USD Outlook Turning Increasingly Bearish- AUD Holds at Resistance

Talking Points:

- USDOLLAR Eyes December Low (10,565)- Bullish Bias at Risk

- AUDUSD Continues to Test Key Resistance Ahead of RBA Minutes

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10558.96 | 10591.61 | 10552.13 | -0.28 | 101.69% |

USDOLLAR Daily

Chart - Created Using FXCM Marketscope 2.0

Break of December Low (10,565) Negates Bullish Bias- Lower High in Place

Downside Targets in Focus as Bearish RSI Momentum Gathers Pace

Interim Resistance: 10,657 (61.8 expansion)- Former Support

Interim Support: 10,509 (23.6 retracement) to 10,524 (38.2 retracement)

Release | GMT | Expected | Actual |

Import Price Index (MoM) (JAN) | 13:30 | 0.1% | 0.1% |

Import Price Index (YoY) (JAN) | 13:30 | -1.8% | -1.5% |

Industrial Production (JAN) | 14:15 | 0.2% | -0.3% |

Capacity Utilization (JAN) | 14:15 | 79.3% | 79.5% |

Manufacturing Production (SIC) (JAN) | 14:15 | 0.1% | -0.8% |

U. of Michigan Confidence (FEB P) | 14:55 | 80.5 | 81.2 |

The near-term decline in the Dow Jones-FXCM U.S. Dollar Index (Ticker: USDollar) could be the start of a longer-term bearish trend as the greenback struggles to find support.

Indeed, the lack of momentum to hold above the December low (10,565) negates the bullish bias for the USD, and the dollar may continue to give back the rebound from back in October should it fail to preserve the upward trend dating back to September 2012.

With that said, the Federal Open Market Committee (FOMC) Minutes due out next week may help to limit the downside risks for the greenback as the central bank remains poised to discuss another $10B taper at the March 19 meeting, but we may revert back to ‘selling bounces’ in the reserve currency as the bearish momentum in the Relative Strength Index (RSI) continues to take shape.

Join DailyFX on Demandto Cover Current U.S. Dollar Trade Setups

AUDUSD Daily

RSI to Provide Confirmation/Conviction- Remains at Risk for Downside Break

Interim Resistance: 0.9050 (23.6% expansion) to 0.9070 (38.2% retracement)

Interim Support: 0.8670 (100.0% expansion) to 0.8700 (78.6% expansion)

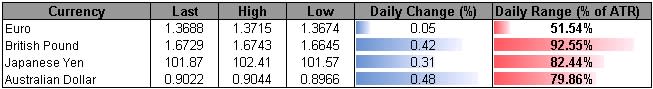

The greenback weakened against all four components, led by a 0.48 percent rally in the Australian dollar, but the AUDUSD remains at risk of carving a lower high as is fails to break and close above resistance.

Indeed, the Reserve Bank of Australia (RBA) Minutes may limit the downside for the higher-yielding currency as Governor Glenn Stevens adopts a more neutral tone for monetary policy, but the central bank may have little choice but to further embark on its easing cycle amid the rise in unemployment.

With that said, we will continue to watch the RSI for confirmation as well as conviction as the bullish momentum appears to be coming to an end, and the AUDUSD should resume the long-term bearish trend as the fundamental outlook for the $1T economy remains tilted to the downside.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.