Union Pacific (UNP) Q3 Earnings Beat Estimates, Rise Y/Y

Union Pacific Corporation UNP reported better-than-expected third-quarter 2021 results.

Earnings of $2.57 per share surpassed the Zacks Consensus Estimate of $2.48. Moreover, the bottom line rallied 27.9% on a year-over-year basis.

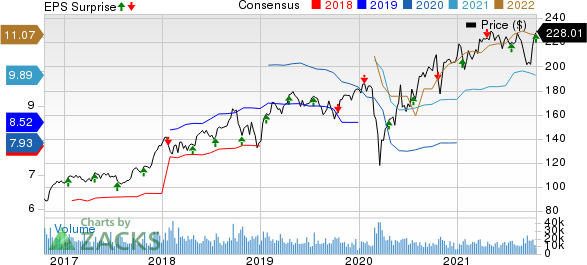

Union Pacific Corporation Price, Consensus and EPS Surprise

Union Pacific Corporation price-consensus-eps-surprise-chart | Union Pacific Corporation Quote

Operating revenues of $5,566 million also beat the Zacks Consensus Estimate of $5,381.7 million. The top line increased 13.2% on a year-over-year basis due to an uptick in freight revenues (up 12% to $5,166 million). Business volumes, measured by total revenue carloads, were flat compared with third-quarter 2020 levels.

Operating income in the third quarter surged 20% year over year to $2,432 million. Total operating expenses escalated 9% to $3,134 million. Operating ratio (operating expenses, as a percentage of revenues) improved to 56.3% compared with 58.7% in the year-ago quarter, despite being hurt to the tune of 140 basis points by higher fuel prices. Notably, lower the value of the metric, the better.

This currently Zacks Rank #3 (Hold) company’s third-quarter effective tax rate rose to 23.3% from 23.1% in the year-ago quarter. In the third quarter, Union Pacific repurchased 8.6 million shares at an aggregate cost of $1.8 billion. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Segmental Performance

Bulk (Grain & grain products, Fertilizer, Food & refrigerated, Coal & renewables) freight revenues were $1,687 million, up 14% year over year. Both revenue carloads and average revenue per car increased 4% and 9%, respectively, on a year-over-year basis.

Industrial freight revenues totaled $1,911 million, up 22% year over year. Both revenue carloads and average revenue per car surged 14% and 6%, respectively, on a year-over-year basis.

Freight revenues in the Premium division were $1,568 million, up 1% year over year. Revenue carloads fell 9%, while average revenue per car increased 11% on a year-over-year basis.

Meanwhile, other revenues increased 24% to $400 million in the third quarter.

Liquidity

The company exited the third quarter of 2021 with cash and cash equivalents of $1,194 million compared with $1,799 million at the end of 2020. Debt (due after a year) increased to $27,560 million at the end of the quarter from $25,660 million at 2020-end. Debt-to-EBITDA ratio (on an adjusted basis) is at 2.8 compared with the December 2020-end figure of 2.9.

Sectorial Snapshot

Within the broader Transportation sector, Delta Air Lines DAL, J.B. Hunt Transport Services JBHT and Kansas City Southern KSU recently reported third-quarter 2021 results.

Delta, reported third-quarter earnings (excluding $1.59 from non-recurring items) of 30 cents per share, outpacing the Zacks Consensus Estimate of 15 cents. Revenues of $9,154 million also beat the Zacks Consensus Estimate of $8,370.6 million.

J.B. Hunt, reported third-quarter earnings of $1.88 per share, surpassing the Zacks Consensus Estimate of $1.77. Total operating revenues of $3144.8 million outperformed the Zacks Consensus Estimate of $3002.1 million.

Kansas City Southern, reported third-quarter earnings (excluding 31 cents from non-recurring items) of $2.02 per share, missing the Zacks Consensus Estimate of $2.07. Quarterly revenues of $744 million, however, surpassed the Zacks Consensus Estimate of $725.9 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research