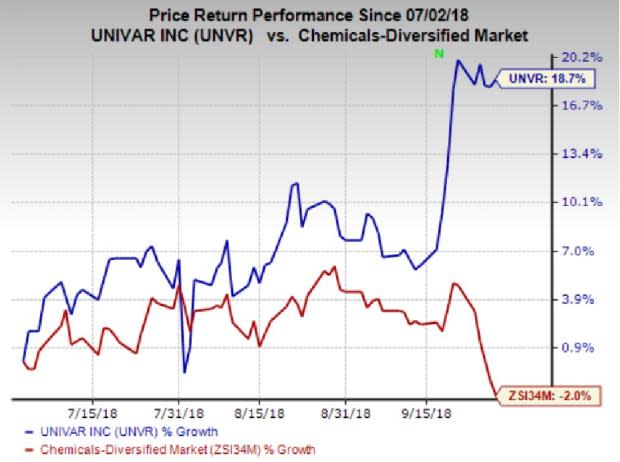

Univar (UNVR) Up 19% in 3 Months: What's Driving the Stock?

Shares of Univar Inc. UNVR have popped around 19% over the past three months. The company has also significantly outperformed its industry’s decline of roughly 2% over the same time frame.

Univar, a Zacks Rank #3 (Hold) stock, has a market cap of roughly $4.3 billion. Average volume of shares traded in the last three months was around 887.2K. The company has an expected long-term earnings per share growth rate of 9.7%.

Let’s take a look into the factors that are driving this chemical company.

Driving Factors

Healthy earnings outlook and buoyant prospects from the proposed acquisition of Nexeo Solutions have contributed to the gain in Univar’s shares.

Univar sees adjusted earnings in the range of $1.65-$1.85 for 2018, reflecting an increase from $1.39 in 2017. For the third quarter, the company expects adjusted EBITDA to grow by low double-digit clip year over year.

Univar remains focused on cost-cutting, expense management and productivity actions, which is helping it to minimize operational costs and boost margins. The company is also gaining from its strategic initiatives, efficiency gains and prudent investments to drive growth.

Moreover, Univar is working on key initiatives — Operational Excellence, Commercial Greatness and One Univar — targeted at enhancing its profitability or return on investment. Reinvestment for core business growth, meaningful buyouts and lowering debt burden are the key features of the company’s capital allocation policy.

Univar, last month, entered into a definitive agreement to buy global chemicals and plastics distributor, Nexeo Solutions, Inc, in a cash and stock deal valued at roughly $2 billion. The deal is unanimously approved by the boards of the companies and is expected to close in the first half of 2019, subject to receipt of regulatory approvals and adherence to other customary conditions.

The combination is expected to drive growth and boost shareholders’ value with the largest sales force in North America along with extended product offering and most efficient supply chain network in the industry.

According to Univar, the transaction is expected to be accretive to cash flow and earnings starting in the first full year after the closure of the deal. It is expected to deliver $100 million or 43 cents per share (after-tax) of annual run rate cost savings by the third year following closure and reduce annual capital expenditures by $15 million immediately.

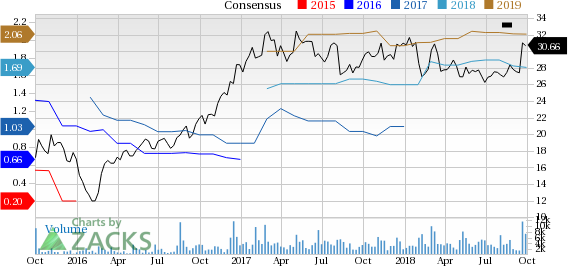

Univar Inc. Price and Consensus

Univar Inc. Price and Consensus | Univar Inc. Quote

Stocks to Consider

Stocks worth considering in the basic materials space include ArcelorMittal MT, Nucor Corporation NUE and Nutrien Ltd. NTR, each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ArcelorMittal has an expected long-term earnings growth rate of 4.8%. The company’s shares are up roughly 17% in a year.

Nucor has an expected long-term earnings growth rate of 12%. The company’s shares have gained around 13% in a year.

Nutrien has an expected long-term earnings growth rate of 14%. The company’s shares have gained around 20% in a year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Univar Inc. (UNVR) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Potash Corporation of Saskatchewan Inc. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.