USD/JPY Rallies off of Two-Month Low After Retail Sales Beat Modestly

THE TAKEAWAY: USD Advance Retail Sales (MAY) > +0.6% versus +0.4% expected, from +0.1% (m/m) > USD Initial Jobless Claims (JUN 8) > 334K versus 346K expected, from 346K > USDJPY BULLISH

The US consumer continues to scrape by despite the fiscal impositions weighing on the broader economy – the payroll tax hike from January and the budget sequestration commencing in March. Advance Retail Sales, one of the better data proxies to broader consumption trends, increased by +0.6% m/m in May, the highest rate since February, when sales increased by +1.1% m/m. The headline print beat the consensus forecast of +0.4% m/m, and was just slightly under the high estimate of +0.8% m/m.

Also released, shining another bright light on the US economy, was the Initial Jobless Claims report for the week ended June 8. Claims fell to 334K, well-below the consensus forecast of 346K, and was the lowest such level since the week ended April 26 (327K). Should claims hold below 340K throughout June, a headline NFP print of +200K is possible.

Overall, this feeds neatly into the idea of reducing QE3 by the Federal Reserve next week, although these data today more or less brings the likelihood back to even on whether or not the reduction occurs. Certainly, if the US consumer is strengthening despite fiscal headwinds, there is reason to believe that the Fed will view the economy in a more favorable light and opt for a relatively more hawkish stance. Thus far, that trade is being reflected in USD-based pairs.

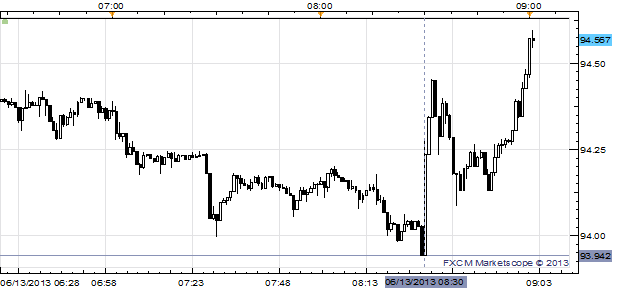

USDJPY 1-minute Chart: June 13, 2013

Charts Created using Marketscope – prepared by Christopher Vecchio

Following the announcement, the USDJPY rallied from a kneejerk low at ¥93.94 to as high as 94.58, at the time this report was written. Before the announcement, the USDJPY had erased all of its gains since April 4, when the Bank of Japan had announced its QE program that reignited the rally towards 100.00.

Elsewhere, the EURUSD slipped from $1.3318 to as low as 1.3293 following the report, and was trading at said level at the time this report was written. The data could continue to spur the “QE3 taper trade” today, which implies higher US Treasury yields, and thus a stronger US Dollar.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.