U.S. Silica (SLCA) to Up Industrial & Specialty Products Prices

U.S. Silica Holdings, Inc. SLCA announced that it would increase the prices of Industrial and Specialty segment products. This will include non-contracted silica sand, aplite, diatomaceous earth and clay products used mainly in glass, foundry, paints, coatings, elastomers, roofing, chemicals, recreation, building products, agricultural, pet litter and other applications.

The price hike will be in the range of 6-14%, depending on the product and grade. The revised price will be in effect for shipments commencing Feb 1, 2022.

These price increases will enable the company to offset significant and continuing cost increases in energy, labor, transportation, materials and manufacturing costs.

Shares of U.S. Silica have surged 92.4% in the past year against a 3.6% decline of the industry.

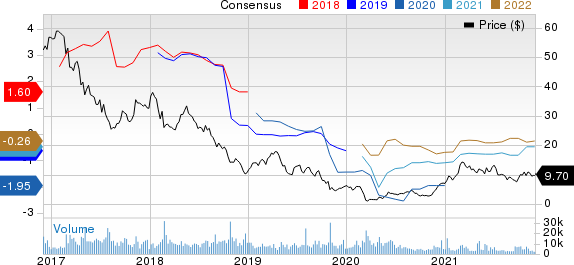

Image Source: Zacks Investment Research

The company, in its last earnings call, predicts sustainable long-term growth in its segments in the fourth quarter and 2022. It has a strong portfolio of industrial and specialty products and a solid pipeline of new products. It is focused on generating positive free cash flow and bolstering its balance sheet in 2022.

The Oil & Gas unit is progressing through a transitional year and strong commodity prices along with an expected rise in consumer spending are anticipated to lead to a favorable well-completion environment next year, U.S. Silica noted.

U.S. Silica Holdings, Inc. Price and Consensus

U.S. Silica Holdings, Inc. price-consensus-chart | U.S. Silica Holdings, Inc. Quote

Zacks Rank & Key Picks

U.S. Silica currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Nucor Corporation NUE, The Chemours Company CC and Celanese Corporation CE.

Nucor has an expected earnings growth rate of 583.2% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 7.7% upward in the past 60 days.

Nucor beat the Zacks Consensus Estimate for earnings in two of the last four quarters, while missing the same twice. The company has a trailing four-quarter earnings surprise of roughly 2.74%, on average. The stock has surged around 92.8% in a year. NUE currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. The stock has increased around 16.5% in a year. CC currently carries a Zacks Rank #2.

Celanese has a projected earnings growth rate of 139.5% for the current year. The consensus estimate for the current year has been revised 8.8% upward in the past 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in each of the last four quarters. CE has a trailing four-quarter earnings surprise of 12.7%, on average. The company’s shares have gained around 15.9% in a year. Celanese currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research