At UK£03.06, Is William Hill plc (LON:WMH) A Buy?

William Hill plc (LON:WMH), a hospitality company based in United Kingdom, received a lot of attention from a substantial price movement on the LSE over the last few months, increasing to £3.36 at one point, and dropping to the lows of £2.79. This high level of volatility gives investors the opportunity to enter into the stock, and potentially buy at an artificially low price. A question to answer is whether William Hill’s current trading price of £3.06 reflective of the actual value of the mid-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at William Hill’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change. See our latest analysis for William Hill

Is William Hill still cheap?

The stock seems fairly valued at the moment according to my valuation model. It’s trading around 18.59% above my intrinsic value, which means if you buy William Hill today, you’d be paying a relatively reasonable price for it. And if you believe the company’s true value is £2.58, there’s only an insignificant downside when the price falls to its real value. Furthermore, it seems like William Hill’s share price is quite stable, which means there may be less chances to buy low in the future now that it’s fairly valued. This is because the stock is less volatile than the wider market given its low beta.

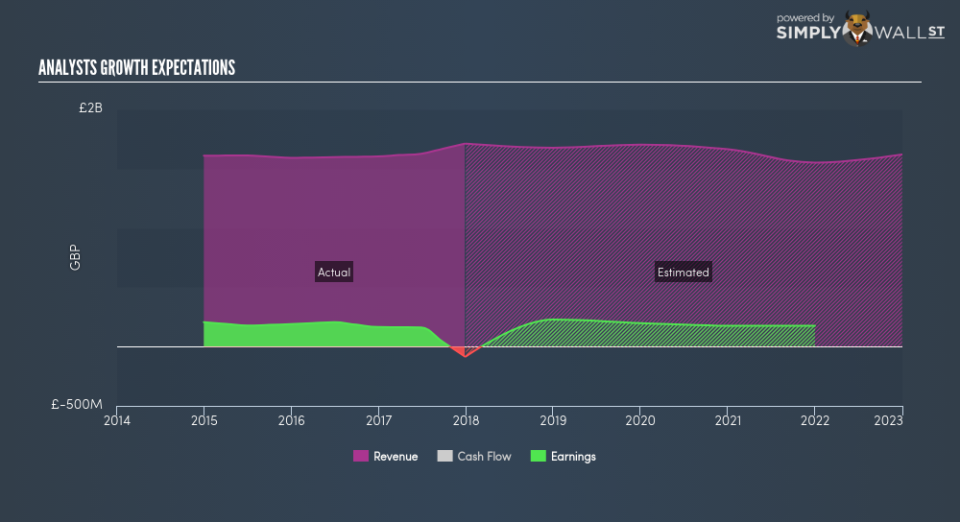

What kind of growth will William Hill generate?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company’s future expectations. However, with an expected decline of -2.74% in revenues over the next couple of years, near-term growth certainly doesn’t appear to be a driver for a buy decision for William Hill. This certainty tips the risk-return scale towards higher risk.

What this means for you:

Are you a shareholder? Currently, WMH appears to be trading around its fair value, but given the uncertainty from negative returns in the future, this could be the right time to reduce the risk in your portfolio. Is your current exposure to the stock optimal for your total portfolio? And is the opportunity cost of holding a negative-outlook stock too high? Before you make a decision on the stock, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on WMH for a while, now may not be the most optimal time to buy, given it is trading around its fair value. The price seems to be trading at fair value, which means there’s less benefit from mispricing. Furthermore, the negative growth outlook increases the risk of holding the stock. However, there are also other important factors we haven’t considered today, which can help crystalize your views on WMH should the price fluctuate below its true value.

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on William Hill. You can find everything you need to know about William Hill in the latest infographic research report. If you are no longer interested in William Hill, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.