50 basis points in September, compared with 32% just one day ago, according to the CME FedWatch Tool. Recently, traders had been seeing a 75 basis-point hike as the likelier scenario after the jobs report last week showed that the economy is still in very good shape to sustain more rate hikes. Several central bankers have signaled that they will continue to tighten until they see inflation come down significantly.

"The Fed will be cheered by the news, especially the fact that core inflation was also lower than expected," said Richard Carter, head of fixed-interest research at Quilter Cheviot, a U.K.-based investment management firm. "They will still need to hike rates at their next meeting in September, but this reduces the risk of another 75 basis-point move and, going forward, we might just see markets act a little calmer than they have to date.”

UPDATE (Aug. 10, 2022 13:18 UTC): Adds chart from the CME FedWatchTool and additional information about the Fed's path forward.

UPDATE (Aug. 10, 2022 13:23 UTC): Adds quote from Richard Carter, head of fixed interest research at Quilter Cheviot.