UnitedHealth: Operating Prowess and Value in Abundance

UnitedHealthGroup (NYSE:UNH) is a strong company that I believe has a very attractive risk-adjusted return profile. However, after a drawdown of nearly 10% in the stock price in the past six months, some investors must wonder if the bears are right about potential headwinds from the court ruling that the federal government can collect overpayments it made to the company due to UnitedHealth's misreporting on its Medicare Advantage plans.

After assessing UnitedHealth's operational status and its stock's market-based factors, I believe that despite the headwinds, a tremendous value opportunity exists as UnitedHealth looks underappreciated and oversold. Here's why.

Operational review

Although UnitedHealth is a life and health insurer with additional long-term solutions, investors must consider that the company also has another source of growth potential through its Optum business unit.

Optum provides long-term health solutions with a digitalization aspect phased into its business model. In addition, Optum's ecosystem includes components such as practitioner consultations, pharmacy services and data analytics.

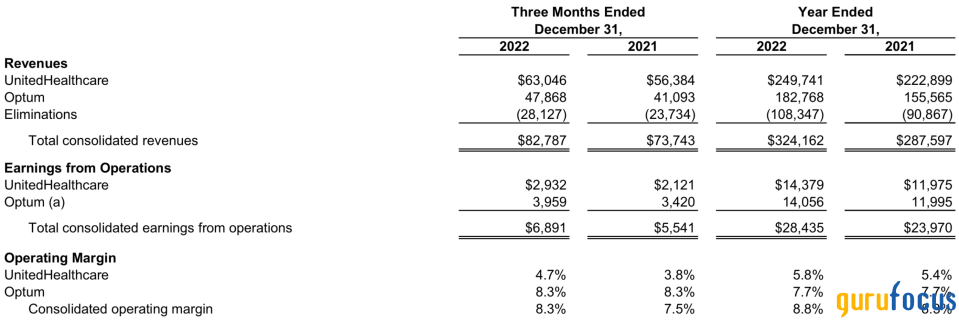

Optum contributes to more than half of UnitedHealth's revenue mix, and its full-year growth of 17% shows just how potent the segment is. Sure, Optum's net profit margin of a little over 8% is not desirable. However, investors must consider two factors: 1) Optum is still in a growth phase with an emphasis on reinvestment, and 2) Optum provides business-wide synergies to UnitedHealth, which enhances its market position and potential future profitability.

Source: UnitedHealth

Furthermore, UnitedHealth's headline earnings are extremely attractive as both the composition of its earnings and the tangible results are aligned toward further success prospects.

Insurers that provide long-term solutions have less lumpy earnings than property and casualty insurers. Thus, UnitedHealth's earnings from premiums will likely grow at a constant year-over-year rate.

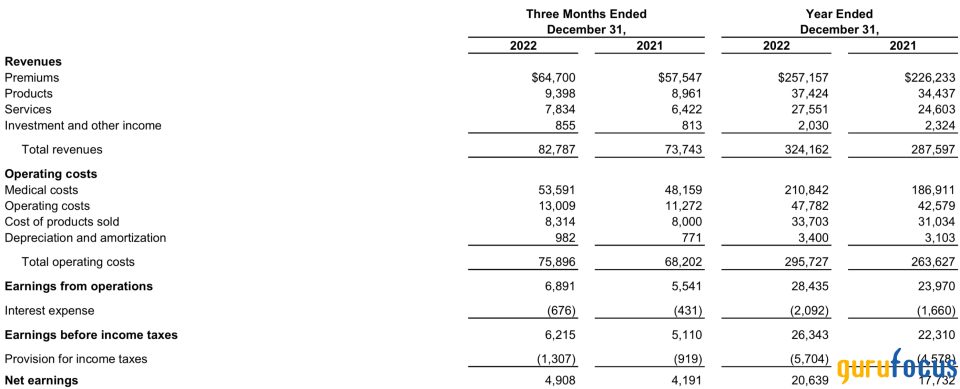

As displayed by the company's latest quarterly earnings report, UnitedHealth's year-over-year income from premiums skyrocketed. The line item's annual growth is partially due to harder pricing in the insurance industry. However, UnitedHealth's 25.9% life and health insurance market share means it has an advantage over its peers, allowing it to price its offerings more elastically.

Source: UnitedHealth

Along with its premiums-based revenue stream, UnitedHealth derives some of its revenue from investments. Although the company does not boast significant income from investments, a year-to-date financial market recovery may mark a portion of UnitedHealth's asset base, consequently marking up its asset base.

Outlook

With UnitedHealth's retrospective financial performance covered, the question beckons: What does the future hold for UnitedHealth?

UnitedHealth's management affirmed a positive outlook for 2023 in November, stating that the company will likely deliver between $357 to $360 billion in annual revenue coupled with cash from operations worth $27 to $28 billion. In terms of residual value, I estimate that UnitedHealth will deliver up to $23.65 per share, which is favorable in today's macroeconomic environment.

Sustained price advantages in the life and health insurance industry support the company's outlook. Although mean reversion is inevitable, insurers will probably continue to benefit from higher premiums in 2023. Additionally, Optum's secular growth is well beyond a conventional level, lending additional support to UnitedHealth's implied profitability.

Valuation and dividends

UnitedHealth's asset base is easily quantified as most of its assets are quoted and available to the general public. Although less so than banks, insurance companies are best valued by observing their price-book ratios.

At face value, UnitedHealth's price-book ratio is in overvalued territory. However, a closer look shows that the company's book value is growing exponentially, leaving the stock's price-book ratio below its intercept.

Furthermore, UnitedHealth's forward price-earnings ratio is lower than its current price-earnings ratio. Additionally, its forward price-earnings ratio is at a 20% peer discount. Thus, a pooled analysis of UnitedHealth's price multiples implies that the stock hosts relative value.

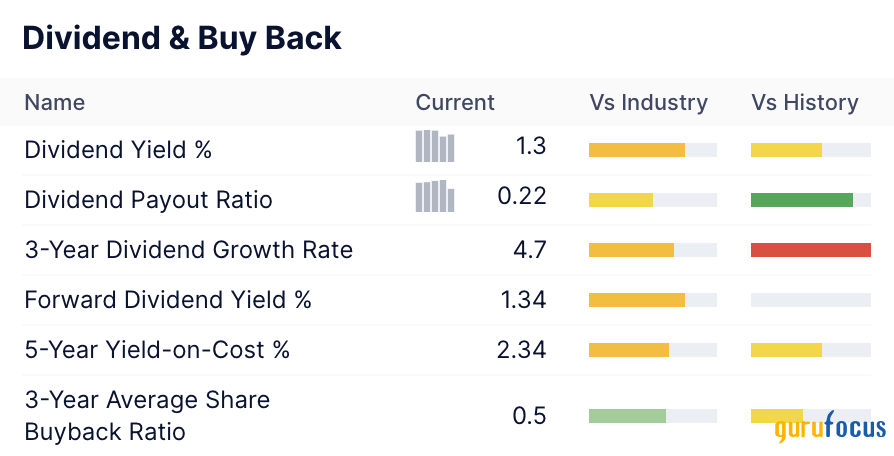

Lastly, UnitedHealth provides some carry returns with a forward dividend yield of 1.34%. Moreover, UnitedHealth's dividends are sustainable as it hosts a medium-ranged payout ratio of 0.22 and a robust three-year dividend growth rate.

Noteworthy risks

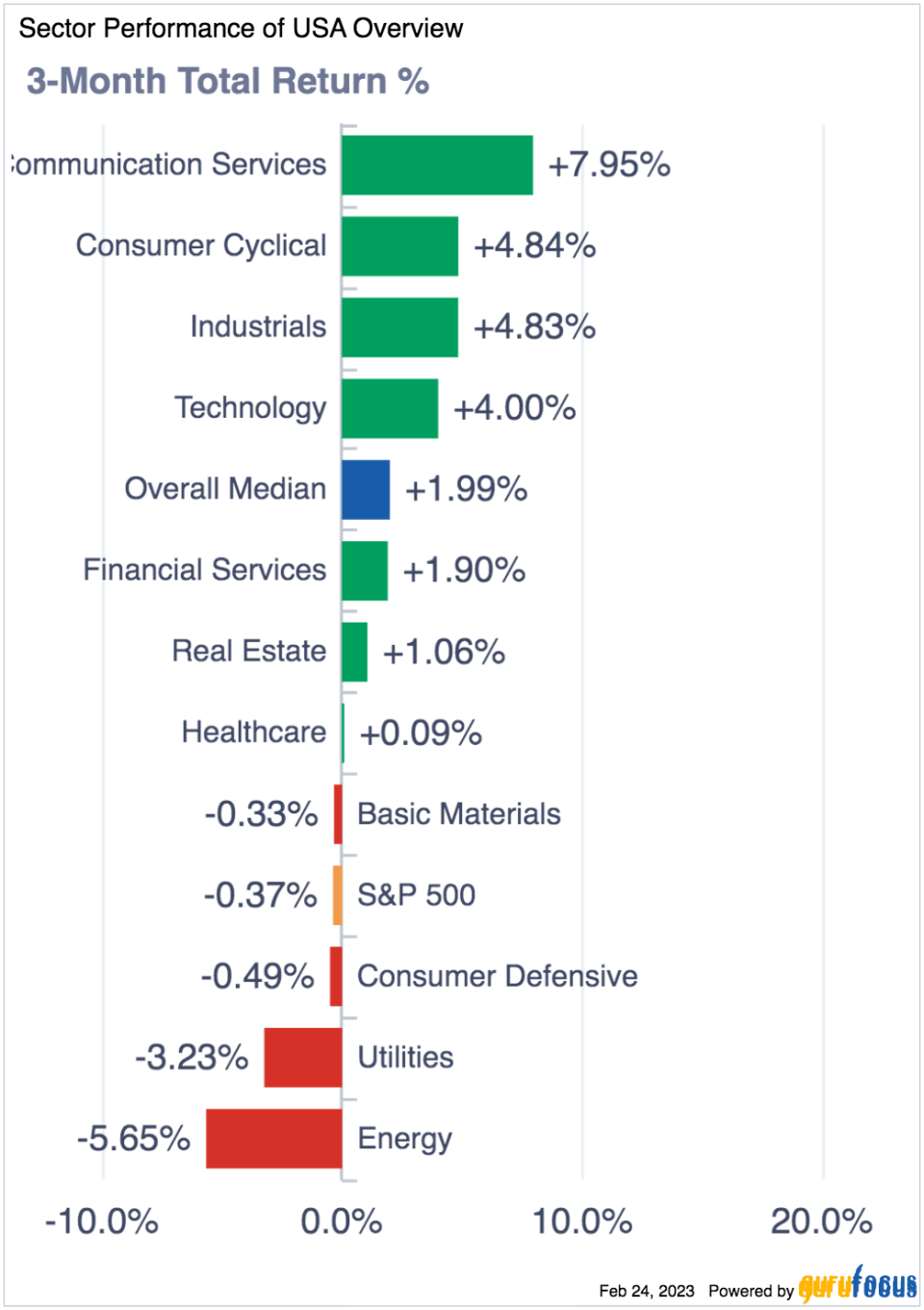

A noteworthy risk relating to UnitedHealth is the cyclical change in security behavior witnessed since the turn of the year. As the diagram below shows, cyclical and high-beta stocks have outperformed lower-risk stocks due to an improved economic outlook. Thus, UnitedHealth's stock might continue to lack demand if investors resume their risk-on approach.

An additional risk in the pipeline is the aforementioned factor of tapering insurance premiums. Insurance premiums are priced at a multiyear high, and any signs of mean reversion will be seen as unfavorable by UnitedHealth's investors.

Final word

I believe UnitedHealth's six-month drawdown could provide a value opportunity for those who are interested in the stock. UnitedHealth's long-term solutions are well supported by renewed growth stemming from its Optum segment. Moreover, sustained multiyear high insurance premiums pricing may lead to additional stock support.

UnitedHealth's book value is growing at a rate of knots. More so, the company is undervalued relative to its peers on an earnings basis and provides a decent dividend.

This article first appeared on GuruFocus.