Upbeat BoE Lifts British Pound Across the Board - 2 Potential Trades

Talking Points:

- BoE’s tone moves forward policy calendar by one year.

- Light calendar this week offers little by way of data on Tuesday.

- British Pound may benefit most against Euro, Japanese Yen.

To receive this report in your inbox every morning, sign up for Christopher’s distribution list.

INTRADAY PERFORMANCE UPDATE: 11:35 GMT

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.04% (+1.10% prior 5-days)

ASIA/EUROPE FOREX NEWS WRAP

The British Pound surged against its major counterparts this morning after the release of the Bank of England’s Quarterly Inflation Report (QIR). The QIR struck a more hawkish tone than anticipated, with the BoE upgrading its labor market forecast considerably.

In August, the QIR detailed the central bank’s forward guidance strategy that implied that rates would remain low unless the Unemployment Rate hit 7.0% by the 3Q’16; this assessment today was upgraded to the 3Q’15.

While the inflation forecast was downgraded after yesterday’s softer CPI report, the tone struck in the QIR was that of a more optimistic BoE, with Governor Carney even suggesting that it’s hard to ignore that the “glass is half full.” Accordingly, with British Pound strength developing this morning, there are two potential trades on the horizon:

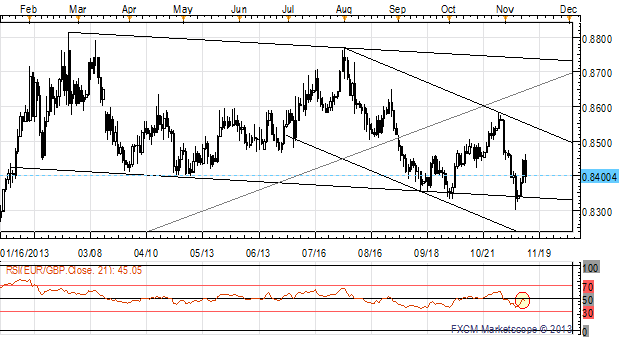

EURGBP Daily Chart: January 16 to Present

- The EURGBP has set a lower high after breaking the uptrend from July 2012, and price has pierced sideways channel support (dating back to January).

- A new descending channel may be emerging; confirmation below 0.8300.

- Rebound from 0.8300 sees daily RSI (21) capped by 50; structure remains bearish.

- Weekly close

Read more: Euro Hobbled by ECB, NFPs - Will 3Q GDP Reports Confirm Fears?

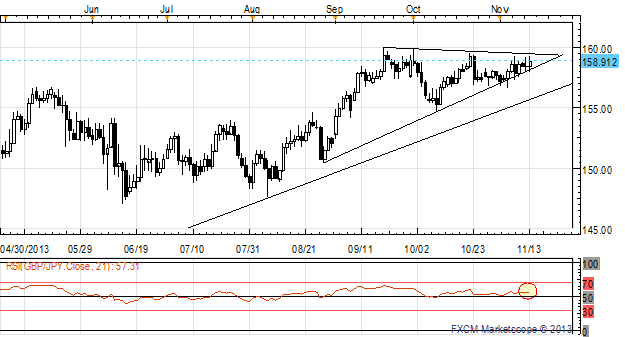

GBPJPY Daily Chart: April 30 to Present

- The GBPJPY remains supported by an uptrend dating back to November 2012, and a more concerted uptrend since April 2013.

- Price has consolidated in an ascending triangle since September; daily RSI (21) has held above 50 during this stretch, suggesting momentum remains bullish.

- Market has become extremely choppy past two-weeks (several hundred pip swings in a few hours); preference is to trade ‘outside of price.’

- Longs eyed once price establishes itself above 160.00 on a weekly basis.

- Retail trader sentiment suggests further gains possible for GBPJPY.

ECONOMIC CALENDAR – UPCOMING NORTH AMERICAN SESSION

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators. Want the forecasts to appear right on your charts? Download the DailyFX News App.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.