UBER Down More Than 4% Despite Q2 Earnings & Revenue Beat

Uber Technologies, Inc. UBER reported second-quarter 2021 earnings of 58 cents per share against the Zacks Consensus Estimate of a loss of 53 cents. In the year-ago period, the company had incurred a loss of $1.02. Total revenues of $3,929 million outperformed the Zacks Consensus Estimate of $3,740.3 million. The top line rose significantly year over year (improved 35% sequentially), primarily due to recovery in its mobility operations. Despite this better-than-expected performance, shares of the company declined more than 4% in after-market trading on Aug 4.

While adjusted EBITDA loss narrowed to $509 million from $837 million in the year-ago quarter, it widened by $150 million from the first quarter of 2021 due to increased investments on drivers to meet the spurt in mobility demand.

In the second quarter, majority (50%) of the company’s revenues came from Delivery. Revenues from this segment, which is experiencing a boom amid the pandemic-triggered rise in online order volumes, surged more than 100% year over year to $1,963 million. Revenues from the Mobility segment recovered significantly, rising more than 100% from the second quarter of 2020 when coronavirus-led restrictions caused a dramatic drop in ride volumes. Mobility revenues amounted to $1,618 million. Meanwhile, Freight revenues climbed 65% year over year to $348 million. Rest of the revenues came from All Other sources.

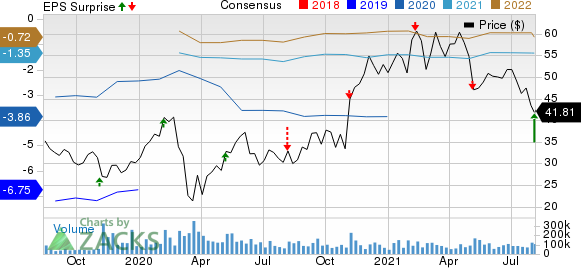

Uber Technologies, Inc. Price, Consensus and EPS Surprise

Uber Technologies, Inc. price-consensus-eps-surprise-chart | Uber Technologies, Inc. Quote

Total revenues soared 76% year over year to $1,984 million in the United States and Canada. While revenues increased 44% to $307 million in Latin America, it skyrocketed more than 150% to $929 million in Europe, the Middle East and Africa. Revenues soared more than 200% year over year to $709 million in the Asia-Pacific region. Monthly active platform consumers jumped 84% to 101 million.

Gross bookings from Mobility improved more than 100% to $8,640 million. Gross bookings from Delivery augmented 85% to $12,912 million. Gross bookings from Freight also climbed 64% to $348 million. Total gross bookings ascended more than 100% to $21,900 million.

Cost of revenue increased significantly year over year due to rise in courier payments and Freight carrier payments, higher incentives in some markets, as well as costs associated with ride volume increases in the Mobility segment. Total costs and expenses surged 45.4% year over year to $5,117 million with sales and marketing expenses rising 70.7% and general and administrative expenses ascending 9%.

Uber, carrying a Zacks Rank #3 (Hold), exited the second quarter with cash and cash equivalents of $4,443 million compared with $5,647 million at the end of 2020. Long-term debt, net of current portion at the end of the quarter, was $7,798 million compared with $7,560 million at December 2020-end.

The company is hopeful about its ability to achieve adjusted EBITDA profits by the fourth quarter of 2021. For the third quarter, Uber expects Adjusted EBITDA loss to reduce to less than $100 million. Gross bookings are estimated in the band of $22-$24 billion in the current quarter.

Performance of Other Computer & Technology Stocks

Within the broader Computer and Technology sector, AMETEK, Inc. AME, T-Mobile US, Inc. TMUS and Carrier Global Corporation CARR recently reported earnings numbers.

AMETEK’s second-quarter 2021 adjusted earnings of $1.15 per share beat the Zacks Consensus Estimate by 3.6%. Net sales of $1.39 billion surpassed the Zacks Consensus Estimate of $1.33 billion. The stock carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

T-Mobile, carrying a Zacks Rank #3, reported second-quarter 2021 earnings of 78 cents per share, surpassing the Zacks Consensus Estimate by 26 cents. Quarterly total revenues of $19,950 million surpassed the consensus estimate of $19,391 million.

Carrier Global, carrying a Zacks Rank #2, reported second-quarter 2021 adjusted earnings of 64 cents per share, outperforming the Zacks Consensus Estimate by 14.3%. Net sales of $5.44 billion also beat the Zacks Consensus Estimate of $4.95 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMETEK, Inc. (AME) : Free Stock Analysis Report

TMobile US, Inc. (TMUS) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

Carrier Global Corporation (CARR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research