Is Universal Insurance Holdings, Inc. (UVE) A Good Stock To Buy?

How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don't always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Universal Insurance Holdings, Inc. (NYSE:UVE).

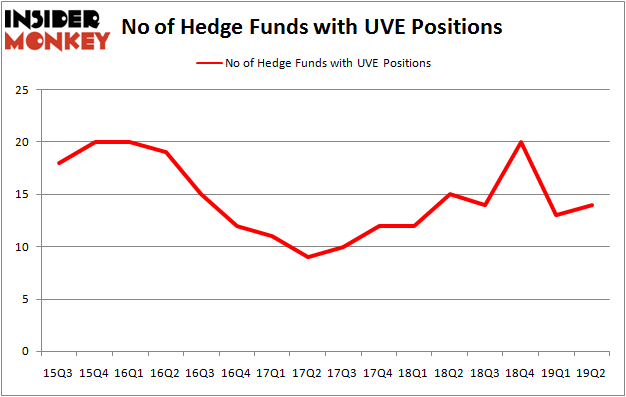

Is Universal Insurance Holdings, Inc. (NYSE:UVE) a great investment today? Prominent investors are becoming more confident. The number of bullish hedge fund bets inched up by 1 recently. Our calculations also showed that UVE isn't among the 30 most popular stocks among hedge funds (see the video below). UVE was in 14 hedge funds' portfolios at the end of the second quarter of 2019. There were 13 hedge funds in our database with UVE holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We're going to analyze the latest hedge fund action regarding Universal Insurance Holdings, Inc. (NYSE:UVE).

What does smart money think about Universal Insurance Holdings, Inc. (NYSE:UVE)?

Heading into the third quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from the first quarter of 2019. On the other hand, there were a total of 15 hedge funds with a bullish position in UVE a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Universal Insurance Holdings, Inc. (NYSE:UVE), which was worth $12.6 million at the end of the second quarter. On the second spot was AQR Capital Management which amassed $12.1 million worth of shares. Moreover, Arrowstreet Capital, Stadium Capital Management, and Marshall Wace LLP were also bullish on Universal Insurance Holdings, Inc. (NYSE:UVE), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key money managers have jumped into Universal Insurance Holdings, Inc. (NYSE:UVE) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most outsized position in Universal Insurance Holdings, Inc. (NYSE:UVE). Marshall Wace LLP had $5.4 million invested in the company at the end of the quarter. Renaissance Technologies also initiated a $2.9 million position during the quarter. The other funds with brand new UVE positions are Ken Griffin's Citadel Investment Group and Roger Ibbotson's Zebra Capital Management.

Let's also examine hedge fund activity in other stocks similar to Universal Insurance Holdings, Inc. (NYSE:UVE). We will take a look at Third Point Reinsurance Ltd (NYSE:TPRE), Odonate Therapeutics, Inc. (NASDAQ:ODT), Amphastar Pharmaceuticals Inc (NASDAQ:AMPH), and Standard Motor Products, Inc. (NYSE:SMP). All of these stocks' market caps are closest to UVE's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position TPRE,20,65115,1 ODT,13,634369,4 AMPH,9,22407,-1 SMP,11,105177,-1 Average,13.25,206767,0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $207 million. That figure was $59 million in UVE's case. Third Point Reinsurance Ltd (NYSE:TPRE) is the most popular stock in this table. On the other hand Amphastar Pharmaceuticals Inc (NASDAQ:AMPH) is the least popular one with only 9 bullish hedge fund positions. Universal Insurance Holdings, Inc. (NYSE:UVE) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on UVE as the stock returned 8.1% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019