UGI Corporation (UGI): Ex-Dividend Is Coming In 3 Days, Should You Buy?

Important news for shareholders and potential investors in UGI Corporation (NYSE:UGI): The dividend payment of $0.25 per share will be distributed into shareholder on 01 January 2018, and the stock will begin trading ex-dividend at an earlier date, 14 December 2017. Investors looking for higher income-generating stocks to add to their portfolio should keep reading, as I examine UGI’s latest financial data to analyse its dividend characteristics. Check out our latest analysis for UGI

Here’s how I find good dividend stocks

When researching a dividend stock, I always follow the following screening criteria:

Is it the top 25% annual dividend yield payer?

Has it consistently paid a stable dividend without missing a payment or drastically cutting payout?

Has the amount of dividend per share grown over the past?

Is is able to pay the current rate of dividends from its earnings?

Will the company be able to keep paying dividend based on the future earnings growth?

How does UGI fare?

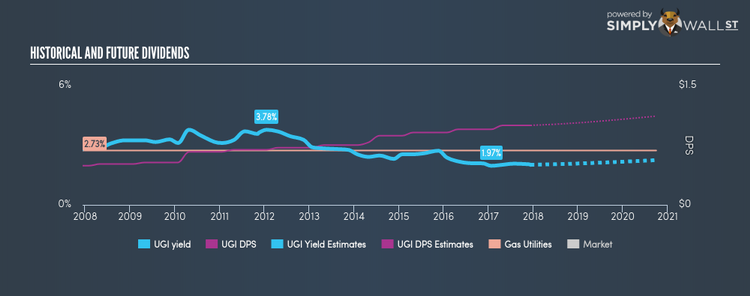

UGI has a payout ratio of 38.78%, meaning the dividend is sufficiently covered by earnings. In the near future, analysts are predicting a payout ratio of 41.13%, leading to a dividend yield of 2.15%. Furthermore, EPS is forecasted to fall to $2.51 in the upcoming year. If there’s one type of stock you want to be reliable, it’s dividend stocks and their stable income-generating ability. In the case of UGI it has increased its DPS from $0.49 to $1 in the past 10 years. It has also been paying out dividend consistently during this time, as you’d expect for a company increasing its dividend levels. These are all positive signs of a great, reliable dividend stock. Relative to peers, UGI generates a yield of 2.02%, which is on the low-side for gas utilities stocks.

What this means for you:

Are you a shareholder?

Are you a shareholder? Investors of UGI can continue to expect strong dividends from the stock moving forward. With its favorable dividend characteristics, UGI is one worth keeping around in your income portfolio. But, depending on your portfolio composition, it may be worth exploring other dividend stocks to improve your diversification, or even look at high-growth stocks to complement your steady income stocks. I encourage you to continue your research by taking a look at my interactive free list of dividend rockstars as well as high-growth stocks to potentially add to your holdings.

Are you a potential investor? With this in mind, I definitely rank UGI as a strong dividend stock, and makes it worth further research for anyone who likes steady income generation from their portfolio. As always, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. Another aspect to consider for UGI is how much it’s actually worth. Is UGI still a bargain? Dig deeper in our latest free analysis to find out!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.