How Can the US Midterm Election Impact the Financial Markets?

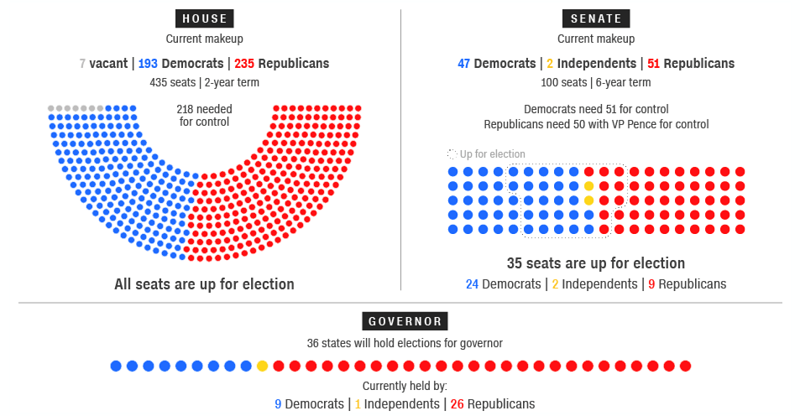

With the US midterm elections just a few days away, it’s worth thinking about what they could mean for global markets. If the polls have it right, the Democrats will take the House quite comfortably, while the Senate will remain in the hands of Republicans.

If that is the case, for the first time since the 2016 election, the GOP will no longer control the White House, Senate, and House, which will introduce a new dynamic to Washington.

Some Historical Perspective

Firstly, it’s worth looking at history for some perspective. The party in opposition to the president’s party does usually win more seats during the midterm election. So, it would not be unusual for the Democrats to win the House, the Senate, or both. In this case, there are also a large number of Republicans retiring (39 to be exact), so more seats than usual do not have an incumbent defending them.

While it’s often assumed that a Democrat-led house is bad for the stock market, and will be in this case, historically a Democrat controlled house has actually been slightly better than a GOP controlled house for stocks. At the same time, it’s worth remembering that we are in the tenth year of a bull market.

Historically, we have also seen market volatility increase ahead of the midterms, as we are seeing now. But, since current market volatility has several other causes – the trade war, rates, and valuations – it may not automatically end after the election.

Likely Outcome of Expected Results

If the Democrats do take the House, there are several likely outcomes. The first will be more gridlock in Washington, with fewer new laws being passed. This could be both good and bad – depending who you ask. Fewer legislative changes could mean more certainty, something investors like.

Trump and the GOP will have a hard time introducing new tax cuts or making the last round of tax cuts permanent. Some analysts even think it’s possible some tax cuts would be reversed.

Trump would also struggle to ratchet up the trade war with China, which may put his whole trade strategy in jeopardy. This would have implications for global markets, and in particular for emerging markets.

A Democrat-controlled House would probably lead to new investigations into Trump, his campaign and his business interests. The topic of impeachment may well come up to, though it would be unlikely to go very far as any verdict requires the support of 67 senators. It’s also believed that Robert Mueller will announce his findings on alleged collusion between the Trump campaign and Russia.

And Finally, large gains for Democrats would turn attention to the 2020 election and the chances and implications of the Dems taking the Senate and White House.

Of course, this is all assuming the results are in line with the polls. There are two possible surprise outcomes, namely the GOP keeping both the House and Senate or the Democrats winning control of both. Because both scenarios are unexpected, they would lead to large reactions from the market.

As far as markets are concerned, the midterm elections aren’t taking place in a vacuum. Investors are concerned about the trade war, interest rates, valuations and the sustainability of earnings growth.

The S&P500

If the Democrats do take the house, the knee-jerk reaction will probably be lower stock prices as further tax cuts would no longer be on the table. If an initial shock doesn’t have a knock on effects, markets will then look at the longer-term implications including the global economy and the trade war.

Gridlock in Washington may actually lead to more certainty with regard to policy and regulation as major changes would become less likely. It would also be in both parties’ interests to continue investing in infrastructure – but there is always the possibility that one or other party may try to scuttle a new bill for political gain. This would be very bad for markets.

Over the next two years, there will be plenty of opportunities for Washington to trigger new periods of volatility over the debt ceiling, investigations into Trump and possible impeachment hearings.

In the event that the Republicans retain the House, a relief rally is almost certain, but that may be followed by a new era of uncertainty as Trump attempts to double down on his policies.

The US Dollar

The USD has been a rocket for most of 2018, in part at least because of the trade war. A Democrat-controlled House would stand in the way of further escalation of the trade war, and potentially reverse some of the previous measures. Many analysts believe this will lead to USD weakness, although one would expect that to some extent this would be priced in by now.

Gridlock in Washington may also stall further tax cuts and possibly even slow government spending, both of which could also lead to USD weakness.

If the GOP does happen to retain control of the House, we can expect a strong rally in the USD as this is the result that is probably not priced into the market.

Emerging Markets

The biggest beneficiary of the Dems winning the house may be emerging markets. Emerging market assets – currencies, bonds, and equities – have all been under pressure since before the trade war started and are heavily oversold. A de-escalation of the trade war would lead to the expectation of revitalized demand for raw materials from China which may trigger a sharp relief rally for emerging-market assets. Dollar weakness would support such a rally too.

If the Democrats do not win the House, we can expect to see another wave of selling in emerging markets.

Conclusion

The question, of course, is how much of the expected result is already priced in? For the most part, markets have been focussed on interest rates and the trade war over the last 6 months. Equities have fallen, but a host of other reasons have been given for that. In addition, on two occasions when polls showed the gap between the parties narrowing (in May and August) there was little reaction from markets. That would suggest the expected result is not fully priced in – and we may see some trading opportunities in the next week.

This article was originally posted on FX Empire