United Parcel's (UPS) Dividends & Buyback Aid, Expenses Ail

United Parcel Service, Inc. UPS is benefiting from its shareholder-friendly initiatives. These initiatives not only instill investors’ confidence but also positively impact earnings per share.

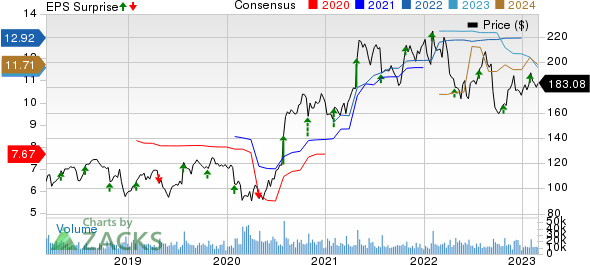

The company recently reported fourth-quarter 2022 earnings of $3.62 per share beat the Zacks Consensus Estimate of $3.58 and improved 0.8% year over year. Revenues of $27,033 million fell short of the Zacks Consensus Estimate of $27,946.6 million and decreased 2.7% year over year.

United Parcel Service, Inc. Price, Consensus and EPS Surprise

United Parcel Service, Inc. price-consensus-eps-surprise-chart | United Parcel Service, Inc. Quote

How is United Parcel Placed?

UPS’ strong free cash flow-generating ability is encouraging, supporting its shareholder-friendly activities. In 2022, UPS generated a free cash flow of $9,038 million. Robust free cash flow generation by UPS is a major positive, leading to an uptick in shareholder-friendly activities. Notably, UPS paid dividends worth $5,114 million and repurchased shares worth $3,500 million in 2022. In 2023, UPS expects to make dividend payments of $5.4 billion and repurchase shares worth $3 billion.

Concurrent with the fourth-quarter 2022 earnings release, UPS’ board of directors raised its quarterly cash dividend to $1.62 per share, effective from the first quarter of 2023. This marked the 14th consecutive year of a dividend increase. The raised dividend will be paid out on Mar 10, 2023, to all its shareholders of record as of Feb 21, 2023. Additionally, UPS has approved a $5-billion share repurchase authorization, replacing the company’s existing authorization.

On the flip side, increase in operating expenses is a concern. Due to the 56.4% rise in fuel expenses, operating costs increased 3.3% in 2022.

Rising capital expenses further add to its woes. In 2022, UPS incuured $4,769 million of capital expenditures, up 13.7% year over year. The company now expects current-year capital expenditures to be $5.3 billion, well above 2022 level. The increased capex guidance, even though aimed at long-term benefits, may dent current-year profit margins.

Zacks Rank & Stocks to Consider

Currently, United Parcel carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader Zacks Transportation sector are Copa Holdings, S.A. CPA, Alaska Air Group, Inc. ALK and American Airlines AAL. Copa Holdings presently sports a Zacks Rank #1 (Strong Buy), while Alaska Air and American Airlines currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Copa Holdings has an expected earnings growth rate of 33.66% for the current year. CPA delivered a trailing four-quarter earnings surprise of 33.35%, on average.

The Zacks Consensus Estimate for CPA’s current-year earnings has improved 12.65% over the past 90 days. Shares of CPA have soared 7.2% over the past six months.

Alaska Air has an expected earnings growth rate of 32.64% for the current year. ALK delivered a trailing four-quarter earnings surprise of 8.98%, on average.

The Zacks Consensus Estimate for ALK’s current-year earnings has improved 11.4% over the past 90 days. Shares of ALK have soared 4.7% over the past six months.

AAL has an expected earnings growth rate of more than 100% for the current year. AAL delivered a trailing four-quarter earnings surprise of 7.79%, on average.

The Zacks Consensus Estimate for AAL’s current-year earnings has improved 40.5% over the past 90 days. Shares of AAL have gained 13% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report