UPS to Report Q4 Earnings: What's in Store for the Stock?

United Parcel Service UPS is scheduled to report fourth-quarter 2019 earnings numbers on Jan 30, before market open.

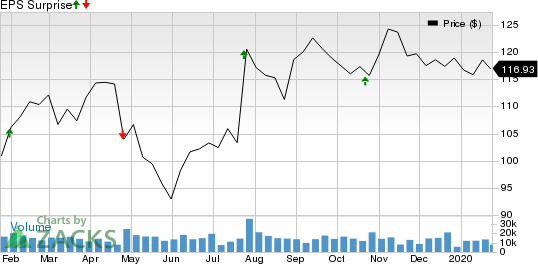

The company has a decent track record with respect to earnings per share, having outperformed the Zacks Consensus Estimate in three of the last four quarters.

United Parcel Service, Inc. Price and EPS Surprise

United Parcel Service, Inc. price-eps-surprise | United Parcel Service, Inc. Quote

Given this backdrop, let’s delve into the factors that might have influenced the company’s performance in the fourth quarter.

With UPS incurring significant costs to upgrade its facilities, its bottom-line number is likely to reflect the negative impact of elevated expenses. Moreover, as UPS has Chinese exposure, trade-related issues are also likely to have affected the company’s quarterly performance. Evidently, the Zacks Consensus Estimate for International Package revenues is currently pegged at $3,814 million, reflecting a 0.4% decline from the year-ago quarter reported figure.

Revenues in the Supply Chain and Freight unit are expected to have suffered primarily due to trade-related sluggishness. The Zacks Consensus Estimate for this segment’s revenues is currently pegged at $3,417 million, reflecting a 0.8% decline, year on year.

Though the Phase 1 trade deal between United States and China bodes well as it provides tariff relief, UPS’ quarterly results will not reflect this development’s favorable impact as the agreement was signed this January.

However, solid e-commerce growth is likely to have boosted the top line in the soon-to-be-reported quarter. The holiday season during the October-December period is anticipated to have further fueled e-commerce growth during the period under consideration, in turn bolstering revenues. Notably, the Zacks Consensus Estimate for revenues in the U.S. Domestic Package segment, UPS’ primary revenue-generating unit, suggests a 6.4% year-over-year rise.

Highlights of Q3 Earnings

In the last reported quarter, the company delivered a positive earnings surprise of 0.5%. Total revenues also surpassed the Zacks Consensus Estimate. Moreover, both the top and the bottom lines improved year over year, courtesy the U.S. Domestic Package segment’s impressive performance. The company’s transformation initiatives also aided results.

Earnings Whispers

Our proven model does not conclusively show a beat for UPS this earnings season. The odds of a beat increase with a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). However, that is not the case here as highlighted below.

Earnings ESP: UPS has an Earnings ESP of -1.69% as the Most Accurate estimate is pegged at $2.07, lower than the Zacks Consensus Estimate by 4 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: UPS currently carries a Zacks Rank of 3 but a negative Earnings ESP makes surprise prediction difficult.

Stocks to Consider

Investors interested in the broader Transportation sector may also consider Canadian Pacific Railway Limited CP, Alaska Air Group ALK and Norfolk Southern Corporation NSC, as these stocks possess the right combination of elements to come up with an earnings beat in their upcoming releases.

Canadian Pacific has an Earnings ESP of +0.39% and currently carries a Zacks Rank #3. The company will announce fourth-quarter financial numbers on Jan 29.

Alaska Air has an Earnings ESP of +1.89% and holds a Zacks Rank of 3, at present. The company is set to report quarterly figures on Jan 28.

Norfolk Southern has an Earnings ESP of +0.36% and is a Zacks #3 Ranked stock. It is scheduled to release fourth-quarter numbers on Jan 29.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

Canadian Pacific Railway Limited (CP) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.