The unemployment rate for recent college graduates is getting even worse

New data from the New York Fed highlights how the job situation for recent graduates is worsening.

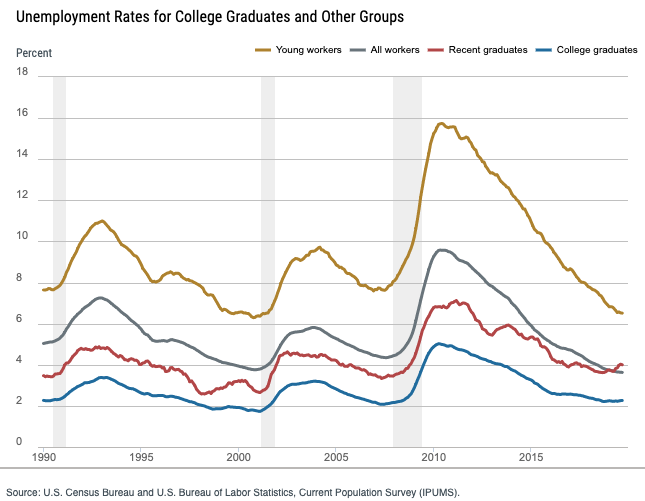

While the rest of the labor market trends favorably, fresh graduates are more likely to be unemployed than the base U.S. working population. That has not happened before in the New York Fed data going back to 1990.

While the unemployment rate for all college graduates aged up to 65 (blue line) is trending lower — currently near its lowest level of this current economic cycle — the market for recent college graduates (red) is bucking the overall trend.

With the backdrop of a robust U.S. labor market, this is “an important and worrisome trend to watch because it never dropped to prior cycle lows,” DataTrek’s Jessica Rabe wrote in a note. “Even though those who have graduated from college typically get hired before less educated workers.”

‘It's caught everyone's attention’

The rates are calculated as a 12-month moving average. Recent college graduates are defined as those between the ages of 22 and 27, with a bachelor’s degree or higher.

The graphic above shows how the unemployment rate for recent college graduates has been inching upwards, from 3.8% in May to 4% in September. In contrast, the unemployment rate for overall workers was 3.6% in September.

The reason for the red line “migrating upwards,” was due to a mismatch of skills, RSM Chief Economist Joe Brusuelas told Yahoo Finance.

“We’re late in the business cycle, so it's caught everyone's attention,” he explained. “There's some concern about the unemployment rate … [but] that may have more to do with the level of experience and difficulties in finding entry level work right now for the educated class.”

Fresh graduates are having a hard time because of the lack of experience and relevant education, according to Brusuelas. “It's a mismatch of skills,” he noted. “[And] that's perhaps weighing employment in that cohort.”

No one:

Entry level job:

“Seven years experience & PhD required”— Father Sean Misty (@seanieviola) November 4, 2019

Looking for jobs actually makes me wanna cry. Like how can I have a MINIMUM 12 MONTHS EXPERIENCE IF NO ONE EMPLOYS ME TO BEgiN WITH. ha ha ha *begins to sob uncontrollably*

— bethany🎃 (@bethmcgrogan_) November 4, 2019

Moody’s Analytics Chief Economist Mark Zandi previously told Yahoo Finance that the trend also “likely reflects in part greater caution by businesses given the slowing economy and uncertainty created by the trade war.”

Nonetheless, despite the gloomy outlook, “is it a risk to the economic outlook? Certainly not at this point,” added Brusuelas.

Student debt crisis could get worse

The unemployment rate bears much more significance when factoring in the level of student debt these fresh graduates are holding.

Borrowers currently hold nearly $1.5 trillion in outstanding student loans. Fresh graduates owe an average of $29,200 in debt, according to a report by the Institute for College Access & Success.

Nearly a quarter of those who had taken out a Direct Loan were either in delinquency or default at the end of last year, the report added.

The financial hardship endured by these borrowers has inspired a variety of solutions, from reforming the existing system to forgiving student debt entirely.

Yeah I just got off the phone with your student loan department. They literally can’t help me cuz I’m out of forbearance and I’m about to default on my loans cuz I’m broke and unemployed. 🤷🏻♀️ so unless you can magically give me more forbearance, you can’t help.

— Sarah (@ThePsarahdactyl) May 3, 2019

And if delinquencies and defaults were to increase, it could possibly affect the broader U.S. economy.

“Debt has acted as a long-term drag on demand for housing and autos. It does have a real macroeconomic component to it,” Brusuelas said. “At one point, this is going to have to be addressed.”

—

Aarthi is a writer for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

'Severely derogatory': U.S. student debt defaults have 'grown stunningly'

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.