Uber beats Q3 earnings expectations powered by growth in Eats business, Rides falls short

Uber (UBER) reported its Q3 2020 earnings after the closing bell on Thursday, beating analysts’ expectations on solid growth from its Eats business. Still, the impact of the ongoing coronavirus pandemic continues to be a concern for Uber’s main Rides business, which fell short of analysts’ forecasts.

Here are the most important numbers from the report compared to what analysts were expecting from the company in the quarter, as compiled by Bloomberg.

Gross bookings: $14.75 billion versus $14.49 billion expected

Rides gross bookings: $5.91 billion versus $6.44 billion expected

Eats gross bookings: $8.55 billion versus $7.80 billion expected

Losses per share: $0.62 versus $0.61 expected

The company’s stock was down more than 2% following the report.

Uber’s ride-sharing model has been dramatically impacted by the pandemic, with rider totals plummeting due to a lack of available entertainment options ranging from movie theaters and bars to ball games. Exacerbating the problem is a lack of business travelers who would normally look to Uber as an alternative to using a black car or yellow cab service.

For the quarter, Uber saw revenue decline 18% year-over-year, with revenue from its Rides business falling 53% year-over-year. Still, it’s Eats business continued to perform well with revenue growing 125% year-over-year.

“Despite an uneven pandemic response and broader economic uncertainty, our global scope, diversification, and the team’s tireless execution delivered steadily improving results, with total company Gross Bookings down just 6% year-on-year in September,” Uber CEO Dara Khosrowshahi said via a statement.

Sign up for Yahoo Finance Tech newsletter

In Q2, Uber reported a $1.8 billion loss after its Rides business collapsed by a stunning 74% year-over-year. In May, the company filed paperwork with the SEC indicating that it was to cut roughly 14% of its workforce, or 3,700 jobs, primarily in its customer support and recruiting divisions.

And while there are signs of returning growth, a steady increase of coronavirus cases across the U.S. and Europe could further hinder Uber’s efforts to return to its pre-COVID ridership levels.

Still, Wedbush analyst Dan Ives wrote in a research note that he is seeing positive movement in Uber’s direction, especially as consumers feel less comfortable taking mass transit during the pandemic.

“The overall environment is starting to considerably improve for Uber over the coming quarters with 2Q marking a clear trough in volumes and fundamentals in our opinion,” he wrote.

“We also believe a consumer dynamic that is becoming commonplace across cities both in the US and internationally is many steering clear of mass transportation given health concerns and lack of comfort taking subways/buses and thus could be an incremental demand driver for ridesharing vendors over the next few quarters (at least).”

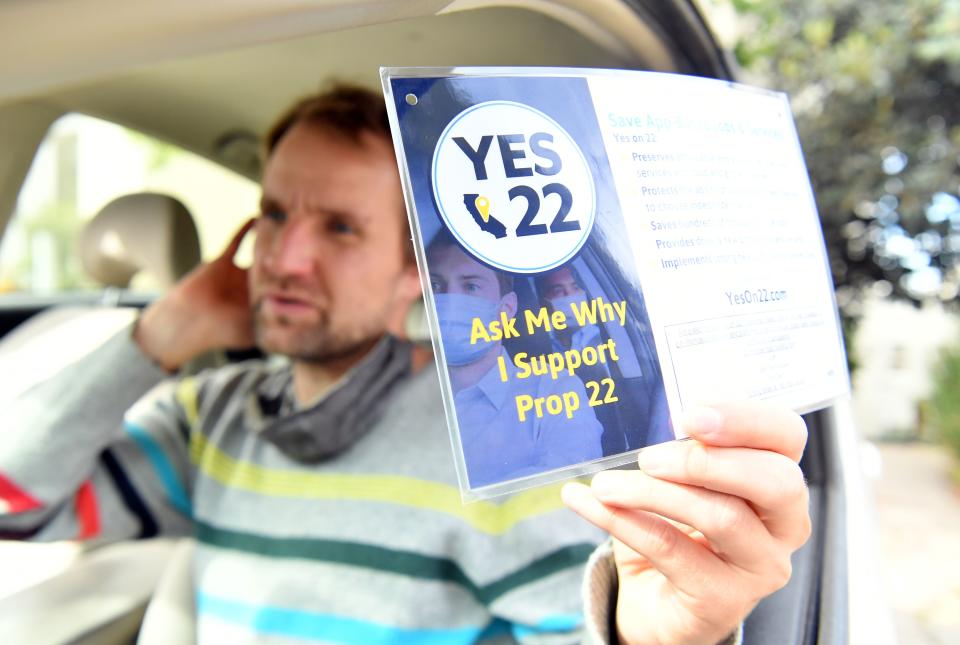

Uber’s earnings announcement follows an Election Day victory for the company with the passage of California’s Proposition 22, a measure that exempts it, along with rival Lyft (LYFT) and businesses like Instacart and GrubHub (GRUB), from having to treat drivers like employees.

Without a win, Uber and Lyft threatened to pull out of California entirely. The firms have made similar moves in the past, most notably in Austin, Texas, which they left in 2016 after the city passed a measure calling for stricter background checks and fingerprinting for drivers. A year later, however, the Texas State Legislature overruled Austin, and Uber and Lyft returned to the city.

Whether the firms would have actually delivered on their threat to leave California, the world’s fifth largest economy and a major market for ride-sharing services, will remain an unanswered question.

Got a tip? Email Daniel Howley at dhowley@yahoofinance.com over via encrypted mail at danielphowley@protonmail.com, and follow him on Twitter at @DanielHowley.

More from Dan:

Big Tech is still in trouble regardless of whether Trump or Biden wins

Bill Gates calls COVID-19 vaccine conspiracy theories “wild” and “unexpected”

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.