U.S. Sweeping Rules to Take a Toll on AMAT, KLAC, LRCX & ASML

The semiconductor industry is on the verge of facing another turmoil.

The industry, which has been facing the wrath of the coronavirus pandemic in the forms of supply-chain disruptions for the past two years, now faces fresh turbulence due to escalating tensions between Washington and Beijing as a result of the recently imposed export curbs on China’s chip companies by the U.S. Department of Commerce.

The Biden administration introduced a sweeping set of export controls to cut China from obtaining key chips and semiconductor manufacturing equipment.

The new export regulation states that semiconductors, which are developed with U.S. technology for use in artificial intelligence, high-performance computing, data centers and supercomputers, can only be sold to China-based companies with an export license.

The underlined rules restrict U.S.-based companies from working with China chip producers.

We believe that the scenario is expected to increase supply-chain disruptions for the semiconductor industry and significantly hurt the China semiconductor market.

This is evident from the performance of some of the top semiconductor ETFs. Over the past month, SPDR S&P Semiconductor, iShares Semiconductor, VanEck Vectors Semiconductor and First Trust Nasdaq Semiconductor ETFs have plunged 13%, 15.4%, 15.1% and 14.5%, respectively.

These export curbs are likely to hit hard some of the U.S. semiconductor giants like Applied Materials AMAT, KLA Corporation KLAC, Lam Research LRCX and ASML Holding ASML.

Applied Materials, KLA and Lam Research have already received letters stating them to stop their shipments of equipment to wholly China-owned factories producing advanced logic chips, with an immediate effect.

For all the above-mentioned companies, China remains an important market, as they hold a significant number of operations in the country in the form of manufacturing facilities after the United States.

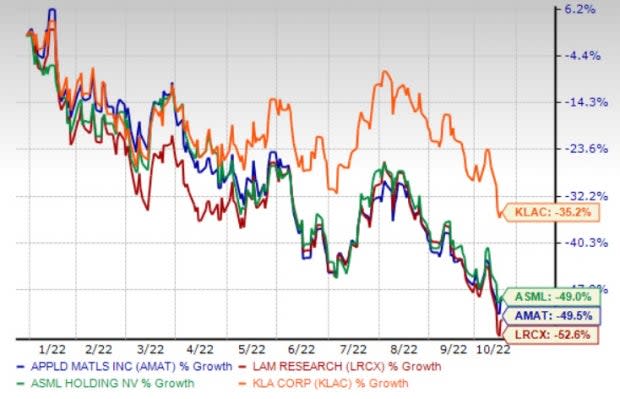

Image Source: Zacks Investment Research

Applied Materials, one of the world’s largest suppliers of equipment for the fabrication of semiconductors, flat panel liquid crystal displays, and solar photovoltaic cells and modules, generated $7.5 billion in revenues from China in fiscal 2021. The figure accounted for the majority (33%) of its total revenues.

As a consequence of recent export curbs, the company has revised its guidance downward. For fourth-quarter fiscal 2022, the company expects net sales of $6.4 billion (+/- $250 million), lower than the previously mentioned $6.65 billion (+/-$400 million). Also, the company anticipates non-GAAP EPS of $1.54-$1.78 compared with the prior mentioned $1.82-$2.18. The company expects its first-quarter fiscal 2023 sales to be impacted by the underlined sweeping rules.

Nevertheless, this Zacks Rank #3 (Hold) company, which has lost 49.5% on a year-to-date basis, has applied for additional export licenses and authorizations. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KLA Corporation is an original equipment manufacturer of process diagnostics, and control equipment and yield management solutions required for the fabrication of semiconductor integrated circuits or chips.

In fiscal 2022, the company generated $2.7 billion in revenues from China, which is its biggest market. The figure accounted for 29% of the total revenues. KLA has already stopped offering supplies and services to its China-based customers in order to abide by the recent sweeping rules.

We believe that this will be a major headwind for this Zacks Rank #4 (Sell) company in second-quarter fiscal 2023. Notably, KLAC has declined 35.2% on a year-to-date basis.

Lam Research supplies wafer fabrication equipment and services to the semiconductor industry. In fiscal 2022, the company generated $5.4 billion in revenues from China, which is its biggest market. Notably, China contributed 31% to the total revenues in the fiscal year.

Hence, the latest export restrictions are likely to take a huge toll on this Zacks Rank #4 company in the current fiscal quarter as well as the year. Notably, LRCX has lost 52.6% on a year-to-date basis.

ASML Holding is a leading manufacturer of advanced technology systems for the semiconductor industry, and is well-known for its extreme ultraviolet lithography machines. The company generated €2.7 billion in revenues from China in 2021. The figure contributed 14.7% to the total revenues.

The company circulated a memo, which prohibits any of its employees in the United States from providing servicing, shipping and support to any customers or advanced fabs in China until further notice.

ASML currently carries a Zacks Rank #3. Its shares have declined 49.1% on a year-to-date basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KLA Corporation (KLAC) : Free Stock Analysis Report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research