Is the USD Reversal on Tap? Weekly Scalp Setups Ahead of FOMC

Last week’s report highlighted setups in play as the US Dollar rebounded off key near-term support, achieving all our primary objectives before turning over mid-week. Once again we find the greenback at that same support structure ahead of tomorrow’s highly anticipated release of the FOMC minutes. Here are the updated daily levels we will be trading.

EURUSD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

Interim resistance 1.3450 (today’s high, 2/13 Close, Mid-month pivot)

Topside breach targets 1.35 and 1.36

Interim support 1.3340- Key support 1.3226- 1.3247 (Bullish Invalidation)

Daily RSI failure to extend passed early August highs suggests momentum waning

Key Events: German / EZ Manufacturing/Services PMI on Thursday and Consumer Confidence on Friday

Notes: A breach above technical resistance at 1.3340 earlier in the month was quickly refuted, shifting our focus lower into our primary objective at 1.3226-1.3247 (which was attained on the 13th). The reaction down there was telling with an RSI 60-breach and a push above the August highs taking the pair above the June highs. While price action does look constructive here, I remain neutral as slight RSI divergence and failure of the oscillator to overtake the previous high suggests topside momentum may be waning. Bottom line: Looking for a new high into 1.35 with RSI conviction or a push back below 1.3340 before we tempt the short-side again.

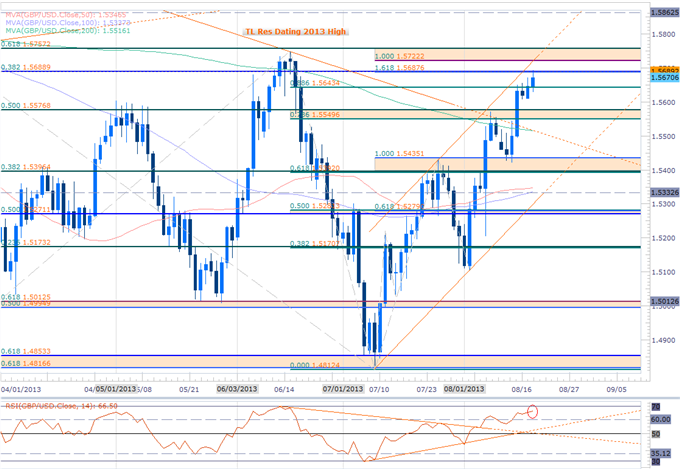

GBPUSD Daily Chart

Technical Outlook

Primary objective at 1.5395- 1.5435 achieved on August 13th before reversing through key resistance

Interim resistance now 1.5687/90, 1.5722- 1.5757, 1.5860

Support 1.5640, 1.5550/75, 1.54- 1.5435 (Bullish Invalidation)

Daily RSI holding above 60 (constructive)

Key Events Ahead: 2Q Preliminary GPD on Friday

Notes: The break above key technical resistance at 1.5550- 1.5577 last week offered conviction on long scalps into initial resistance target at 1.5687/90. We may yet see another push into a key resistance range at 1.5720-1.5757 before turning over. A push through this zone targets 1.5860.

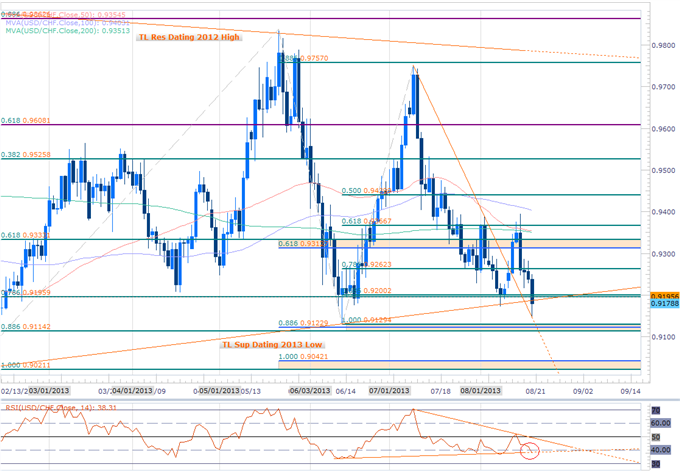

USDCHF Daily Chart

Technical Outlook

Interim support now 9114-9130- Key Support 9020-9042 (Bullish Invalidation)

Interim resistance 9260 (Fib confluence) backed by 9312-9333 and 9366 (Bearish Invalidation)

Daily RSI testing lower bound of the range- Topside trigger now set

Key Events Ahead: July Trade Balance data on Wednesday (Watch US Docket)

Notes: USDCHF achieved our primary and secondary objectives at 9312- 9333 and 9393 on Aug 14th before turning over. Bottom line – I’m still interested in long exposure here – Note that today’s decline rebounded right off former trendline resistance. Bottom line: Looking for the break back above 9200 with RSI conviction to test the long side once again with a break below 9114 shifting our focus lower.

USDOLLAR Daily Chart

Technical Outlook

USDOLLAR back at key support range 10,650/75

Medium-term bias bullish above this mark

Support break targets objectives at 10,580- 10,611

Broader outlook remains weighted to the topside above 10,585- 10,611 support range

Daily RSI trigger pending for long side- 40-Break Sub 10,650 bearish

Key Events Ahead: FOMC Minutes Tomorrow- Fed Symposium in Jackson Hole starts Thursday

Notes: The USDOLLAR setup is unchanged from last week with the index continuing to hold above this support range as we head into the FOMC minutes release tomorrow. A break below looks for a test of critical support between 10,580- 10,611 (TL support dating 5/1, current operative channel support, 23.3% retracement off the 2011 low, 78.6% retracement off the June low and 100% extension off the July high). Topside objectives 10,744 and 10,780- 10,800.

Review today’s Scalp Webinar for further insights and current trade setups

Trade these setups and more live alongside DailyFX with Analyst on Demand

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael Tuesday, Wednesday and Thursday mornings for a Live Scalping Webinar on DailyFX Plus (Exclusive of Live Clients) at 1230 GMT (8:30ET)

Introduction to Scalping Strategies Webinar

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.